Dollar Dominance And The Rise Of Nontraditional Reserve Currencies – Analysis

By Serkan Arslanalp, Barry Eichengreen and Chima Simpson-Bell

The US dollar has long played an outsized role in global markets. It continues to do so even as the American economy has been producing a shrinking share of global output over the last two decades.

But although the currency’s presence in global trade, international debt, and non-bank borrowing still far outstrips the US share of trade, bond issuance, and international borrowing and lending, central banks aren’t holding the greenback in their reserves to the extent that they once did.

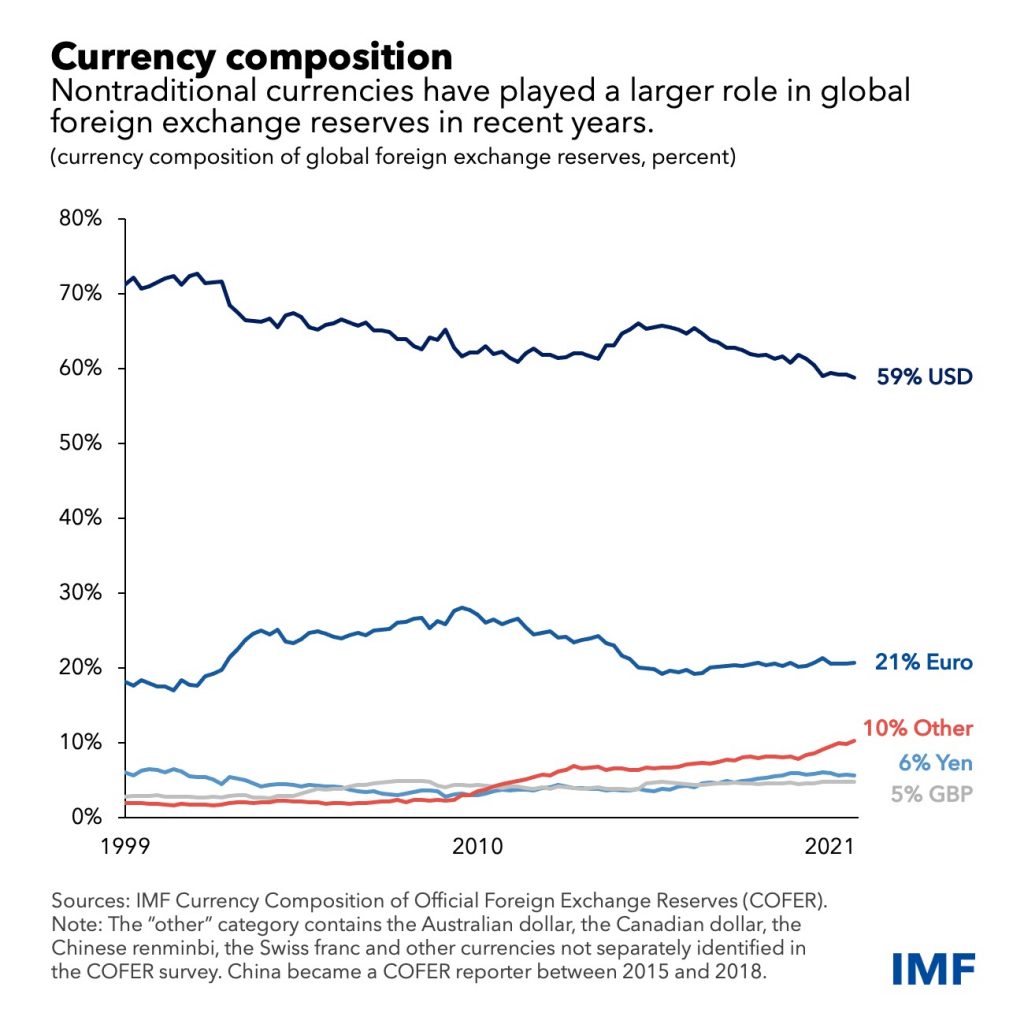

As the Chart of the Week shows, the dollar’s share of global foreign-exchange reserves fell below 59 percent in the final quarter of last year, extending a two-decade decline, according to the IMF’s Currency Composition of Official Foreign Exchange Reserves data.

In an example of the broader shift in the composition of foreign exchange reserves, the Bank of Israel recently unveiled a new strategy for its more than $200 billion of reserves. Beginning this year, it will reduce the share of US dollars and increase the portfolio’s allocations to the Australian dollar, Canadian dollar, Chinese renminbi and Japanese yen.

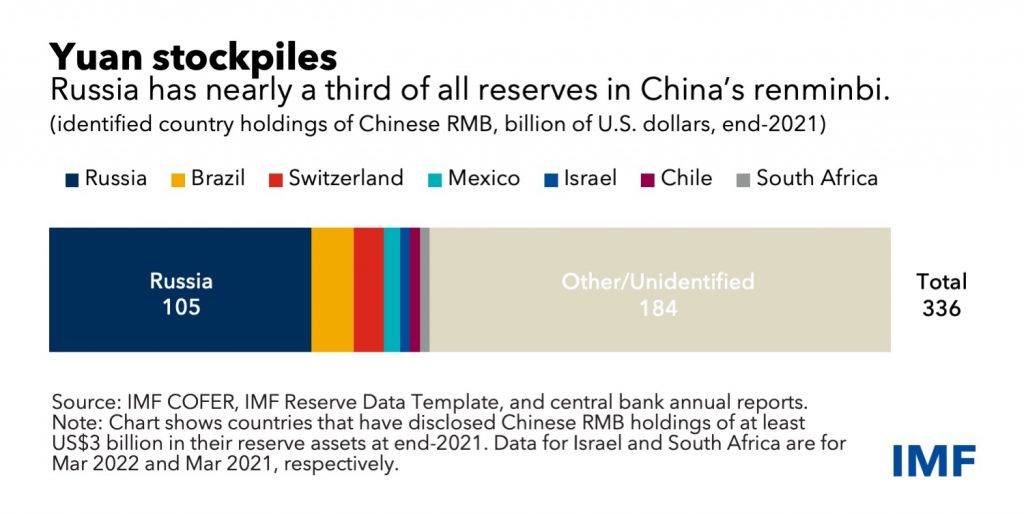

As we document in a recent IMF working paper, the reduced role of the US dollar hasn’t been matched by increases in the shares of the other traditional reserve currencies: the euro, yen, and pound. Moreover, while there has been some increase in the share of reserves held in renminbi, this accounts for just one quarter of the shift away from dollars in recent years, partly due to China’s relatively closed capital account. Moreover, an update of data referenced in the working paper shows that, as of the end of last year, a single country—Russia—held nearly a third of the world’s renminbi reserves.

By contrast, the currencies of smaller economies that haven’t traditionally figured prominently in reserve portfolios, such as the Australian and Canadian dollars, Swedish krona and South Korean won, account for three quarters of the shift from dollars.

Two factors may help to explain the movement into this set of currencies:

- These currencies combine higher returns with relatively lower volatility. This appeals increasingly to central bank reserve managers as foreign exchange stockpiles grow, raising the stakes for portfolio allocation.

- New financial technologies—such as automatic market-making and automated liquidity management systems—make it cheaper and easier to trade the currencies of smaller economies.

In some cases, the issuers of these currencies also have bilateral swap lines with the Federal Reserve. This, it can be argued, creates confidence that their currencies will hold their value against the dollar.

At the same time, the importance of this factor can be questioned. The nontraditional currencies tend to float. In practice, they fluctuate widely against the dollar. And their issuers have rarely if ever drawn on their bilateral swap lines with the Fed. A regression analysis shows that having a Fed swap line is associated with a 9 percentage point increase in the dollar share of the recipient’s reserves. This may indicate that swap lines are an imperfect substitute for actual reserves.

A more plausible explanation is that these nontraditional reserve currencies are issued by countries with open capital accounts and track records of sound and stable policies. Important attributes of reserve currency issuers include not just economic weight and financial depth, but also transparent and predictable policies. In other words, the stability of the economy and policy decisions matter for international acceptance.

A regression analysis of global reserve currency shares confirms that a higher economic risk premium, measured by the cost of using credit derivatives to insure against default, reduces a currency’s share in global reserves. Evidently, holders favor the currencies of countries known for good governance, economic stability and sound finances.

*About the authors:

- Serkan Arslanalp is Deputy Division Chief in the Balance of Payments Division of the IMF’s Statistics Department. He has worked in several departments of the Fund (APD, MCM, FAD, AFR) on a range of countries (advanced economies, emerging markets, low-income/fragile states) and policy areas (strategy; bilateral, regional, and global surveillance; Fund lending operations; standards; capacity development).

- Barry Eichengreen, George C. Pardee and Helen N. Pardee Professor of Economics and Political Science

- Chima Simpson-Bell is an Economist in the IMF’s African Department. Previously, he worked in the Statistics Department as a member of the Balance of Payments Division. He joined the IMF in 2020. His research covers issues in sovereign debt, international reserves, and currency unions. He holds a PhD in Economics from the European University Institute.

Source: This article was published by the IMF Blog