Financial Stability Needs Supervisors With The Ability And Will To Act – Analysis

By Tobias Adrian, Fabiana Melo, Marina Moretti and Jay Surti

Keeping banks safe and sound, and anchoring financial stability, hinges as much on good supervision as on effective risk management and governance in banks, robust regulation, and vigilant markets.

We saw it earlier this year, as turbulence in the banking sector precipitated three questions: Are banks’ risk management practices strong enough? Is prudential regulation adequate? Is banking supervision effective, or can it be improved?

The making of good supervision

While much attention is typically devoted to the needed upgrading of regulations following episodes of bank distress, upgrading of supervisory effectiveness can be left bereft of corresponding attention—despite our analysis consistently showing that it is key to banking and financial stability.

In a new paper, Good Supervision: Lessons from the Field, we reflect on the lessons learned from the recent bank turmoil in the United States and Switzerland and review progress made across countries in delivering effective supervision, drawing on the IMF’s surveillance and capacity building work of the past 10 years.

Good supervision might be thought of as a construction site—where design, material, and skill all come together to culminate in a resilient structure. Supervisors require operational independence to carry out their tasks free of outside pressures, along with accountability. They need a clear mandate to ensure they are focused on the right trouble spots. And they need adequate legal powers to back their actions. Sufficient resources, appropriate skillsets, and the application of sound judgment and deep analysis based on accurate situational awareness of the outlook, risks, and vulnerabilities, are also vital to supervisors taking timely and conclusive action.

The global financial crisis had highlighted the importance of supervisors needing to be assertive and intrusive, that is, demonstrating the will and ability to act. The 2012 update of the global standards for banking supervision—the Basel Core Principles—raised expectations for supervisors take account of economic and business trends, as well as the build-up and concentration of risks inside and outside the banking sector. “Light touch” supervision, often invoked as part of efforts to encourage economic activity and foster competition, had proved unsuccessful—institutional and systemic distress had followed in its wake, with the blame inevitably placed, after the fact, on the absence of intrusive and timely supervisory effort.

Progress, but a long road ahead

First the good news. Our review found much progress in risk monitoring and analysis across advanced, emerging, and developing countries, with many of them having incorporated forward-looking supervisory approaches, in some cases harnessing data-intensive and technology-driven tools.

Wider adoption of stress tests has also been a great advance. These tools help broaden supervisors’ views of threats facing individual banks, the banking sector, and the financial system, beyond the historical data and past experiences. Likewise, business model analysis has become integral to supervisory frameworks in many countries, helping flag vulnerabilities early on and convey these in their dialogue with banks.

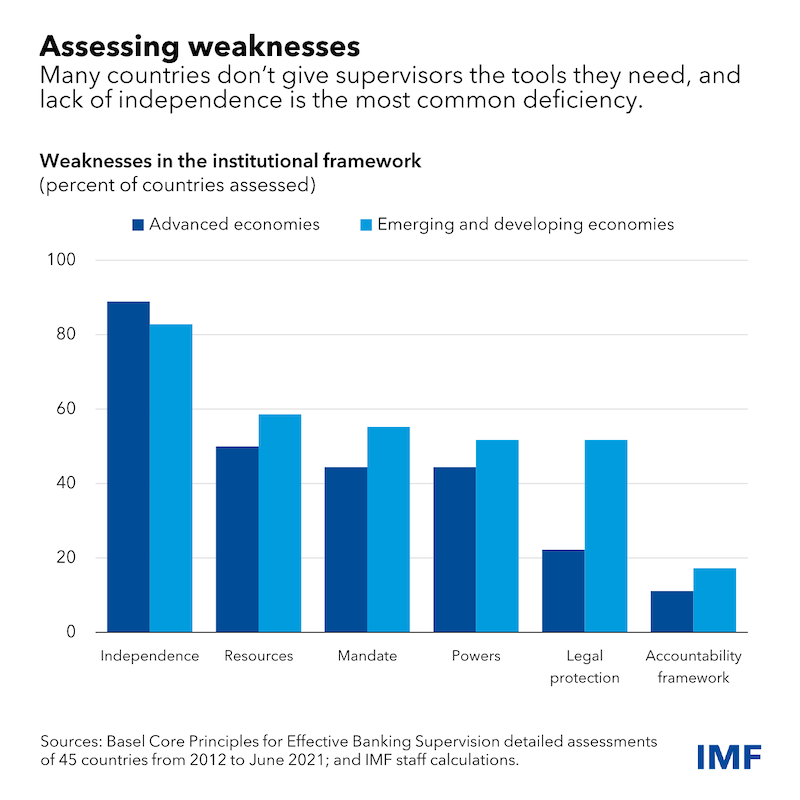

But in key respects, progress on supervision has not been sufficient. Our findings show that more than half of the jurisdictions do not have independent bank supervisors with a clear safety and soundness mandate, with sound internal governance, or with resources appropriate to their assigned responsibilities. Deficiencies also remain in supervisory approaches, techniques, tools, and (use of) corrective and sanctioning powers.

As a result, undertaking timely action based on supervisory findings continues to be a challenge. The ongoing structural evolution of the financial sector, such as the growth of nonbank financial intermediation, the digitalization of finance, and climate change, adds to supervisory challenges and makes these weaknesses even more relevant.

Higher bar for good supervision

Bringing supervision up to the task at hand requires action on four important fronts:

- Take a more systematic approach to requiring banks to go beyond quantitative regulatory thresholds and prudential rules when business and macro-financial risks are high.

- Overcome the tendency to under-allocate resources and attention to all but the largest of banks, as vulnerabilities at smaller banks can also trigger or amplify adverse systemic impact.

- Ensure that trained and experienced supervisors are available and can focus attention on governance, business models, and risk management at banks.

- Develop internal processes for decision making and escalation of actions that are clear and effective.

But efforts by supervisors alone will not be sufficient. Attention by other policymakers, including parliaments, to ensure a vigilant, independent, well resourced, and accountable supervisory structure is needed. Stronger institutional foundations enhance supervisors’ will and ability to act and purging perceived or actual vulnerability to government or industry influence will pay rich dividends.

About the authors:

- Tobias Adrian is the Financial Counsellor and Director of the IMF’s Monetary and Capital Markets Department. He leads the IMF’s work on financial sector surveillance and capacity building, monetary and macroprudential policies, financial regulation, debt management, and capital markets.

- Fabiana Melo is a Deputy Division Chief in the Financial Supervision and Regulation Division of the Monetary and Capital Markets Department. Since joining the IMF in 2009, she has been involved in Basel III/FSB/G20 related policy work, including the Core Principles for Effective Banking Supervision (BCP), regulation of Fintech, and Governance. She has participated in several FSAPs, including the Euro Area, the U.S.A, Germany, New Zealand, Philippines, Paraguay, Spain, Italy, Iceland, Austria, and Russia. Fabiana also coordinates technical assistance projects in several countries.

- Marina Moretti is Deputy Director in the Monetary and Capital Markets Department of the International Monetary Fund (IMF). In this capacity, she oversees the policy and technical work on financial supervision and regulation as well as on financial crisis preparedness and management.

- Jay Surti is Deputy Chief of the Global Financial Stability Analysis Division in the IMF’s Monetary and Capital Markets Department. He has also worked in the IMF’s European and African departments. His research interests cover financial institutions and markets and macro prudential policy. Mr. Surti holds a PhD in Economics from Boston University.

Source: This article was published by IMF Blog