Brussels Wants Regions To Make Better Use Of EU Funds

By EurActiv

(EurActiv) — With the long-term budget topping the EU agenda, European institutions are emphasising the continent’s regions as the battleground where the economic crisis would be won or lost, yet propose to increase conditions laid on growth-oriented funding.

Ahead of the EU summit this week, the European Commission’s Regional Policy directorate and the Committee of the Regions organised a set of open days aimed at making sources of funding more transparent and highlighting cohesion policy success stories.

Johannes Hahn, the commissioner for regional policy, said this represented “the last good occasion to send out a strong regional voice to member states and the European legislator.”

Hahn said the EU’s crisis exit strategy was based on “restoring sound public finance, structural reform for improving competitiveness and targeted investments for growth and jobs.”

To get his point across, and help secure a healthy level of financing, the commissioner sent his staff a series of points he wanted to emphasise during the open days.

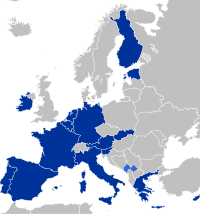

Among the points was the role structural funds played in helping Finland recover from a deep economic recession in the 1990s – before its EU accession – suggesting they could play a similar role within the crisis-laden eurozone.

The president of the EU consultative body the Committee of the Regions, Ramón Luis Valcárcel, also made the case for keeping the cohesion budget intact, telling reporters: “The regions must push the member states and make sure there is no blockage in the Council and the European Parliament.”

“A brave budget is suitable for the crisis”, he said.

However, Valcárcel will be aware that as national governments feel the pinch during the crisis they are unlikely to back a strong budget, at least not without conditions.

Investment strategy

The Italian Minister for Territorial Cohesion, Fabrizio Barca, spoke to the European Parliament on Wednesday (10 October), spelling out what his country was doing with EU structural funds.

Italy, he said, had one of the highest levels of national co-financing in the union, some 53% of projects. The figure is expected to drop to 47% but that, he said, was “still high”. Co-financing from private sources is seen as a way to help leverage and multiply structural funds.

Barca also said he took a “holistic” approach to cohesion, attempting to address social inclusion as well as investing in infrastructure projects.

“There is no point in giving money to companies, without having citizenship,” he said.

The minister said what was needed was “investment with strategy behind it.”

Barca said this was especially important in the poorer south of the country, hailing a money-saving project to speed up justice cases, which took four to five times longer than in the north.

He made clear that territorial cohesion involved saving money in areas where it was being wasted while protecting funding where it was needed. Barca said that Italy had “taken account of the crisis in the choices it has made,” attempting to protect “essential services,” such as kindergartens and health care centres for the elderly, from closures.

‘Local level’

Where Barca outlined work done in Italy, the Committee of the Regions held a workshop discussing funding projects in the northwest of England.

The workshop was aimed at pointing out whether financial engineering instruments could play a significant role in supporting post-2014 structural funds throughout the EU.

A Liberal Democrat councillor for the City of Liverpool, Flo Clucas, said €204 million had been invested as part of a so-called “JEREMIE” holding fund. JEREMIE funding is a market-driven financial instrument carried out with the EIB to provide debt and equity funding for small and medium-sized enterprises, as opposed to traditional grants.

This, she said, had contributed towards a significant amount of economic growth and job creation in the region.

Other, private initiatives are also underway in the region, taking a so-called “hands-on” approach to investment.

Penny Attridge, an investment director at SPARK, a venture capital company, spoke at the workshop of initiatives she had undertaken with SMEs in the northwest. Her company takes a so-called “early-stage approach” to investment, she said, carefully selecting businesses before making a small initial investment of some €60,000.

At the beginning, the focus is encouraging profitable businesses practices rather than injecting large amounts of cash. Larger investments usually follow.

She said often what SMEs need is someone who “understands the disciplines of European funding”.

An investment manager at the European Investment Bank, Bruno Robino, said that to achieve results with EU funds “implementation has to be done at local level” as well as consulting the institutions.

Subsidiarity

The emphasis for local implementation could be viewed as a plea to the EU and national governments to respect the principle of subsidiarity.

The EU executive wants to keep robust regional funding in place, especially investment-oriented structural funds, but proposes to impose stricter conditions on its use. The Commission views this as a way to safeguard against the misuse of public money, and avoid ‘another Greece’, but the move has come across staunch opposition in the Committee of Regions.

The regional consultative body believes this would contravene subsidiarity, Claire Dhéret, an analyst at the European Policy Centre, told EurActiv. Subsidiarty is and organising principle, enshrined in the EU treaty, which states that policy should be undertaken by the smallest, or least centralised, capable authority.

The Committee fears the move would require citizens and regional authorities to foot the bill in the event that EU investment does not come good, even if it is the result of a wider economic slowdown, she said.

Dhéret said the Committee did not think it fair to penalise regions “because of the macroeconomic conditionality positions of member states”.