Can IPEF Outweigh India’s Over Dependency On China For Supply Chain? – Analysis

The recent disruptions in global supply chain, leading to China losing prominence, are prompting serious discussions on India’s dependency on China. Hitherto, notwithstanding political face-off, India’s fast growth in electronic and electrical and pharmaceutical industries were largely dependent on supply chain from China. Given the China’s prominence in global supply chain in distress due to COVID 19 and Russian invasion of Ukraine, which invited more than 5000 sanctions against Russia unleashing collateral impact on China, new synergies have emerged for global supply chain.

Against these backdrops, questions are mooted should India continue to depend on China for its supply chain or divert to other nations. China was the second largest trading partner of India in 2021-22 and 2019-20 and largest trading partner in 2020-21. China’s larger stake in Indian trade was driven by India’s imports, which led to unabated dependence on China.

India’s dependence on China in electronic goods varied from 77 percent to 98 percent on parts of ICs, mobile phones, smart cards, sound recording and reproducing, solar cell/ photovoltaic in 2019-20. China’s dominance in the import of telecom and electronic products increased manifold after the Government initiated the Digital India programme in 2015. In pharmaceutical, almost 100 percent APIs (Active Pharmaceutical Intermediates) are imported from China.

However, Sino-India trade movement witnessed an inverse relation in export and import trajectories after 2017-18. During the five years period of 2013-14 to 2017-18, import from China was the trigger for trade buoyancy. Thereafter, export to China became the engine for growth. Against these backdrops, the launching of IPEF (Indo-Pacific Economic Framework) sparks a new hope to reduce China dependency. The crucial factor for rising hope is that excepting USA and India, all other members of IPEF are part of China led RCEP. Most of these members are embroiled in strategic concerns on China’s influence in trade and political overreach in the region.

There are two issues which raise concern on India’s China dependency. First, China’s supply chain turned vulnerable with zero COVID strategy and second, China’s BRI project (Belt and Road Initiative) is losing significance with the withdrawal of several members from the project.

India is not a participant in BRI. Eventually, China’s infrastructure connectivity projects with Chinese loans is unlikely to impact on India. However, China’s behemoth in supply chain to India is a matter of concern. China is the biggest import destination for India. It accounted for 15.4 percent of India’s total import in 2021-22.

Given these, it is argued that it is an uphill task to reduce China dependency. But there is another viewpoint. Some Asian NICs ( Newly Industrial Nations) of RCEP, who are also participants in IPEF, have emerged potential alternatives to China.

To mention it, Vietnam is a case in point. India’s imports of electronic and electrical goods from Vietnam increased three fold almost over a decade in between 2012-13 to 2020-21. Vietnam has become the third biggest import source for electronic items after China and Hong Kong. The ascendancy of Vietnam for an alternative supply chain was geared by ASEAN-India FTA in 2012-13.

India withdrew from RCEP, given the concern of backdoor entry of China. Nevertheless, India has already succumbed to China’s back door entry through Vietnam. As a case in point, a strong correlation was developed between Vietnam export to India and Vietnam import from China between 2012-13 and 2020-21. Surge in Vietnam exports of electronic and electric goods to India commensurate with Vietnam’s large import from China. Vietnam imports of electronic and electric goods from China increased more than seven times, over the same period.

Supply chain industry, which accounts for three-fourth of world trade, is in distress after Trump led USA’s dumping imports from China with high tariff and Russia invasion of Ukraine. Given these, China’s predominance in supply chain is ebbing and China+1 or decoupling from China are the emerging new strategies for supply chain

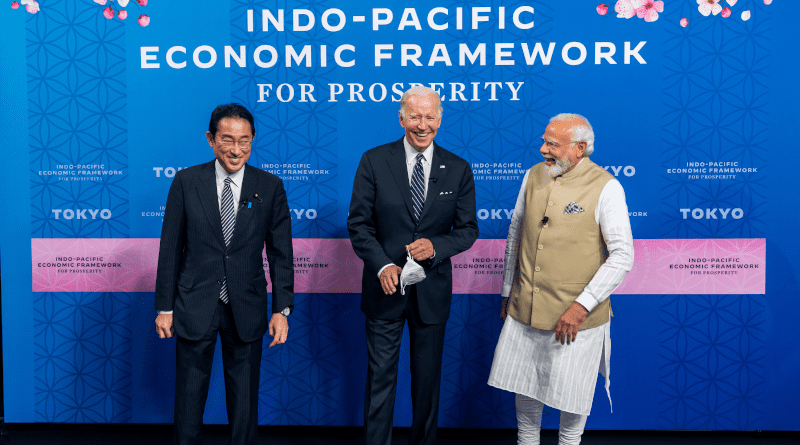

Indo-Pacific region is the emerging power struggle between USA and China. In this new axis of global power struggle, India is in the threshold of becoming big power in the region. IPEF is not a traditional economic block with duty free movement of goods. It is positioned as economic alliance, mainly to counter China’s predominance in trade and political influences in Indo-Pacific region.

There are several ways where IPEF will outbid China in the Indo-Pacific region and outweigh India’s China dependency. First, IPEF accounts for bigger share in India’s trade than China led RCEP. It was 29.7 percent in 2020-021, as compared to 25.2 percent by RCEP. Secondly, while larger share of trade with IPEF was exports base , trade with RCEP was import based. In 2020-21, IPEF accounted for 32.4 percent of India’s total export as compared to 22.7 percent of export to RCEP. Conversely, RCEP accounted for larger share of 36.8 percent of India’s total imports as compared to 27.4 percent imports from IPEF. In the case of IPEF, USA was the engine for export growth and in case of RCEP , China was the trigger for import surge. Third, RCEP connotes more risks for wider trade deficit than IPEF.

These demonstrate that IPEF has an edge over RCEP in downsizing China’s predominance in the region with China+1 strategy or decoupling from China, which may turn benign to India.