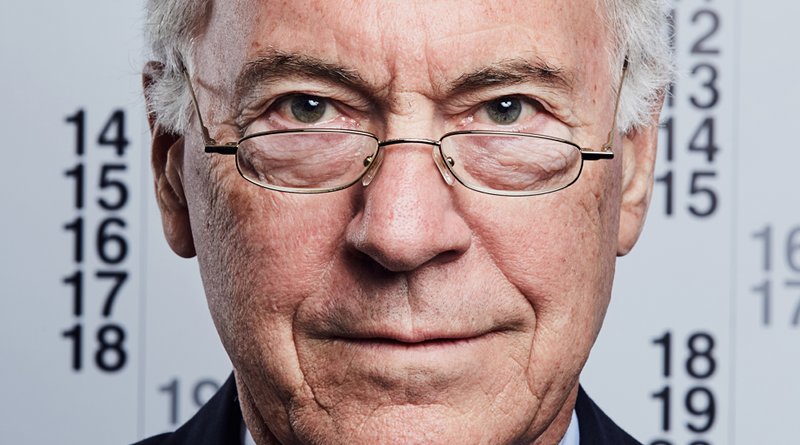

Steve H. Hanke: US Annualized Inflation Hit A 40-Year High Last Summer – OpEd

By Peter Tase

In an interview for Markets Insider journalist Theron Mohamed, Professor Steve H. Hanke encompassed the main trends in US economy and their consequences in national fiscal policy.

According to Professor Steve H. Hanke: stocks look expensive – and a recession is ‘right around the corner.’ The Johns Hopkins professor expects an economic collapse in the first half of next year.

Professor Hanke sees inflation cooling, 10-year Treasury yields falling, and house prices staying afloat.

The professor of applied economics at the Johns Hopkins University is known for serving as the president of Toronto Trust Argentina when it was the world’s best-performing market mutual fund in 1995.

The following is a summary of Prof. Hanke’s interview provided to Mr. Theron Mohamed, a Markets Insider Journalist:

“As for the housing market, Hanke noted there’s a shortage of homes for sale. He attributed that to limited inventory of existing homes, and more than 15 years of insufficient construction of new homes. As a result, he suggested unmet demand would shore up prices.

Hanke, a former economic adviser to President Ronald Reagan, also laid out to Insider as to why he expects US growth to falter.

He noted the nation’s money supply “exploded” during the pandemic as the federal government flooded the economy with cash. That caused asset prices to soar and, later, economic activity to surge.

Annualized inflation also hit a 40-year high of more than 9% last summer, as professor Hanke and John Greenwood, a fellow at Johns Hopkins and Invesco’s former chief economist, predicted in July 2021.

The Federal Reserve has “thrown things into reverse” since last spring, Hanke said. The central bank has raised its benchmark interest rate from nearly zero to north of 5% and worked to shrink its balance sheet.

“The money supply is falling like a stone and is currently contracting at a minus 3.7% annual rate – something we have not seen since 1938,” he said.

The renowned economist warned that a decline of that magnitude would likely choke economic growth: “We believe that a recession is baked in the cake and will commence during the first half of 2024.”

Hanke also highlighted that he and Greenwood predicted in February that inflation would fall to about 2% by the end of 2023. Price growth has already cooled to around 3% in recent months.

Moreover, the veteran currency and commodity trader flagged the gap between the current 10-year Treasury yield of around 4.3%, and the expected 1.9% yield based on its trend rate over the last 43 years.

“With lower inflation and a recession right around the corner, I anticipate that the 10-year yields will come down and the gap will close,” Hanke said.

The economist has been ringing the alarm on stocks and the economy for some time. He warned in February that pressure on corporate profits and shrinking output didn’t bode well for equities, and cautioned earlier this month that complacent investors were “sleepwalking” into market turmoil and a recession.”