Ralph Nader: Update To Upset Cisco Shareholders

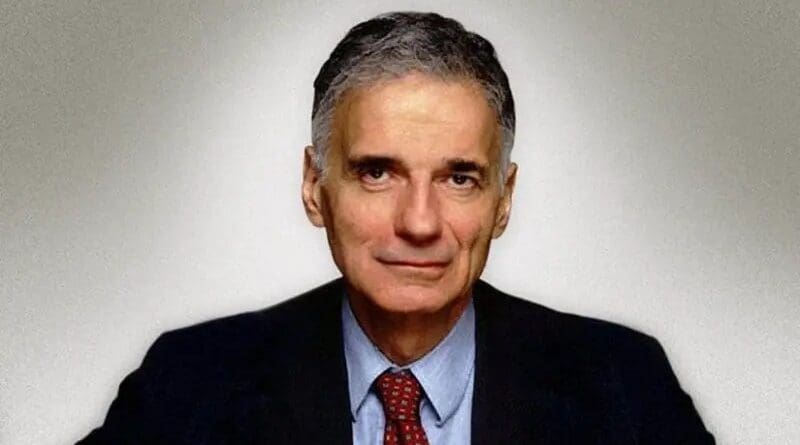

By Ralph Nader

Dear Cisco Shareholder:

Thank you for your e-mail support for my demand that Cisco’s bosses disgorge some of that $43+ billion in cash that management is stockpiling, back to its owners – the shareholders. My criticism and demand for a 50 cent annual dividend and a special $1 per share dividend were reported in the Wall Street Journal (June 24), Barron’s Financial Weekly the next day and CNBC two days later.

Your e-mails were thoughtful and wonderfully impatient. You were properly critical of top Cisco management, often urging that John Chambers and members of the Board of Directors be replaced.

Some e-mails provided documentation signifying that a shareholder revolt will focus on the details of mismanagement; and executive self-enrichment that fostered this climate of leaving the shareholders behind. You know that investors have few rights vis-a-vis their hired hands at the top except to sell their stock. That exit doesn’t really change policy unless the sellers include the giant mutual funds and pension funds that do very little to pressure management even when they own large amounts of stock – as one of you pointed out.

One e-mail declared, “I own Cisco shares. Management is hoarding cash. Afraid they will make another boneheaded acquisition, to the detriment of the company. Will happily support increase in dividend, special dividend, a change in management, or shakeup of the board.”

That sums up the sentiment of many of you who contacted us.

Another e-mail said simply “Long 5500 shares. I’m in for the revolt.”

Another e-mail: “Chambers and other executives should go to zero income until the Cisco shares get back to at least $25 per share.”

Then there was this intriguing e-mail from a Cisco employee – “Wondering how current employees may express their interest in putting our company’s cash balance to work or returning it to shareholders. How can we express our view without making our names or status as employees [public] without fear of potential negative ramifications?” You may wish to contact the Government Accountability Project for advice (www.whistleblower.org).

So, what’s next? Several suggestions:

First, urge other Cisco shareholders you know to contact us at [email protected]. There is strength in numbers.

Second, send us more of your experiences with Cisco investor relations or your knowledge of past Cisco “back-of-the-hand” treatment of their owners.

Third, do you know any Hedge Fund managers or someone with the influence of Carl Icahn – to whom I’ve put in a call – willing to help pressure Chambers and company to act and act fast for a special/one dollar dividend per share and to explain how they are going to increase shareholder value and not engage in foolish acquisitions or wasteful stock buybacks?

On a broader note, the Wall Street Journal reports that non-financial U.S. companies are sitting on $1.9 trillion in cash, not investing it in productive projects at a time when our economy could use a boost. Imagine if Apple, Google, Microsoft and many other companies paid, for the first time, or raised their dividends and together poured $200 billion into the hands of shareholders. That would increase consumer demand when it is needed. Instead management seems content to sit on the inert cash in excess of what is prudently needed.

Top management, having turned the wide-open ‘business judgment’ rule into an anti-shareholder forcefield, has to realize that this trove of money is not their money, it is our – the owner – shareholders’ money!

Stay in touch and stay tuned at www.nader.org, where you can see Cisco’s June 21, 2011 response to my letter.

Best wishes,

Ralph Nader