Europe Stockpiling Oil As Iran Conflict Looms

By EurActiv

(EurActiv) — European governments are rushing to boost stockpiles of crude oil and fuel, anxious to comply with new EU rules and amid reports that Israel is preparing to launch an attack on Iran.

Belgium and the Netherlands have issued tenders to import a total of around 250,000 tonnes of diesel and gasoline for delivery in September and October, their agencies said.

France has also bought diesel and awarded a crude oil tender this week while Belgium is increasing its crude stocks.

“This is yet another unexpected source of support for oil demand… [It] shows how the geopolitical concerns about Iran and Syria are bullish for oil even in the absence of an actual supply disruption,” said Seth Kleinman, head of energy research at Citi.

Iran tensions

European governments appear to be preparing for further supply disruptions in the Middle East as tensions have mounted between Israel and Iran over Tehran’s nuclear programme.

Israeli media have reported that Prime Minister Benjamin Netanyahu has decided to launch an attack on Iran’s nuclear facilities in the Fall.

Iranian President Mahmoud Ahmadinejad reacted on Friday, calling Israel a “cancerous tumour” with no place in a future Middle East, drawing an unusually strongly-worded condemnation by EU foreign policy chief Catherine Ashton.

Ashton is acting as chief negotiator for six powers – the United States, Russia, China, France, Germany and Britain – that are trying to persuade Iran to scale back its nuclear programme through economic sanctions and diplomacy. They fear Iran’s nuclear programme aims at producing weapons, though Tehran says it serves peaceful purposes only.

EU oil stock directive

State inventories have come into focus as speculation mounts that the United States and other Western governments may release stocks to dampen prices and prevent high energy costs from undermining sanctions against Iran.

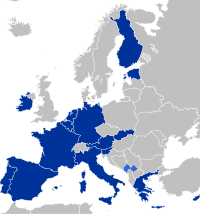

An EU directive passed in 2009 and designed to mitigate the impact of a supply crisis requires EU members to hold reserves equal to 90 days of average daily net imports or 61 days of average daily consumption ahead of a December 31 deadline.

One third of the stocks must be held in products, according to the EU directive.

“We are in the process of building stocks to meet our strategic obligations under the new EU rules,” said Alain Demot, general manager of Belgium’s Apetra, adding that more tenders would be issued in coming months.

Apetra said its tender was for 57,000 tonnes of diesel and was awarded on Thursday (16 August). It also said it had issued a crude oil tender and that a cargo of 900,000 barrels of crude oil would be delivered before the end of August into Belgian storage held in Wilhelmshaven, Germany.

Dutch agency COVA said it had issued a tender to import 200,000 tonnes of gasoline and had awarded a portion of the volume.

France’s SAGESS said it bought 2 million barrels of diesel or 267,000 tonnes before the end of June to meet its EU requirements. It awarded a tender to buy 2.1 million barrels of Saharan Blend crude for September delivery earlier this week.