World Oil Markets: 2011 In Review – Analysis

By EIA

(EIA) — The year 2011 was eventful for oil markets, as reflected both in price trends and developments that may presage broader structural shifts over the coming years.

The spot price of North Sea Brent crude averaged over $111 per barrel in 2011, marking the first time the global benchmark averaged more than $100 per barrel for a year. U.S. benchmark West Texas Intermediate (WTI), plagued by transportation bottlenecks, fell short of eclipsing its record annual average of $99.67 per barrel set in 2008, but its 2011 average of $94.86 still represented a $15 increase over 2010.

Bookended by the departure of Tunisian President Zine El Abidine Ben Ali in January and by the withdrawal of U.S. troops from Iraq in December, the year saw many developments in countries seen as critical for global oil supply. Yet, however dramatic the short-term oil market impact of these events, their full transformative effect on the oil industry can be assessed only in the context of broader structural changes. The multiple factors driving these shifts may not individually be seen as game-changing, but collectively they may prove sufficient to make 2011 something of a turning point.

The disruption in Libyan crude exports during that country’s civil war, one of the top supply stories of 2011, is a case in point. Ultimately, compounded by other politically-driven production cuts in Syria and Yemen, this disruption triggered a release of oil from strategic storage in International Energy Agency (IEA) member countries, only the third such release in IEA history.

Total estimated production losses from Libya, Syria, and Yemen for 2011, which reached 450 million barrels (bbls), were only partly offset by a release of IEA stocks and increased output from Saudi Arabia, and were clearly a leading factor behind last year’s record rise in Brent crude oil prices. By year’s end, however, Libyan crude had begun to return to oil markets, as field production resumed faster than U.S. Energy Information Administration (EIA) and many other analysts had expected.

The full significance of the Libyan crude disruption may best be seen as part of a broader story. The shortfall’s impact, though considerable, could have been even larger if it had not been partly cushioned by exceptionally weak demand in Europe, the main outlet for Libyan crude. While the Libyan civil war may be over, production issues could linger.

Just how quickly Libyan output can sustain pre-crisis levels remains unclear, as are the security and political arrangements that will replace those of the Gadhafi regime. Beyond Libya itself, will increased social spending by other regional oil producers in an apparent bid to preempt the spread of unrest, become permanent, as some analysts have suggested, creating a new revenue requirement that could lead key producers to favor higher crude oil prices to help balance their national budgets? If so, the recent events in Libya may best be seen as only one among a series of factors that evoke higher price expectations of OPEC producers and restrict the long-term availability of North African and Middle East oil supply, whether due to internal competition for barrels from domestic end-users, increased revenue requirements, or political and social pressures.

Extreme weather and economic woes proved as disruptive for demand in 2011 as Middle East unrest did for supply. In Japan, the Fukushima nuclear disaster following the earthquake and tsunami disrupted both nuclear power generation and the broader economy, temporarily trimming energy demand as a whole but encouraging fuel switching to oil (as well as other fossil fuels) for power generation. In Europe, Greece’s sovereign debt crisis raised concerns about financial contagion, the future of the euro and the region’s economic recovery. Here too, headline events must be seen in perspective.

While Japan recovered rapidly from the Fukushima disaster, the tragedy raised worldwide concerns about nuclear safety, bringing to the fore long-simmering questions about the industrialized world’s aging nuclear fleet and the future of global electric power generation. Much of Japan’s nuclear capacity remains idle, lifting utility demand for liquefied natural gas and, at the margin, oil. On the other hand, Europe’s renewed economic woes served only to further reduce the liquid fuels share of demand of Organization for Economic Cooperation and Development (OECD) member countries relative to that of non-OECD economies. While the latter group has not yet overtaken the former as the largest liquid fuels consumer, the two came closer in 2011 than ever before and a crossover is likely to occur in the near future.

Whether supply- or demand- focused, the headline events of 2011¸ however momentous they were, should not overshadow other shifts, which may prove no less significant for U.S. and global oil markets. Last year’s unusual patterns in benchmark crude pricing offer a powerful illustration of those shifts. Early in 2011, amid fast-rising crude oil production from the U.S. and Canadian midcontinent, prices for U.S. inland crude benchmark West Texas Intermediate (WTI) started to weaken significantly relative to those for broadly traded coastal or imported crude oil grades, such as Louisiana Light Sweet or North Sea Brent.

WTI’s discount had started to tighten by year’s end, as pipeline and railroad companies took steps to move more stranded crude oil from inland U.S. markets to the Gulf Coast, yet remained unusually wide by historical standards.

In the United States and Canada, the production gains generated by technological advances, such as the combination of hydraulic fracturing and horizontal drilling, can hardly be overstated. Very preliminary data indicate that U.S. crude production increased significantly in 2011. Those increases are expected to continue in 2012 and to spread to other countries.

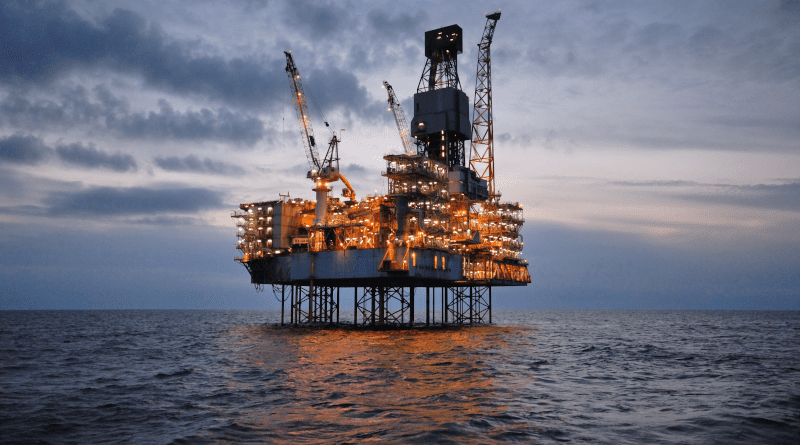

Meanwhile, in Brazil, production is also slated to increase as advances in deepwater drilling unlock the country’s vast subsalt resources. All together, the Americas accounted for the majority of non-OPEC crude production growth in 2011, and are expected to continue dominating non-OPEC supply growth over the next few years.

As a consequence, oil markets in the Americas are becoming increasingly integrated and self-sufficient.

Canadian oil sands and U.S. supplies are displacing U.S. imports from Europe, West Africa and, until recently, the Middle East – a trend that may gain momentum once logistical links are put in place to bypass current crude transportation bottlenecks in the midcontinent. At the same time, product exports from the United States to expanding markets to the south are growing rapidly, as discussed below.

This quiet revolution in crude oil production is driving an even quieter one in the downstream. Seeking to leverage their access to rising volumes of discounted heavy Canadian crude, U.S. Midwest refiners have been investing in infrastructure to process more of those relatively low-quality barrels. Their counterparts on the Gulf Coast, having long enjoyed more feedstock flexibility than other refiners in the rest of the OECD, are expanding overall crude capacity.

In contrast, East Coast refiners, which do not currently enjoy those feedstock advantages and face diminishing local product demand, have been trimming capacity. The result is that refined product trade flows are being redrawn. In 2011, the United States shifted to net product exporter status for the first time since at least 1949. The East Coast, however, appears likely to become more dependent on product imports.

If 2011 was an eventful year for oil markets, 2012 might be even more so. At the onset of 2012, the U.S. and international markets face considerable uncertainty, not least from the unresolved dispute between Iran and the United Nations over Iran’s nuclear program. Iran relies heavily on revenue from its crude oil exports, and various actions affecting Iran’s oil trade are under consideration by several major countries as a way to increase the pressure on Iran to comply with its nuclear non-proliferation obligations. These developments are occurring against the backdrop of an oil market deeply transformed by technological advances in production, a redistribution of global demand growth, far-reaching shifts in crude and product trade flows and lingering political uncertainty in many producing countries. The U.S. Energy Information Administration will monitor these far-reaching changes and continue to assess their impacts and significance for U.S. consumers and all market participants.

Gasoline price moves higher for a second week while diesel price drops

The U.S. average retail price of regular gasoline rose just over four cents last week to reach $3.30 per gallon. The average price is nearly $0.23 per gallon higher than last year at this time. The East Coast price increased just over five cents per gallon while the Midwest price increased almost four cents per gallon versus last week. Gulf Coast and West Coast prices both increased over four cents per gallon. The West Coast price remained the highest in the country at $3.55 per gallon. Going against the trend, the Rocky Mountain average decreased about four cents per gallon to $3.04 per gallon.

The national average diesel price fell for the sixth straight week, dropping less than a penny to $3.78 per gallon. The diesel price is $0.45 per gallon higher than last year at this time. Prices on the East Coast, Gulf Coast, and West Coast all increased a fraction of a penny to $3.84 per gallon, $3.71 per gallon, and $3.98 per gallon, respectively. The Midwest and Rocky Mountain regional averages both decreased. In the Midwest, the price is $3.68 per gallon, a drop of more than two cents per gallon versus last week. After declining two and a half cents, the Rocky Mountain region averaged $3.84 per gallon.

U.S. average heating oil price increases

The residential heating oil price increased during the week ending January 2, 2012. The average residential heating oil price rose by $0.01 per gallon last week to reach $3.84 per gallon, nearly $0.51 per gallon higher than the same time last year. The wholesale heating oil price increased by $0.03 per gallon last week to $3.00 per gallon, $0.35 per gallon more than last year at this time.

The average residential propane price increased by less than $0.01 per gallon, rising to $2.87 per gallon, which is $0.13 per gallon higher than last year. The average wholesale propane price decreased by $0.01 per gallon to $1.34 per gallon. This was a decrease of $0.08 per gallon when compared with the January 3, 2011 price of $1.42 per gallon.

U.S. propane inventories fall for fifth straight week

Total U.S. inventories of propane continued their seasonal draw last week, falling by 1.0 million barrels to end at 55.2 million barrels. The Gulf Coast region experienced the largest decline of 0.6 million barrels. Midwest regional stocks dropped by 0.2 million barrels, while Rocky Mountain/West Coast regional stocks fell by 0.1 million barrels and East Coast regional stocks were down slightly. Propylene non-fuel use inventories represented 9.9 percent of total propane inventories.