The United States Shifts Gears In The Asia-Pacific – Analysis

By Hiroshi Matsushima

The US Inflation Reduction Act (IRA) is a milestone on the path towards the electric vehicle (EV) era — a monumental shift with the potential to remodel not just the US automotive industry, but the global landscape. Washington is working to establish alternatives to China’s control over critical mineral resources within the Asia-Pacific region, potentially recalibrating the global EV industry.

With its targeted incentives, including a battery production tax credit and purchase incentives for EVs assembled in the United States, the IRA underscores President Joe Biden’s administration’s commitment to stimulating sustainable growth and bolstering its domestic manufacturing.

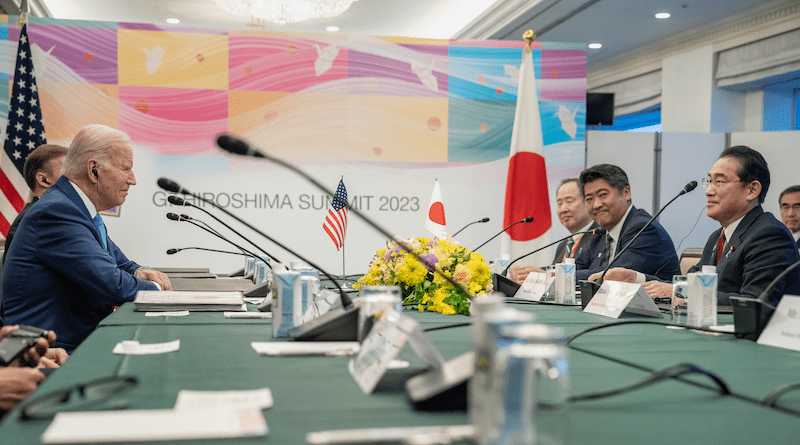

But the IRA will also have far-reaching global effects, as evidenced by the US–Japan agreement in March 2023. This accord, which allows metals sourced or processed in Japan to qualify for IRA subsidies, is a strategic manoeuvre and a signal flare. It could mark the initiation of a series of strategic alliances forming across the Asia-Pacific region. Australia, another resource-rich nation, recently jumped on the IRA subsidy initiative, and Indonesia, which has vast nickel reserves, seems ready to follow suit.

Other recent policy changes in the United States will amplify the impact of the IRA. The Biden administration’s ambitious new tailpipe emissions standards, in tandem with the directives proposed in the Bipartisan Infrastructure Law, accelerate the IRA’s push towards greener transportation.

Government projections suggest that under the full thrust of this multifaceted policy framework, EVs, which accounted for just 5.8 per cent of new vehicle sales in the US in 2022, could reach as much as 67 per cent of new vehicle sales in the United States by 2032. Collectively, these policy measures outline a comprehensive strategy for nurturing a resilient supply chain, encompassing both US and Asia-Pacific allies, ideally positioned to meet the escalating demand for critical minerals — the linchpin of emerging clean energy technologies.

As countries embark on the transition to EVs, a high-stakes global competition is emerging. Amid the contest for EV market share and industry leadership, the economic consequences of this rivalry are set to reverberate globally. Heightened competitive dynamics may compel legacy automakers and their home countries, including Japan and South Korea, to grapple with a vortex of challenges. These challenges include surging research and development investment needs, shrinking profit margins due to fierce competition from both new and established players, tightening regulations and the spectre of trade barriers.

Yet this flux of changes also creates opportunities. Manufacturing hubs like Thailand and resource-rich territories such as Australia and Indonesia stand to benefit. By capitalising on increased demand for resources and parts, these countries could stimulate their economic growth and expand their global influence, provided they leverage their comparative advantages and make strategic investments in infrastructure and innovation.

But outcomes hinge on a range of variables that pose potential risks, such as price volatility, supply disruptions, environmental or social impacts and geopolitical tensions. The most potent variable in this landscape is China, whose dominance in the EV supply chain is deep-rooted. The dominance is deeply entrenched in the upstream and midstream phases — from raw minerals through battery production. Yet it is China’s vast and rapidly expanding EV market that could further fortify this grip. This holistic control will continue to empower China to steer global markets even amid potential disruptions and escalating US-China tensions.

China, with such a vast influence over the EV supply chain and its capacity to leverage political pressure, is well-positioned to adroitly exploit shifts in supply-demand dynamics. The strategies that China might employ, drawing from historical precedents, include controlling prices and supply or even engaging in tactical diplomacy, such as strategically influencing trade agreements or imposing economic sanctions to exert pressure.

The United States, through its recent policy initiatives, is striving to gain control over a global market that is as geographically dispersed as it is vertically integrated — a Herculean task. In this pursuit, any strategic US endeavour to decouple from China will likely face intense pushback. Such pushback, combined with China’s potential to escalate its strategies, may inadvertently create opportunities for China to consolidate its market presence. This narrative underscores the intricacies of the high-stakes global competition and the nuanced balance required to navigate the future of EVs.

The Biden administration’s actions could reshape market dynamics and redefine the industry’s competitive landscape. The IRA — with the resulting subsidy initiatives stretching across the Asia-Pacific region — is altering the outlook for the global auto industry. A multifaceted array of opportunities and challenges lies ahead. For Asia-Pacific nations, this isn’t merely a challenge — it’s an opportunity to counterbalance China’s dominance in this emerging technology. The key to unlocking this potential lies in strategic foresight, regional cooperation and thoughtful policy calibration.

The journey into the uncharted territory of the EV era will be fraught with economic and political complexity. Yet each strategic step brings closer the vision of a balanced global EV industry and a future less dependent on a single player.

About the author: Hiroshi Matsushima is Economic Fellow at the Institute for Policy Integrity at New York University School of Law.

Source: This article was published by East Asia Forum