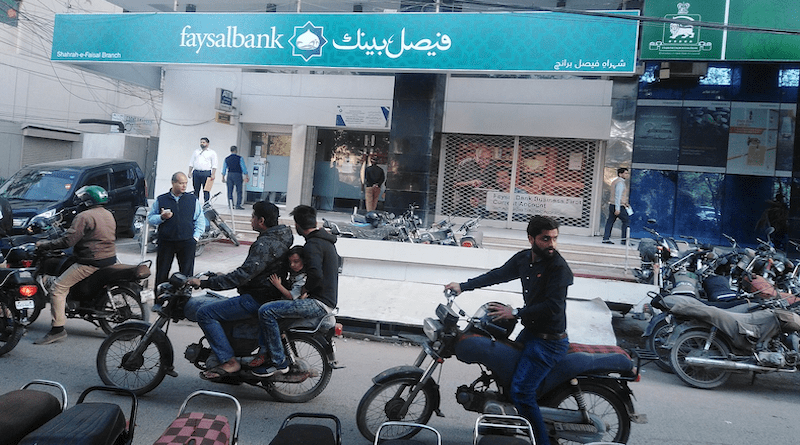

Pakistan: Faysal Bank To Become A Full-Fledged Islamic Bank By End 2022

Faysal Bank will become a full-fledged Islamic bank by the end of 2022 after ring-fencing its residual conventional loan portfolio, said Chief Financial Officer Syed Majid Ali.

Speaking at a press briefing at the bank’s head office, Syed said the Bank will surrender its conventional banking mandate once the regulator grants it the licence for Islamic banking.

Five Islamic banks and 17 conventional banks with Islamic banking branches currently operate in Pakistan. The share of Islamic banking assets in the overall banking industry is still below 20%, while the share of Sharia-compliant deposits is also below 20%, to be precise 19.4%.

“There’s never been a conversion of a conventional bank to an Islamic bank at such a massive scale. What we’ve done here is going to be taught as a case study worldwide,” said Syed.

Faysal Bank decided to convert its entire business from conventional to Shariah-compliant five years ago. It adopted the “asset-led conversion” model, which prioritized the conversion of banking assets such as investments and financings over that of liabilities like deposits.

Besides making all new branches Sharia-compliant from day one, the bank started converting its conventional business into Islamic one branch at a time. As a result, only one of the 639 branches remains conventional as of today. Even that branch will become Sharia-compliant by the end of this year, the CFO said.

The size of Faysal Bank’s balance sheet was Rs997 billion at end of June 2022. Its unconsolidated quarterly profit increased 17.3%YoY to Rs2.25 billion for the latest three-month period.

The Bank currently holds treasury bills and Pakistan Investment Bonds — conventional investment instruments forbidden under Islamic banking regulations — worth roughly Rs70 billion. “We’ll soon dispose of these holdings,” said Syed.

Responding to a question about the paucity of Sharia-compliant investment avenues for the deployment of liquidity, Syed said the conversion wouldn’t be possible had the bank stayed overly focused on ifs and buts of the process. “So what if we’ll have fewer investment avenues?” he said while emphasizing the need for following the religious injunctions against interest-based banking.

Replying to a comment about the similarity of the rates of return offered by conventional and Islamic banks despite the proclaimed differences between the two types, Faysal Bank’s head of Islamic banking Muhammad Faisal Shaikh said its reason is the Karachi interbank offered rate (Kibor), a reference rate at which banks borrow overnight funds from each other in the money market.

“Kibor is a pricing benchmark. A pricing mechanism doesn’t make anything halal or haram,” he said.

It may be recalled that Faysal Bank started operations in Pakistan in 1987 with a tiny branch and as a subsidiary of Faysal Islamic Bank, a Bahraini bank owned by Mohammed bin Faisal Al Saud, the son of the late King Faisal of Saudi Arabia.

It was incorporated in Pakistan on October 03, 1994 as a public limited company under the Companies Ordinance, 1984. ABN AMRO Bank Pakistan, a predecessor to Faysal Bank, acquired Prime Commercial Bank consisting of 69 branches and spanning 24 cities in 2007 for US$227 million to expand its loan and deposit base. In June 2010, Royal Bank of Scotland sold its Pakistan operations to Faysal Bank for £34 million. In 2014 it announced to convert itself into a full-fledged Islamic Bank in three to five years.

Faysal Bank was incorporated in 1994 with the sole aim of helping people and businesses grow financially. Fully equipped with the skills and professionalism, it claims, “We are not just a bank, but an integral partner in our customer’s journey towards economic and financial excellence”.

I is emerged in the banking industry with a competent backing of highly qualified leadership and professional excellence of its parent company, Ithmaar Bank – a Bahrain-based Islamic retail bank that provides retail, commercial, treasury, financial and other banking services.

Faysal Bank launched its first dedicated Islamic Branch in August 2009. Within 10 years, Faysal Islamic Banking grew to be the largest Islamic branch network of a conventional bank in Pakistan, having 400 plus dedicated Islamic Banking branches amongst a network of 550 plus branches.

It also claims, “Our Islamic banking practices are well-researched, under State Bank of Pakistan regulations and Shariah principles”.

The Bank strongly believe that the best way to serve its customers is by offering them products and services that are designed to truly fulfill their needs while also promising adherence to the principles of Shariah and the guidelines provided by the Shariah Board. Be it personal banking or corporate solution for complex financial needs, the unique diversity of its Islamic products and services to cater to all types of customers – Individuals, Institutions, Corporate, Trusts, Consumer and SME.

Its commercial offerings benefit the industry requirements with products that operate on Shariah compliant modes of financing such as Murabaha, Ijarah, Istisna, Musharaka.

The Bank has one of the most comprehensive Islamic deposit product menus in the market, for customers looking for multiple and flexible investment certificates, saving and/or checking account options, both in local and foreign currencies. Its Islamic deposit products are based on Qard, Mudarabah and Musharakah.

It has a host of Banca takaful solutions to cover one’s need for saving, retirement, child education, health and marriage.

The operations of the Bank are supervised by a Shariah Board, comprising of renowned Shariah Scholars, who oversee and issue guidelines on all Islamic banking products and services.

The Bank also has a dedicated and independent Shariah Compliance Department (SCD) to ensure that all Islamic banking activities, transactions and operations are carried out under the approved guidelines of the Shariah Board. The Internal Shariah Audit function ensures no activity is in contradiction to the principles of Shariah