INTERPOL Financial Fraud Assessment: A Global Threat Boosted By Technology

A new INTERPOL assessment on global financial fraud highlights how the increased use of technology is enabling organized crime groups to better target victims around the world.

The use of Artificial Intelligence (AI), large language models and cryptocurrencies combined with phishing- and ransomware-as-a-service business models have resulted in more sophisticated and professional fraud campaigns without the need for advanced technical skills, and at relatively little cost.

Analysis behind the INTERPOL Global Financial Fraud Assessment also points to the global expansion of human trafficking for the purpose of forced criminality in call centres, particularly to carry out ‘pig-butchering’ scams – a hybrid scheme combining romance and investment frauds, using cryptocurrencies.

INTERPOL Secretary General Jürgen Stock said: “We are facing an epidemic in the growth of financial fraud, leading to individuals, often vulnerable people, and companies being defrauded on a massive and global scale.

“Changes in technology and the rapid increase in the scale and volume of organized crime has driven the creation of a range of new ways to defraud innocent people, business and even governments. With the development of AI and Cryptocurrencies, the situation is only going to get worse without urgent action.

“It is important that there are no safe havens for financial fraudsters to operate. We must close existing gaps and ensure information sharing between sectors and across borders is the norm, not the exception.

“We also need to encourage greater reporting of financial crime as well as invest in capacity building and training for law enforcement to develop a more effective and truly global response.”

The report is being launched by the Secretary General at the Financial Fraud Summit, organized by the UK government in London.

Key findings

Other key findings of the report, which is for law enforcement use only, include:

- The most prevalent global trends are investment fraud, advance payment fraud, romance fraud and business email compromise

- Financial fraud is most often carried out by a network of co-offenders, varying from highly structured to loosely affiliated.

- An urgent need to strengthen data collection and analysis in order to develop more informed and effective counter strategies.

To effectively address this globally escalating crime and bridge crucial information gaps, one of the report’s recommendations is the need to build multi-stakeholder, Public-Private Partnerships to trace and recover funds lost to financial fraud.

Since the launch of INTERPOL’s Global Rapid Intervention of Payments (I-GRIP) stop-payment mechanism in 2022, the Organization has helped member countries intercept more than USD 500 million in criminal proceeds, stemming largely from cyber-enabled fraud.

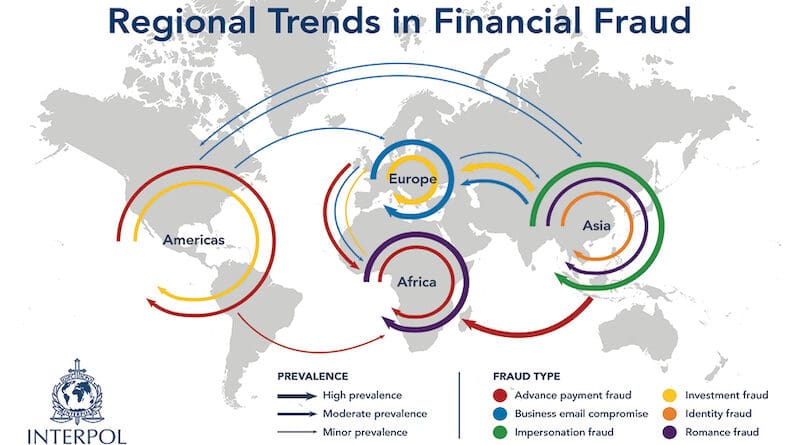

Regional Trends in Financial Fraud

Africa

Business Email Compromise remains one of the most prevalent trends in Africa, however there is increasing use of the pig butchering fraud. Cases of this fraud type have been identified in West and Southern Africa targeting victims in other jurisdictions beyond the continent.

Certain West African criminal groups, including the Black Axe, Airlords and Supreme Eiye, continue to grow transnationally, and are known to have extensive skills in online financial fraud such as romance fraud, investment fraud, advance fee fraud, and cryptocurrency fraud.

Americas

The most common types of fraud across the Americas are impersonation, romance, tech support, advance payment, and telecom frauds.

Human trafficking-fuelled fraud continues to be a growing crime phenomenon. The INTERPOL coordinated operation, Operation Turquesa V, revealed that hundreds of victims were trafficked out of the region after being lured via messaging apps and social media platforms and coerced to commit fraud, including investments frauds and pig butchering.

There is emerging evidence that Latin-American crime syndicates such as Commando Vermelho, Primeiro Comando da Capital (PCC) and Cartel Jalisco New Generation (CJNG) are also involved in the commission of financial fraud.

Asia

Pig butchering fraud schemes initiated in Asia in 2019, and expanded during the COVID-19 pandemic. Subsequently, Asia has emerged as a focal point, with criminal organizations in poorer countries across the region employing business-like structures.

Another fraud type that has experienced a surge in recent years in Asia is a type of telecommunication fraud where perpetrators impersonate law enforcement officers or bank officials to trick victims to disclose their credit card or bank account credentials or to hand over huge amounts of money.

Europe

Online investment frauds, phishing, and other online financial fraud schemes have escalated on carefully selected targets to maximize profits. Mobile phone apps are also being targeted by cybercriminals.

The criminal networks involved in these online schemes often display sophisticated and complex modi operandi, which are usually a combination of different fraud types.

Pig butchering, predominantly carried out of call centres in Southeast Asia, is also on the rise.