How Soaring Shipping Costs Raise Prices Around The World – Analysis

By Yan Carrière-Swallow, Pragyan Deb, Davide Furceri, Daniel Jiménez and Jonathan D. Ostry

The sea carries more than 80 percent of the world’s traded goods, most of which sail inside 40-foot-long steel containers stacked by the thousands atop some of the largest vessels ever built.

The shock of the pandemic underscored just how crucial the maritime container trade is to the global economy. From Shanghai to Rotterdam to Los Angeles, the coronavirus upended supply chains. Ports lacked workers who were home sick. Truck drivers and ship crews couldn’t cross borders because of public health restrictions. Pent-up demand from huge stimulus programs during extended lockdowns overwhelmed the capacity of supply chains. Besides causing delays in getting goods to customers, the cost of getting them there surged.

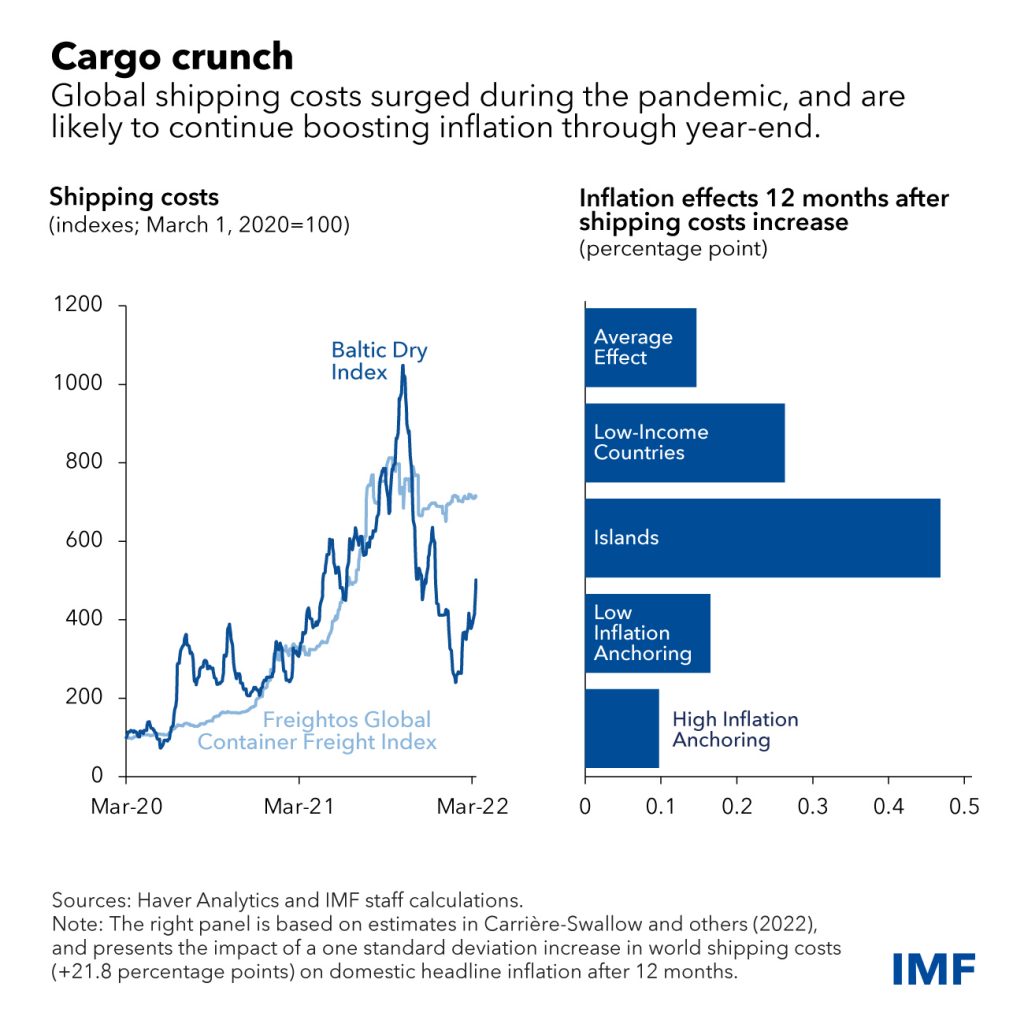

As the Chart of the Week shows, the result of those challenges was that the cost of shipping a container on the world’s transoceanic trade routes increased seven-fold in the 18 months following March 2020, while the cost of shipping bulk commodities spiked even more. Our new research shows that the inflationary impact of those higher costs is poised to keep building through the end of this year . Our analysis predates the war in Ukraine but isn’t isolated from it: the conflict will likely exacerbate global inflation.

Studying data from 143 countries over the past 30 years, we find that shipping costs are an important driver of inflation around the world: when freight rates double, inflation picks up by about 0.7 percentage point. Most importantly, the effects are quite persistent, peaking after a year and lasting up to 18 months. This implies that the increase in shipping costs observed in 2021 could increase inflation by about 1.5 percentage points in 2022.

While the pass-through to inflation is less than that associated with fuel or food prices—which account for a larger share of consumer purchases—shipping costs are much more volatile. As a result, the contribution in the variation of inflation due to global shipping price changes is quantitatively similar to the variation generated by shocks to global oil and food prices.

Our findings also reveal some of the mechanisms at work. We show that higher shipping costs hit prices of imported goods at the dock within two months, and quickly pass through to producer prices—many of whom rely on imported inputs to manufacture their goods.

But the impact on the prices consumers pay at the cash register builds up more gradually, hitting its peak after 12 months. This is a much slower process than what is seen after a rise in global oil prices, which drivers feel at the pump within a couple of months.

Rising shipping costs affect inflation in some countries more than others. First, our research shows that the structural characteristics of an economy matter. Countries that import more of what they consume see larger increases in inflation, as do those who are more integrated into global supply chains. Similarly, countries that typically pay higher freight costs—landlocked countries, low-income countries, and especially island states—see more inflation when these rise.

Second, a strong and credible monetary policy framework can play a role in mitigating the second-round effects from import prices and inflation. Our analysis shows that keeping inflation expectations well-anchored is key to containing the effect of soaring shipping costs on consumer prices, particularly core measures that exclude fuel and food.

Our results suggest the inflationary impact of shipping costs will continue to build through the end of 2022. This will create complicated trade-offs for many central bankers facing increasing inflation and still ample slack in economic activity. Moreover, the war in Ukraine is likely to cause further disruptions to supply chains, which could keep global shipping costs—and their inflationary effects—higher for longer.

*About the authors:

- Yan Carrière-Swallow is a senior economist in the IMF’s Asia and Pacific Department, where he contributes analysis on regional issues and is the desk economist for Indonesia. His research interests span topics in international macroeconomics and digitalization, with a focus on emerging markets and their policies.

- Pragyan Deb, is an economist in the IMF Asia Pacific Department’s Regional Surveillance Division and the desk economist for Myanmar.

- Davide Furceri is Deputy Division Chief of the Regional Studies Division of the Asia and Pacific Department of the IMF. Previous IMF positions include in the Research Department and the Middle East and Central Asia Department.

- Daniel Jiménez is research analyst at the Regional Studies Division of the Asia and Pacific Department of the IMF. He previously worked as a research officer in the same department.

- Jonathan D. Ostry is Deputy Director of the Asia and Pacific Department at the International Monetary Fund and a Research Fellow at the Center for Economic Policy Research (CEPR).

Source: This article was published by IMF Blog