Geopolitical Risks Likely To Undermine China’s Goal Of ‘Stable Growth’ – Analysis

By Anbound

By He Jun

At this year’s National People’s Congress (NPC) and the National Committee of the Chinese People’s Political Consultative Conference (CPPCC) sessions, the Chinese government work report has set a target of 5.5% economic growth and a 2.8% deficit-to-GDP ratio for 2022. For the country’s domestic market, the decline in both of the growth targets and the deficit-to-GDP ratio indicate that economic growth this year will strive to be stable, at the same time the fiscal policy will be in “limited proactivity”.

On March 7, the performance of Chinese stock market once again showed the phenomenon of “A-shares falling during the Two Sessions”. The SSE Composite Index fell below 3,400 points to 3,372.86 points, down 2.17%; the SZSE Component Index closed at 12,573.43 points, down 3.43%; the Growth Enterprise Market Index closed at 2,630.37 points, down 4.3%. Does this mean that capital markets are disappointed with this year’s economic targets and fiscal policy? The answer is probably negative.

Most Asia-Pacific stock markets also plunged on that day. The Hang Seng Index fell 847.66 points, or 3.87%, to 21057 points; the Nikkei 225 closed at 25,221.4102 points, down 764.06 points, or 2.94%; TWSE Capitalization Weighted Stock Index closed down 557.83 points, or 3.15%, at 17,178.69 points; KOSPI Composite Index down 2.29%; while ASX All Ordinaries Index fell 1%. In addition, European stock markets also fell at the opening session. As of 19:55 on March 7, Beijing time, the FTSE 100 Index fell 1.17%; the DAX fell 2.56%; the CAC 40 fell 2.65%.

Obviously, the main reason for the global stock market decline is not China’s macro policy, but the deterioration of the geopolitical situation and the surge in international energy prices caused by the current Russia-Ukraine crisis. International oil prices continued to rise sharply on March 7 at 20:00, Beijing time, with U.S. crude oil futures up 6.66% to USD 123.39 per barrel and Brent crude up 6.25% to USD 125.49 per barrel. Rising oil prices and market concerns about U.S. and European sanctions on Russian energy exports have fueled the process and depth of the world energy resetting.

The war between Russia and Ukraine is still going on, and while both sides are still attempting to negotiate with each other, there is no sign that the war will stop in the near future. Russian President Vladimir Putin has again hardened his position that his military will not stop its operations unless Ukraine meets Russia’s demands and the Ukrainian forces lay down their weapons. In the face of adverse circumstances, capital markets will find it difficult to be confident in future economic prospects, and geopolitical risks will cast a shadow over global markets.

Although China is not directly involved in this geopolitical conflict, as a major power with a huge domestic market, it is not immune to the impact of international risks. What is certain is that China’s goal of “stable growth” this year will face a more complicated environment, and it will be difficult for it to be excluded in the rapidly changing international environment.

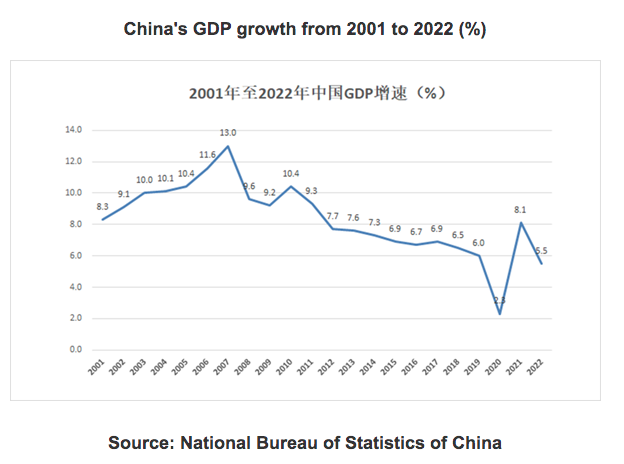

First, in this era of the “post-land oriented development”, China’s economy is still struggling to locate new drivers of growth. Efforts such as the shift from investment-oriented to the consumption-oriented economic model, supply-side structural reform, and the implementation of proactive fiscal policy have failed to reverse the trend of slowdown in the country’s economic growth. It is worth noting that since 2010, China’s economic growth rate has continued to decline in 10 of the 12 years (except for the 6.9% increase in 2017 and the 8.1% rebound in 2021 due to a low base effect caused by the COVID-19 pandemic). After the fluctuations caused by the pandemic, the economic growth is expected to return to its previous trend of slowdown. Analysts at ANBOUND estimate that China’s economy will likely enter “the era of 5% economic growth” starting in 2022.

Second, a variety of external negative factors will affect China’s economic recovery. The market had high expectations for a global and Chinese economic recovery as the global COVID-19 situation improved. However, the outbreak of the Russia-Ukraine crisis has halted this recovery process and posed a considerable challenge to China’s economic recovery. Given the geopolitical risks, China’s huge demand for energy, its high dependence on foreign energy (over 70% in the oil category), and its need for space in the international market, the external environment for the country’s economy is bound to be harsh this year. As China has yet to build a strong “internal circulation”, the impact from the “external circulation” will be transmitted to its domestic market.

In addition to the factors above, China’s policy choices in a changing world will also affect its long-term economic growth in the future. The British think tan Chatham House has recently published an article pointing out that “fortress economics” having major impact on China and Russia. “Fortress economics” advocates that any country with extremely bad relations with the U.S. should try to earn more than it spends. Running a current account surplus is preferable to running a deficit one, which requires external financing. “Fortress economics” also advocates building large foreign exchange reserves to support a country’s ability to spend in the event of sanctions. Many of the new investment priorities now being prioritized by the Chinese government, such as technology, agriculture, and green energy, are aimed at reducing China’s dependence on imports, the article stated. One of the main consequences of “fortress economics” is that the economy will end up growing less than it might.

In the opinion of researchers at ANBOUND, this article that lumps the Chinese economy with the Russian economy in the same category and describes both as “fortress economy” is clearly too biased and ignores the history of China’s economic development, its position in the globalization process, and its attitude toward reform and opening up. That said, the significance of the article is that it reminds China to be on high alert to the possibility of “economic fortressization” in the context of a deteriorating geopolitical environment. Under the current circumstances, if China adjusts its policies in an unfavorable international environment and overemphasizes the “internal circulation” of its economy, it is likely to develop into a “fortress economy”. Such an outcome would certainly be detrimental to its economy.

Final analysis conclusion:

The Russia-Ukraine crisis has further worsened the international geopolitical environment. The severe sanctions imposed by the West on Russia have increased the uncertainty of the global economy, which will undoubtedly pose a significant impact on China’s economic recovery and likely to undermine its goal of “stable growth”.