Social Security: Productivity Growth And The Scary Stories About Rising Retiree To Worker Ratios – Analysis

By Dean Baker

In the wake of the release of the 2024 Social Security Trustees Report, we have seen a wave of columns and news articles telling us that we won’t have enough workers to support a growing population of retirees. The story is that all of us baby boomer types are now retiring and the later generations are not having enough kids, so we will see a fall in the ratio of workers to retirees.

While the major media outlets love to push this line as a horror story, fans of arithmetic know it’s just ungodly silly. I’m tempted to turn this one over to ChatGPT, but I will write it myself again, this time.

The first point is that a falling ratio of workers to retirees is not exactly a new story. If we go to our friendly Social Security Trustees Report, we see that the ratio of workers to beneficiaries was 3.4 back in 2000 when all the baby boomers were still in the workforce. It is now down to 2.7. The ratio is projected to fall further to 2.2 by 2050.

I doubt that most people feel they have been terribly burdened by the falling ratio of workers to retirees in the last quarter century. But the media somehow seem to think it will be a disaster in the next quarter century.

Of course, the full picture would take the total dependency ratio, both the young and old, relative to the working-age population. That also is projected to rise somewhat, from 0.734 this year to 0.823 in 2050.

But this increase is also not a new story. We were at 0.669 in 2005. And we are never projected to come anywhere close to the 0.946 peak hit in 1965, when the baby boomers were all children.

Productivity Growth Allows for Rising Living Standards

But the bigger picture on demographics is the less important part of the story. The reality left out of these scare stories is that we are seeing rising productivity through time, which makes it possible for workers to support a larger population of retirees. The arithmetic on this is straightforward.

Suppose we want retirees to be able to get benefits equal to 70 percent of the average wage. Note this does not imply a sharp reduction in living standards of retirees relative to when they were working. A substantial share of the working-age population is supporting children. They also incur work-related expenses, like commuting, that retirees would not face.

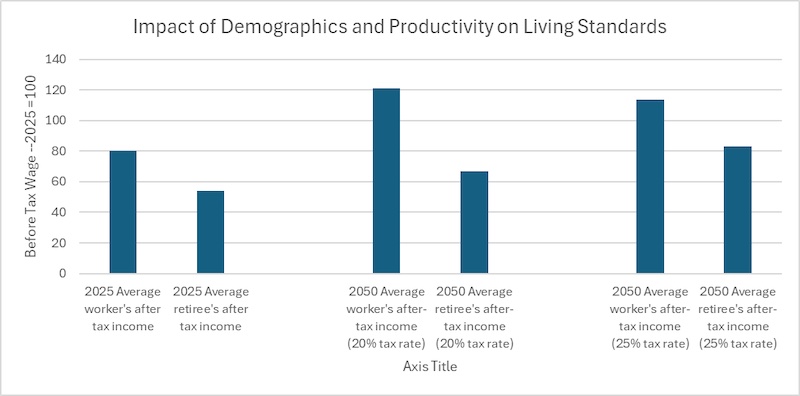

With the current ratio of workers to retirees we would need a tax of roughly 20 percent on the wages of the working population to support this level of benefits. (This would actually only get us 67.5 percent of the average worker’s after-tax pay, but that’s close enough for this exercise.) It is also worth mentioning that the transfer of income from workers to retirees doesn’t have to be done through a tax on wages.

It is the same story if retirees get their income from the ownership of assets, like shares of stock or housing. The point is that people who are not working need to be supported by people who are. From an economic standpoint, it doesn’t matter if retirees get their income from Social Security paid by the government, dividends on shares of stock, or rent paid by tenants on the housing they own.

Suppose we left the taxing structure in place, so we are still pulling away 20 percent of workers’ wages to support the retired population in 2050. With the ratio of workers to retirees down to 2.2 at that point, each retiree will only be getting 55 percent of an average worker’s after-tax pay.

That may sound like retirees would be really screwed, until we factor in productivity growth. The Social Security trustees project that productivity growth will average just over 1.6 percent annually over the next quarter century. If this is fully passed on in higher real wages (long story here), that means wages will be more than 51 percent higher in 2050 than they are today. In this case, 55 percent of an average worker’s after-tax pay would be 23 percent more than today’s retirees are getting. Should we be crying for them?

The world is more complicated. Most people expect their living standards in retirement to be close to their living standards during their working lifetime. Suppose that we decide that we have to tax workers at a 25 percent rate in 2050 to bring the living standards of retirees closer to that of the working population. (This would get us to 73 percent of the average after-tax wage for retirees.)

We know the politics on this could be a problem, but if we’re supposed to be concerned about overburdening our young to pay for retirees, consider that a worker in 2050 paying a 25 percent tax on their pay would have a 42 percent higher after-tax wage than a worker today paying a 20 percent tax rate. It’s still hard to see the horror story.

Speeding Up Productivity Growth

Productivity growth is hugely important for living standards, but the reality is that we are very bad at figuring out ways to speed it up. In fact, we find it very hard to even know what the trend is.

The post-World War II productivity boom ended abruptly in 1973. No one saw it coming and the slowdown was not even fully recognized until years after the fact. Even now there is no consensus on its causes.

The 1995 productivity speedup caught most economists by surprise, although there is at least a general agreement that information technology was most of the story. When productivity growth slowed again in 2005, it caught most economists by surprise and again there is no agreed upon explanation for the slowing.

This means that we can’t just snap our fingers and order an acceleration of productivity growth. But we do know that trends do shift, and it is at least possible that growth could speed up (it also could slow).

We have seen very rapid productivity growth over the last year, with an increase of 2.9 percent. It is at least plausible that artificial intelligence and other new technologies could sustain a faster rate of productivity growth going forward.

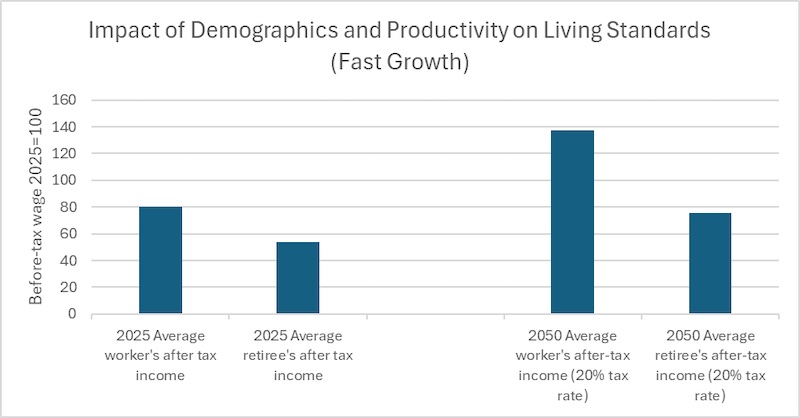

Suppose that we see the growth rate increase by 0.5 percentage points above the 1.6 percent rate projected by the Trustees to 2.1 percent. This is still well below the rates of close to 3.0 percent that we saw in the post-war boom and the 1995-2005 speed up.

In that case, the average wage will be 72 percent higher in 2050 than it is today. And, if we leave the tax rate at 20 percent, the average retiree will have a benefit that is more than 40 percent higher than retirees get today, even assuming no increase in taxes. Where’s the horror story?

To be clear, there is no way we can guarantee this sort of sustained increase in productivity growth. Dealing with the effects of global warming will be a big factor in lowering growth, but it is at least a possible scenario. In any case, it is far more likely than getting a massive change in the willingness of people to have children over the next decade.

There is another dimension to this picture that is often overlooked. When we think of productivity growth our thoughts tend to focus narrowly on economic output, which is appropriate since it is a measure of output. However, the same sorts of technology that might let us produce more output in an hour of work, may also allow us to live healthier lives.

Our current image of a typical person in their 80s may be someone who is frail, and likely to need assistance in many activities of daily life. However, if we have improvements in nutrition and other aspects of health care, people in their 80s in the 2050s may be in far better health than is the case today. That would mean both they are likely to enjoy better lives and require less medical care.

Again, there are no guarantees here. There are many forces pushing the other way. Bad nutrition and drug and alcohol abuse, coupled with an incredibly wasteful healthcare system, could mean that we will see few gains in health status. But it is not absurd to think that gains are possible. In any case, that is not an issue that is in principle beyond our control.

In short, demographics will be a factor in determining standards of living in the decades ahead, but a relatively minor one. Furthermore, it is not one that we can really do very much about. The endless harping on demographics in the media is a distraction from policy changes that actually could improve people’s lives.

This first appeared on Dean Baker’s Beat the Press blog.