Money-Supply Growth Finally Slows In March, Drops To 10-Month Low – Analysis

By MISES

By Ryan McMaken*

After three months in a row of hitting new all-time highs, money supply growth slowed in March, dropping to a 10-month low. This slowdown, however, does not suggest any significant departure from the past year’s high growth in money supply—which came in the wake of unprecedented quantitative easing, central bank asset purchases, and various stimulus packages.

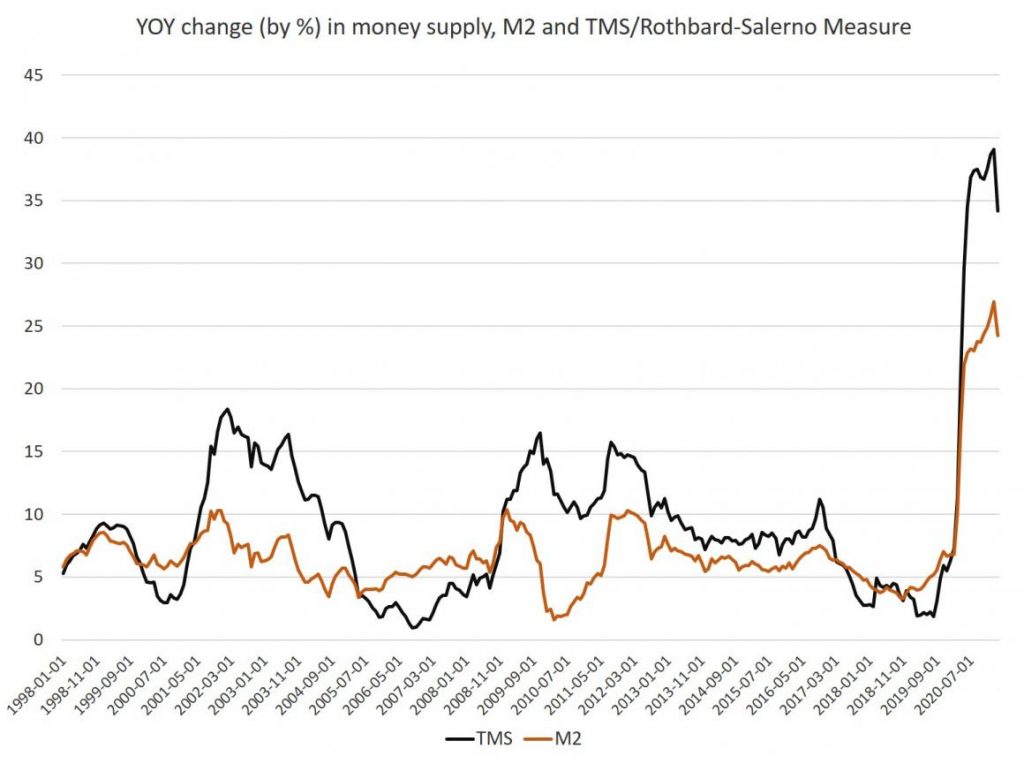

During March 2021, year-over-year (YOY) growth in the money supply was at 34.1 percent. That’s down slightly from February’s rate of 39.1 percent, and up from the March 2020 rate of 11.3 percent. March’s data confirms we’re now twelve months in to the current trend of remarkably high money-supply growth.

Historically, the growth rate has never been higher than what we’ve seen over the past year, with the 1970s being the only period that comes close.

It is likely that historically large amounts of growth will continue for the time being as it appears that now the United States is a year into an extended economic crisis. For example, around 1 million new jobless claims were filed each week from March until mid-September, and claims only finally dropped below 500,000 in early May 2021. Moreover, more than 3.8 million unemployed workers are currently collecting standard unemployment benefits, and total unemployment claims have failed to fall back to non-recessionary levels, even a year after lockdowns began. More than six million additional unemployed are collecting “Pandemic Emergency Unemployment Compensation” as of late March. As of April 2021, total employment remained more than five million jobs down from March 2020.

The central bank continues to engage in a wide variety of unprecedented efforts to “stimulate” the economy and provide income to unemployed workers and to provide liquidity to financial institutions. Moreover, as government revenues have fallen, Congress has turned to unprecedented amounts of borrowing. But in order to keep interest rates low, the Fed has been buying up trillions of dollars in assets—including government debt. This has fueled new money creation.

The money supply metric used here—the “true” or Rothbard-Salerno money supply measure (TMS)—is the metric developed by Murray Rothbard and Joseph Salerno, and is designed to provide a better measure of money supply fluctuations than M2. The Mises Institute now offers regular updates on this metric and its growth. This measure of the money supply differs from M2 in that it includes Treasury deposits at the Fed (and excludes short-time deposits, traveler’s checks, and retail money funds).

Similar to the TMS measure, the M2 growth rate reached new historic highs in March 2021, growing 24.2 percent compared to February’s growth rate of 26.9 percent. M2 grew 10.1 percent during March of last year.

Money supply growth can often be a helpful measure of economic activity, and an indicator of coming recessions. During periods of economic boom, money supply tends to grow quickly as commercial banks make more loans. Recessions, on the other hand, tend to be preceded by periods of slowing rates of money supply growth. However, money supply growth tends to grow out of its low-growth trough well before the onset of recession. As recession nears, the TMS growth rate typically climbs and becomes larger than the M2 growth rate. This occurred in the early months of the 2002 and the 2009 crises. A similar pattern appeared before the 2020 recession, suggesting the US was headed for a recession even before the covid shutdowns.

Recession did become a reality in the Spring of 2020 with the the second, third, and fourth quarters of 2020 all showing negative growth in real GDP. Real GDP was down 9 percent, year over year, during the second quarter, and still down 1.1 percent for the fourth quarter of 2020. Although year-over-year GDP growth was positive during the first quarter of 2021 (at 2.3 percent) this represents very weak growth given the enormous amounts of monetary and fiscal stimulus that have poured into the larger economy. Considering the Fed’s reluctance to scale back stimulus plans, it appears there is little confidence that the economy would stay in positive territory without ongoing stimulus.

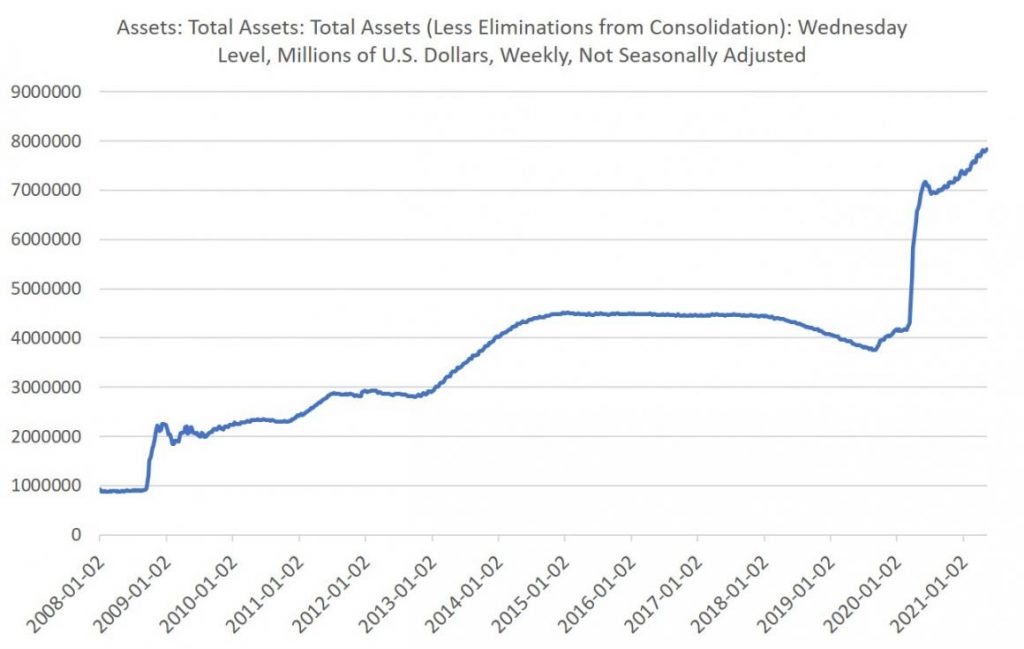

Another factor in money supply growth has been growth in the Fed’s balance sheet. After initial balance sheet growth in late 2019, total Fed assets surged to nearly $7.2 trillion in June and have rarely dipped below the $7 trillion mark since then. Assets are now headed toward a new all-time high of $8 trillion. These new asset purchases are propelling the Fed balance sheet far beyond anything seen during the Great Recession’s stimulus packages. The Fed’s assets are now up more than 600 percent from the period immediately preceding the 2008 financial crisis.

Total Fed assets, going back to 2007:

Some factors are working to depress money creation, however. For example, commercial and industrial loans have been slowing, year over year, since February, with loan growth dropping from 10.1 percent in February to 3.9 percent in March. (By April, loan growth had turned negative.) If loan activity slows or declines, this will put downward pressure on money-supply growth.

*About the author: Ryan McMaken (@ryanmcmaken) is a senior editor at the Mises Institute. Send him your article submissions for the Mises Wire and Power&Market, but read article guidelines first. Ryan has degrees in economics and political science from the University of Colorado and was a housing economist for the State of Colorado. He is the author of Commie Cowboys: The Bourgeoisie and the Nation-State in the Western Genre.

Source: This article was published by the MISES Institute