EIA Releases New Estimates Of Drilled But Uncompleted Wells

By EIA

The US Energy Information Administration’s (EIA) monthly Drilling Productivity Report (DPR), released Monday, now includes a supplement that provides monthly estimates of the number of drilled but uncompleted wells (DUCs) in the seven key oil and natural gas producing regions covered by the DPR.

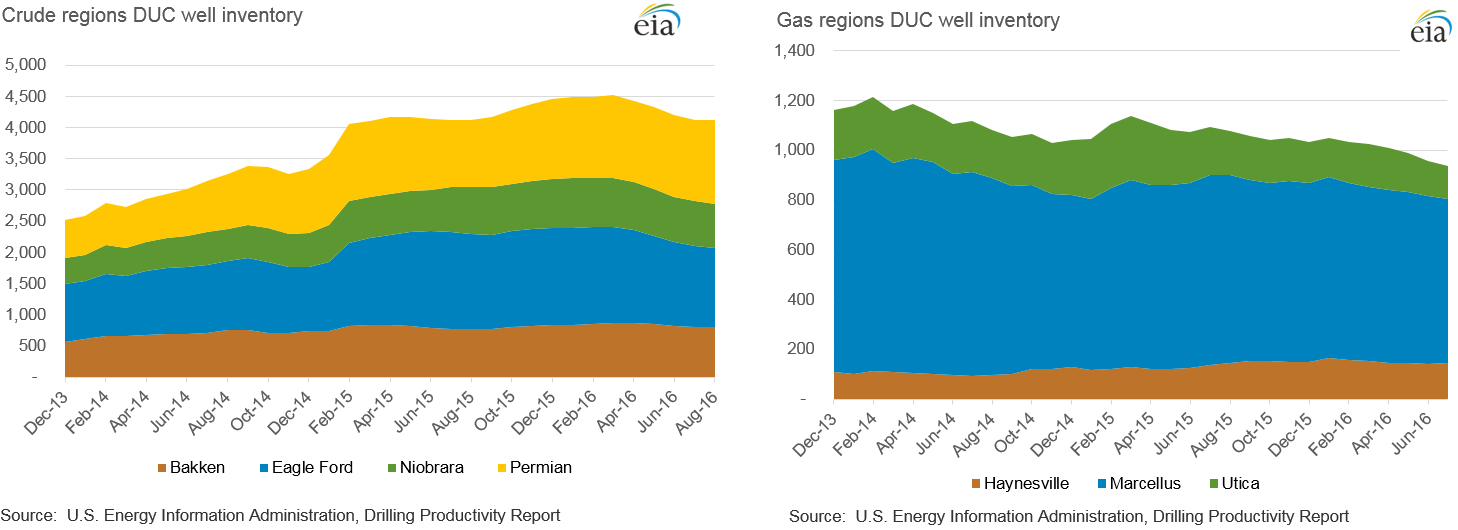

Current EIA estimates show DUC counts as of the end of August totaling 4,117 in the 4 oil-dominant regions and 914 in the 3 gas-dominant regions that together account for nearly all U.S. tight oil and shale gas production.In the oil regions, the estimated DUC count increased during 2014-15, but declined by about 400 over the last 5 months.The DUC count in the gas regions has generally been in decline since December 2013.

When producers are under stress, as has been the case following the large decline in oil prices since mid-2014 that triggered a significant slowdown in drilling and completion activity since late 2014, changes in the number of DUCs can provide useful insight into upstream industry conditions. A high inventory of DUCs also has potential implications for the size and timing of the domestic supply response to a persistent or significant rise in oil prices, since completions of existing DUCs can provide an increase in production with or without any significant changes in the rig count.

While both drilling and completion activity have declined since late 2014, completions have experienced a deeper decline than drilling in the four DPR regions (Bakken, Niobrara, Permian, and Eagle Ford) that account for nearly all tight oil production, resulting in a growing inventory of DUCs. The differential reduction in drilling and completion rates in these regions may be attributed to several factors, including long-term contracts for drilling rigs and lease contracts that mandate drilling and/or production in order to fulfill commitments made to the landowners and mineral-rights owners. The situation appears to be somewhat different in the other three DPR regions (Marcellus, Utica, and Haynesville) where the production mix skews heavily towards natural gas, in which significant price declines began as early as 2012.