Robert Reich: Where Are Record Corporate Profits Coming From? Your Thinning Wallets – OpEd

By Robert Reich

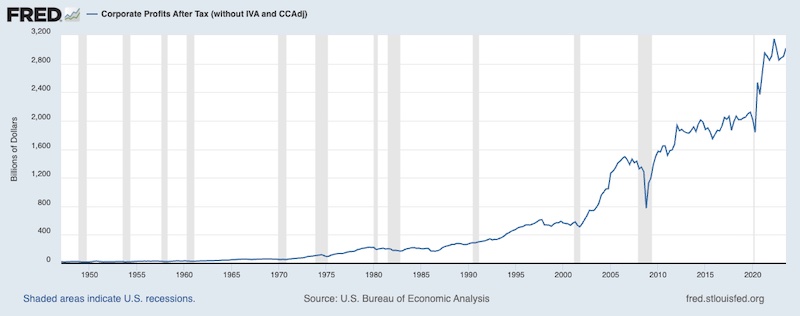

I apologize for beginning this article with a graph. But this is a very important one. It shows corporate profits after taxes, from 1946 through the third quarter of 2023 (the most recent data available).

Notice something?

Corporate profits are near a record high.

Inflation is dropping, but prices aren’t coming down because corporations have enough monopoly power to keep prices high. (Or they’re shrinking the size of the products you’re buying without lowering their prices — a variant of the same thing.)

This is one of the biggest reasons the American public is not crediting Biden with a great economy. Most people aren’t feeling it.

Here’s just one example that will make you fizz: Pepsi.

In 2021, PepsiCo, which makes all sorts of drinks and snacks, announced it was “forced” to raise prices due to “higher costs.” Forced? Really? The company reported $11 billion in profit that year.

In 2023 PepsiCo’s chief financial officer said that even though inflation was dropping, its prices would not. Pepsi hiked its prices by double digits and announced plans to keep them high in 2024.

How can they get away with this?

Well, if Pepsi were challenged by tougher competition, consumers would just buy something cheaper. But PepsiCo’s only major soda competitor is Coca-Cola, which — surprise, surprise — announced similar price hikes at about the same time as Pepsi, and also kept its prices high in 2023.

The CEO of Coca-Cola claimed that the company had “earned the right” to push price hikes because its sodas are popular. Popular? The only thing that’s popular these days seems to be corporate price gouging.

We’re seeing this pattern across much of the economy — especially with groceries.

The rate of inflation is down. The rate of inflation measures how quickly prices are rising: Prices are now rising far more slowly than in the past couple of years.

And while supply chain disruptions really did make it more expensive to produce a lot of goods, the cost to produce them now is rising even more slowly than prices.

But consumer prices are still elevated — allowing most corporations to keep their profit margins near a record high.

They can get away with overcharging you because they have monopoly power — or they have so few competitors that they can easily coordinate price increases with them and avoid price decreases.

If Pepsi and Coca-Cola had lots of competitors, they wouldn’t be able to raise prices so high because someone would make cheaper substitutes, and consumers would buy those instead. But Pepsi and Coke own most of the substitutes!

This isn’t happening just with Coke and Pepsi.

Take meat products. At the end of 2023, Americans were paying at least 30 percent more for beef, pork, and poultry products than they were in 2020.

Why? Near-monopoly power!

Just four companies now control processing of 80 percent of beef, nearly 70 percent of pork, and almost 60 percent of poultry. So of course it’s easy for them to coordinate price increases.

And this goes well beyond the grocery store. In 75 percent of U.S. industries, fewer companies now control more of their markets than they did 20 years ago.

So what should be done?

First, antitrust laws must be enforced.

Kudos to the Biden administration for using antitrust more aggressively than any administration in the last 40 years. It’s taken action against alleged price fixing in the meat industry — which has been a problem for decades.

It’s suing Amazon for using its dominance to artificially jack up prices — one of the biggest anti-monopoly lawsuits in a generation.

It successfully sued to block the merger of JetBlue and Spirit Airlines, which would have made consolidation in the airline industry even worse.

But given how concentrated American industry has become, there’s still a long way to go.

Secondly, big corporations must not be allowed to use their power to gouge consumers.

Senator Elizabeth Warren and others recently unveiled the latest version of their Price Gouging Prevention Act.

“Giant corporations are using supply chain shocks as a cover to excessively raise prices and sometimes charging the same price but shrinking how much consumers actually get,” Warren charges.

The bill would empower the FTC (which would also get $1 billion in additional funding) and state attorneys general to stop companies from charging “grossly excessive” prices, regardless of where alleged price gouging took place in a supply chain.

(The legislation would also protect small businesses — those earning less than $100 million — from litigation if they had to raise prices in good faith during crises.)

The bill would also require public companies to disclose more about their costs and pricing strategies.

I don’t have any illusions that this bill will find its way into law soon. Democrats hold a slim majority in the Senate, and not all Democrats support it. Meanwhile, Republicans and their business backers are dead set against it — and are eager to blame continued high prices on Biden, not on corporations.

But this bill is just as necessary as aggressive antitrust enforcement — and an example of what could and will be done if Democrats sweep the 2024 elections.

The near-record profits of large corporations are coming, in part, out of the paychecks of average Americans — who are still struggling to get by.

Biden and the Democrats must say this loudly and clearly, and tell the public what they are doing — and will do — to stop it.

This article was published at Robert Reich’s Substack

Robert Reich is a deceiver in at least two ways. First, his comments regarding the business profit chart completely ignores the horrific decline in the value of the dollar, such decline being for the most part the fault of the government. Second, a chart showing the tremendous increase in federal income taxes over time should support a similar argument — that the government is ripping off its citizens — but Reich ignores this.