Why Did China’s Macro Leverage Ratio Increase In The First Quarter? – Analysis

By Anbound

By Wei Hongxu

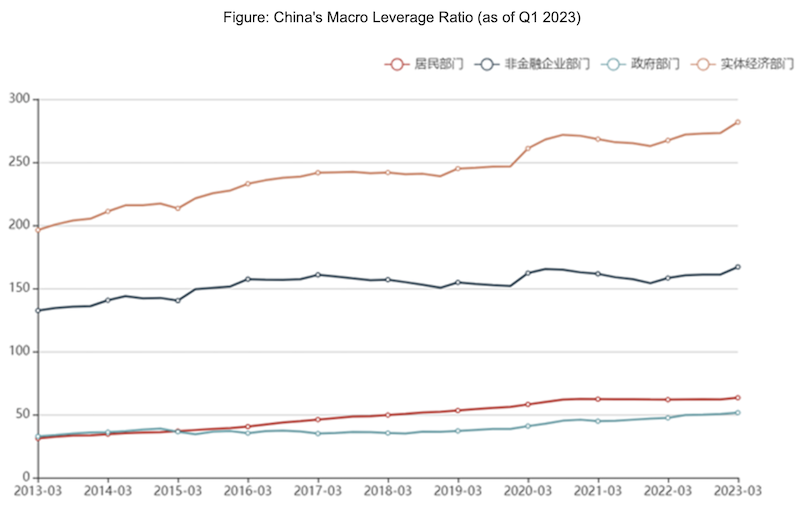

China’s National Institute of Finance and Development (NIFD) has recently released the latest macro leverage ratio for the country at the end of the first quarter of 2023. According to the data, the macro leverage ratio for the first quarter of 2023 rose by 8.6 percentage points, increasing from 273.2% at the end of 2022 to 281.8%.

NIFD has observed that the growth of total social debt has remained relatively stable, with the lower nominal economic growth rate being the primary driver behind the rise in the macro leverage ratio. It is projected that the macro leverage ratio for the entire year will experience an increase of approximately 8 percentage points, indicating a trend of reaching a peak and stabilizing.

According to researchers at ANBOUND, over a longer period, China’s macro leverage ratio has been on a continuous upward trend since 2008. In terms of policy, there has been a process of leveraging, deleveraging, and stabilizing leverage, experiencing some fluctuations along the way. From the outbreak of the COVID-19 pandemic in 2020 until now, the macro leverage ratio has gone through the initial stage to stabilize the economy, as well as the subsequent phase through policy adjustments. Currently, with intensified policy efforts to promote economic recovery, the macro leverage ratio has once again seen a noticeable increase. Striking a balance between stabilizing leverage, maintaining economic stability, and reducing risks is an ongoing challenge for macroeconomic policies that requires continuous adjustment and adaptation.

The noticeable rebound in the macro leverage ratio in the first quarter indicates that the increase in debt has not correspondingly led to economic growth. Economic growth tends to lag behind debt expansion, suggesting that the economic recovery is still not sufficiently robust. According to the report by NIFD, the main factor driving the increase in the macro leverage ratio is the slowdown in economic growth. In the first quarter, the actual GDP growth rate was 4.5%, showing a recovery compared to the previous year. The quarter-on-quarter annualized growth rate reached 9.1%, indicating a significant rebound compared to the previous quarter. However, the nominal GDP growth rate continued to decline. In the first quarter, the nominal GDP only grew by 5.0% year-on-year, which is much lower than the growth rates of money supply and debt during the same period. M2 money supply grew by 12.7% year-on-year, and the total social debt increased by 10.1% year-on-year. While debt growth remained above 10%, the nominal economic growth rate was only 5%, resulting in a significant increase in the macro leverage ratio.

It should be noted that in previous years, the Chinese economy went through a phase of debt-driven growth, where the growth rate of debt gradually declined. According to the NIFD report, the current debt growth rate has fallen from over 20% before 2010 to the current level of 10%. However, economic growth is influenced by both short-term cyclical shocks and long-term downward trends, which inevitably lead to an increase in China’s macro leverage ratio. In the short term, the increase in leverage driven by debt growth reflects two aspects: on the one hand, the debt-driven growth is facing bottlenecks, with its diminishing impact on economic demand; on the other hand, the continuous expansion of debt is also constrained by limited space and sustainability. Both aspects pose threats to achieving sustainable growth in the Chinese economy.

Structurally, NIFD points out that in the first quarter, the sector with the largest increase in the macro leverage ratio is still the non-financial corporate sector, which rose by 6.1 percentage points. The household sector follows, with a rise of 1.4 percentage points, while the government sector had the smallest increase, rising by 1.1 percentage points. In terms of debt growth rate, the government sector had the highest year-on-year increase, reaching 13.7%, and the growth rate of government debt remained relatively stable compared to last year. The household sector’s debt growth has shown some recovery, with an increase in consumer loans and personal business loans to some extent. The debt growth of non-financial corporations has rebounded to a level of 10.3%, reflecting an overall loosening of credit conditions aimed at helping businesses overcome financial constraints and driving economic growth through increased investment. However, the expansion of debt has not resulted in an improvement in effective demand. Insufficient demand remains the most significant factor affecting economic growth and will be crucial in determining the future trend of China’s macro leverage ratio.

Although the level of debt for non-financial corporations continues to expand steadily, it has not been fully reflected in investment activities. In the first quarter of 2023, the debt of the corporate sector increased by 10.3% year-on-year, reaching a relatively high level since 2018. Among them, corporate loans grew at the fastest pace, rising by 14.3% year-on-year, mainly due to loose liquidity. However, these funds did not promptly translate into corporate investment. Fixed asset investment in the first quarter grew by 5.1% year-on-year, maintaining a similar growth rate to the end of last year. Real estate investment still showed negative year-on-year growth, declining by 5.8% compared to the same period last year. Manufacturing investment grew by 7.0% year-on-year, showing a slight decrease compared to the previous year’s growth rate. Infrastructure investment increased by 10.8% year-on-year and remained the primary driving force for investment growth. In turn of this, infrastructure investment is mainly driven by the government sector, while private investment and non-governmental investment still lack strong momentum.

NIFD believes that the coexistence of rising corporate leverage and insufficient investment demand is mainly influenced by three factors. Firstly, the current economic recovery process in China is slower compared to previous cycles. Under triple pressures, it will take time for the corporate sector to regain confidence in economic recovery, and investment decisions by companies are more cautious. Secondly, as operating income and profits of the corporate sector decline, a larger proportion of corporate debt is used for debt repayment, which cannot drive investment growth. Thirdly, the structural policies set by the authorities to support corporate investment with lower loan interest rates may also result in certain loan funds not reflecting the real demand for funds, and even a certain degree of idle capital. This situation, from another perspective, explains the issue of the “two skins” of financial expansion and real economic growth. Its root cause lies in the fact that companies significantly increase debt without rapidly converting it into investment or operational activities. Instead, the debt is used on one hand to deleverage and on the other hand to reserve cash as a precaution against liquidity risks, leading to a decrease in monetary circulation. This issue can be seen as a reflection of insufficient expectations and confidence, and it is a normal state during the period of economic recovery, indicating that economic recovery is a gradual and relatively slow process.

According to NIFD, the increase in household leverage is mainly driven by short-term debt growth, particularly in consumer loans and business loans. The growth rate of consumer loans (excluding housing) reached 8.8%, while the year-on-year growth rate of business loans increased to 18.8%, leading to a rise in household leverage. Among them, personal business loans remain the primary method for households to increase leverage. In the first quarter, the growth rate of residential housing loans further declined to 1.2%. This also reflects the imbalance within the household sector, as households are simultaneously reducing debt through deleveraging efforts while needing to engage in business activities to increase income. The recovery of consumption in the short term, apart from essential daily expenses, is not expected to rebound quickly.

Contrary to common understanding, the government sector experienced the smallest increase in macro leverage ratio during the first quarter, with a rise of only 1.1 percentage points, mainly driven by local government debt. While the government sector had previously played a significant role in boosting infrastructure investment growth in the latter half of last year, the fiscal policy in the first quarter exhibited some moderation. Despite an expansion in the early batch quota for local government bonds, the actual issuance did not witness a significant increase. NIFD suggests that when considering factors such as surpassing debt balance limits in the previous year, the transfer of surplus from specific state-owned financial and monopoly institutions, and the ongoing decline in local government land transfer revenues, the fiscal policy intensity for 2023 is expected to remain relatively stable compared to the previous year. The government sector will need to continue exploring new areas of focus to achieve improved and strengthened performance.

Final analysis conclusion:

Overall, due to low inflation levels, the nominal GDP growth rate of China in the first quarter was lower than the expansion rate of debt, leading to a significant increase in the macro leverage ratio. The existence of a “time lag” between debt expansion and economic recovery, along with inadequate domestic consumer confidence and low investment efficiency, continues to be significant factors influencing the country’s economic rebound. Given the economy’s continued reliance on debt-driven growth, it is anticipated that the upward trajectory of the domestic macro leverage ratio will persist in the foreseeable future. Therefore, it is crucial for the Chinese authorities to prioritize the enhancement of economic efficiency as a key strategy to achieve stable leverage.

About the author: Wei Hongxu is a researcher at ANBOUND