US Core Inflation Slows To 0.1 Percent In August – Analysis

By Dean Baker

The core inflation rate slowed to 0.1 percent in August, its lowest rate since April. This brought the year-over-year inflation rate in the core index to 2.2 percent. A 1.9 percent jump in energy prices brought the overall rate up 0.2 percent in August and 2.7 percent over the last year.

Inflation was well contained in almost all areas of the core except shelter. The core index excluding shelter actually fell by 0.1 percent in August. This index is up by just 1.3 percent over the last year and shows no evidence of any acceleration over the last five years.

In fact, the annualized rate in the non-shelter core comparing the last three months (June, July, and August) with the prior three months (March, April, and May) is just 1.2 percent. The core inflation rate by this measure is 2.0 percent.

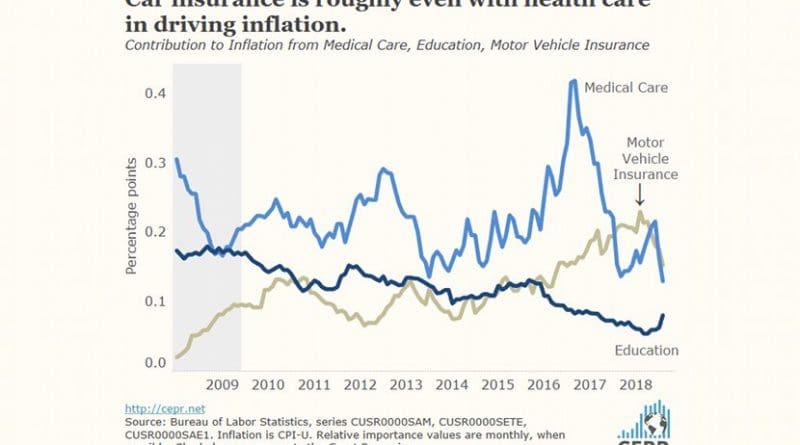

Traditional problem areas in the core seem well under control. The medical care index fell by 0.2 percent for the second consecutive month. It is up 1.5 percent over the last year.

Education rose by 0.5 percent in August, but it is still up by just 2.7 percent over the last year. It has been rising more rapidly in recent months, a 3.5 percent annual rate comparing this quarter with last quarter, but these data are erratic. The index fell 0.1 percent in March, so it is too early to see rising education costs as again being a serious problem.

The index for auto insurance, which has been a major contributor to inflation, was flat in August. It is up 6.4 percent over the last year, but has been rising at just a 2.4 percent annual rate comparing the last three months with the prior three months.

Air fares rose by 2.4 percent in August after jumping by 2.7 percent in July. But this is most likely a seasonal adjustment problem. They are still down by 1.3 percent over the last year.

New vehicle prices were unchanged for the month and are up just 0.3 percent over the last year. Used vehicle prices rose 0.4 percent in August and are up 1.3 percent over the last year. Apparel prices fell by 1.6 percent in August and are down by 1.4 percent over the last year.

Rent continues to be the major source of inflationary pressure in the core index. Rent proper rose by 0.4 percent and owners’ equivalent rent rose by 0.3 percent in August. Over the last year they are up by 3.6 percent and 3.3 percent, respectively.

It is worth noting that people who own their home (roughly 63 percent of households) do not see owners’ equivalent rent as an expense. For these households, the rate of inflation would be better approximated by the CPI minus shelter, which has risen by 2.3 percent over the last year. As the big energy price hikes of last summer pass out of the 12-month window, the CPI minus shelter is likely to fall below 2.0 percent, assuming that energy prices stabilize.

Of course, for renters the opposite is true. For many who pay 40 percent or even 50 percent of their income in rent, the rent component is a much larger share of the inflation they see than its weight in the CPI.

Apart from rising rents, which are driven largely by supply constraints, it is difficult to see any evidence that a tighter labor market is creating inflationary pressures. There is a gap between the inflation rate in food at restaurants and food at home, with the former rising by 2.6 percent and the latter by 0.5 percent over the last year. This could be explained in part by rising wages for restaurant workers, especially in states and cities that have increased the minimum wage. But this additional inflation in a component that accounts for less than 6.0 percent of the overall CPI does not add much to the inflation rate.

The overall story is that, in spite of the unusually low unemployment rate, inflation continues to be very much under control with no evidence of acceleration. Rent remains the one area where inflation is a problem, although this is not driven by labor costs.