Economist Manuel Hinds Explains Benefits Of Dollarization In Argentina – OpEd

By Peter Tase

In February 2024, Manuel Hinds, an economist with a global perspective, with extensive experience in monetary, and financial matters, has published a research paper on the current monetary situation of Argentina in defense of dollarizing its national economy. Mr. Hinds is also a Fellow at The Institute for Applied Economics, Global Health, and the Study of Business Enterprise at Johns Hopkins University. His experience includes being Minister of Finance of El Salvador (1995-1999), carrying out a series of impressive economic reforms that resulted in high growth rates and positioning the country as one of the two investment-grade countries in Latin America, the other being Chile.

In his academic paper entitled: “Would The Dollars Escape From A Dollarized Argentina?”, the Honorable Manuel Hinds makes the following salient points:

1. “As all economists know, or should know, the interest rate equilibrates the monetary markets. People deposit their resources in the local currency if the interest rates paid by these deposits compensate for the risks of having deposited them there and still produce a net yield similar to that they can get abroad in their standard of value, which is the dollar. Since the dollar is the standard of value, yields are compared with those in dollars. For example, if the rate of interest in the dollar market is 4% and the expected rate of devaluation of the peso versus the dollar is 6%, the Argentine banks would have to pay at least a little more than 10% (4+6) to convince people of depositing with them in pesos. Of course, there are other risks additional to currency devaluations. To compensate for these other risks (political risks or the risks of a poorly supervised banking system) for example) should be compensated by the Argentine banks to discourage capital outflows.[1] Well, the outflows appear when the risks and the interest rate are not high enough to compete with the yields of deposits in dollars in Uruguay, New York, or elsewhere. Thus, the more pesos the central bank prints, the more dollar reserves it loses.

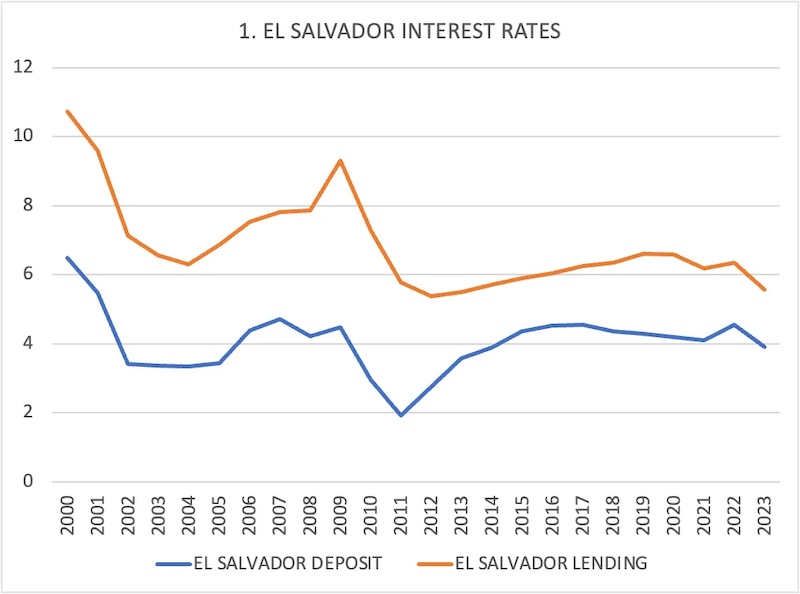

2. Given the Argentinian experience with peso instability, you could think that the interest rates Latin American banks must pay to avoid capital outflows and even encourage inflows must be very high. No. As you can see in Graph 1, the deposit interest rates necessary to keep the Salvadoran financial markets stable and provoke capital inflows went down right after the 2001 dollarization from 6.5% to a level between 2 and 5%. If the market needs more resources, the additional demand for loans will raise the interest rates, and more money will flow from abroad. If you want less money, the interest rates will fall, and capital will flow out.

According to Hinds, these rates have been high enough to keep the banks liquid even during the 2008 and the 2020 COVID crises. Today, the deposit interest rate is about 4.8%, which keeps the flows stable. Yet, in Argentina, the deposit rates in pesos averaged 85.68% and still could not keep the resources in Argentina. The country had a hemorrhage of outflows. The difference has nothing to do with the lack of legs in the dollars arriving in El Salvador. It is due to the trust that the dollar gives to depositors.

“Of course, the low deposit rates result in low lending rates. The 2023 average lending rate in El Salvador was 5.57%. That of Argentina was 87.68% in 2023. A Salvadoran can get a 25- or 30 – year mortgage at 6.5% in the local currency (the dollar). There is no way to get a long-term peso loan in Argentina, at least for ordinary people. So, the argument that dollarization would empty the banks because Argentines would take the dollars abroad doesn’t work in a dollarized economy,” Hinds notes in the article.

The Honorable Manuel Hinds, argues: “The fact that the interest rate dramatically depends on the currency’s stability can be better appreciated in countries where people can deposit in pesos and dollars. In all cases, the interest rate in dollars is much lower than in pesos. This difference is only attributable to the currency because all other risks are the same for the deposits in pesos and dollars – it is the same banks, the same country, the same government, etc. The only difference is the currency. And the public always requires lower interest rates to deposit their resources in dollars than in pesos in the banks of these countries. Notice the great difference between the lending rates in pesos and dollars in Argentina. This shows that people require lower yields to keep their deposits in dollars because the risks of this currency are much lower than in pesos.”

References:

- Manuel Hinds, WOULD THE DOLLARS ESCAPE FROM A DOLLARIZED ARGENTINA?

- John Hopkins Studies in Applied Economics