How A Central Bank Caused One Of History’s Biggest Cons – Analysis

By MISES

By George Pickering*

In the summer of 1821, a roguish Scotsman named Gregor MacGregor arrived by boat in London, and initiated arguably the most audacious confidence scam in history. MacGregor had spent much of the previous decade fighting as a soldier of fortune in the Venezuelan War of Independence, where he had manoeuvred his way up the ranks, eventually being promoted to general by Simón Bolívar.

At some point during this period, local Central American rulers had granted MacGregor a large tract of land, most of which took the form of uninhabitable, malaria-ridden swamp along the Black River, in modern-day Honduras. Despite the poor economic prospects of his new acquisition, MacGregor was determined that the land should be his ticket to fortune, even if that required unconventional measures.

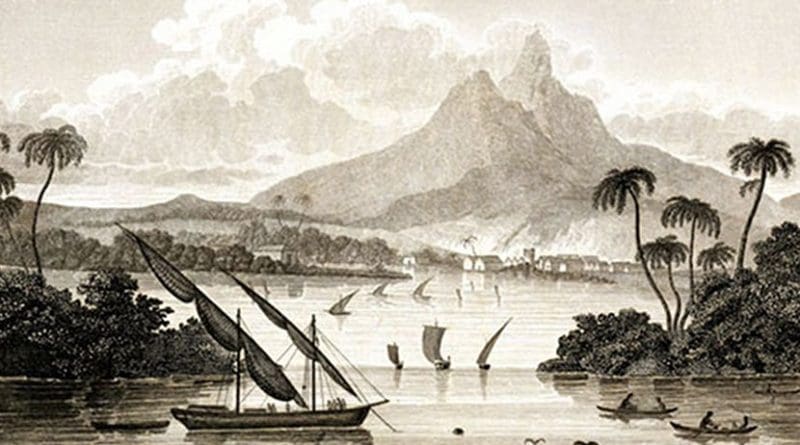

It was this series of events which led to the ‘founding’ of the non-existent country of Poyais. Upon returning to Britain, MacGregor ingratiated his way into London’s high-society, claiming to be the sovereign prince, or ‘Cazique’, of a newly-formed, British-friendly colony on Central America’s Mosquito coast, supposedly named ‘Poyais’ after the Poyer peoples of that area. In order to convince the British public of the realness of this imaginary country, MacGregor was forced to employ an extremely elaborate series of means, foremost amongst them being the publication of a 355-page guidebook for prospective settlers.

This book, likely penned by MacGregor himself, contained a plethora of highly-detailed (and entirely fictitious) descriptions of every aspect of life in Poyais. These included convoluted descriptions of its tricameral parliamentary system and of its commercial and banking systems, distinctly designed uniforms for each regiment of its non-existent armed forces, a fully elaborated honours system, a Poyaisian coat of arms (featuring unicorns), and a national flag. The guidebook also offered detailed descriptions of the climate and agriculture of Poyais, not to mention of its resplendent capital city, and even claimed that the rivers of Poyais contained “globules of pure gold.” In addition to the guidebook, MacGregor established Poyaisian government offices in London, Edinburgh and Glasgow, began having Poyaisian paper money and government documents professionally printed, and even commissioned the composition of songs about Poyais to be sung in the streets of Britain’s major cities.

The trick worked. In late-1822 and early-1823, approximately 270 hopeful colonists set sail for Poyais, and MacGregor was able to raise £200,000 from the sale of Poyaisian ‘government bonds’ — with the loan being obliviously underwritten by the highly respectable City of London bank Sir John Perring, Shaw, Barber & co. — in addition to the money he had made by the sale of Poyaisian land certificates and paper money. When the 50 surviving Poyais settlers made it back to London in October of 1823 with the news that none of it had been true, the resultant outrage exploded throughout the British press. MacGregor, however, had fled to Paris just days before their arrival, and was not only never convicted of any crime for his involvement of the Poyais scheme, but even went so far as to attempt to repeat the exact same scheme in France, in 1826.1

How could this absurd con possibly have succeeded so completely in tricking the British investing public of the early-1820s? The answer is to be found in the British banking system of the time, which was structured in a way that left it particularly able to fuel the kind of economic crises described by the ‘Austrian Business Cycle Theory’ of Ludwig von Mises. In the early-1820s, the British money supply outwardly appeared to be controlled in a very decentralised manner, with approximately 800 banks throughout the country having the right to issue their own banknotes, theoretically redeemable in gold.

However, at the centre of this system stood the Bank of England, Britain’s central bank, which not only had a monopoly on banknote issues in the London area, but was also legally privileged in a way that allowed the private banks of the time to use Bank of England notes as if they were gold, for reserves, clearing transactions, and redeeming their own private notes. Thanks to these legal privileges of Bank of England notes, the private banks of the time were able to pyramid their own credit expansion and note issues atop their fractional reserves of Bank of England notes, which were themselves pyramided atop an even more fractional reserve of gold. This not only allowed a far greater overall extent of credit expansion than if Bank of England notes had not had these privileges, but also gave the Bank of England a huge influence on the extent of credit expansion by the broader British banking system, by altering the volume of its own note issues.2

How does all of this relate to Gregor MacGregor? Because the success of his Poyais scheme was only made possible thanks to the speculative mania which had been fuelled by Bank of England credit expansion through these channels. In an effort to reverse the monetary and price deflation which had been going on since 1819, the British government and the Bank of England decided, in 1822, to initiate a massive and coordinated policy of credit expansion. Just as Mises’ Austrian Business Cycle Theory would lead us to expect, this credit expansion caused a boom of investment in risky ventures and ‘higher-order’ industries.

Given the declining lending standards and borrowing costs which accompany any period of credit expansion, British investors jumped at the chance to invest extensively in the newly-independent states of Latin America, creating a speculative mania surrounding the investments of that continent, which played perfectly into the hands of MacGregor and his attempts to raise money for his non-existent kingdom. It was in this way that the credit expansion of 1822-25 not only gave life to the most audacious confidence scheme in history, but also inflated a wider bubble which finally burst during the financial Panic of 1825, which was arguably the most severe economic crash experienced by Britain in the entire first half of the nineteenth century.

In recent years, central bank credit expansion has often repeated this trick of causing bubbles in absurd and risky investments, such as the ‘NINJA loans’ before the 2007/8 crisis, or the unprofitable tech startups during the dot-com bubble of 1997-2001. However, there is perhaps no lesson from history which more vividly illustrates the dangers of credit expansion-fuelled business cycles than the story of Gregor MacGregor and his imaginary country of Poyais.

About the author:

*George Pickering is a 2018 Mises Institute Research Fellow and a student of economic history at the London School of Economics.

Source:

This article was published by the MISES Institute.

Notes:

- 1. For the complete story of the Poyais scheme, see David Sinclair’s book Sir Gregor MacGregor and the Land that Never Was (London, 2003).

- 2. On all this, see G. Pickering ‘ The Role of Bank of England Note Issues Amongst the Causes of the Panic of 1825 ’. SSRN link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3208923