An Assessment Of China’s Monetary And Financial Data In First Quarter – Analysis

By Anbound

By Wei Hongxu*

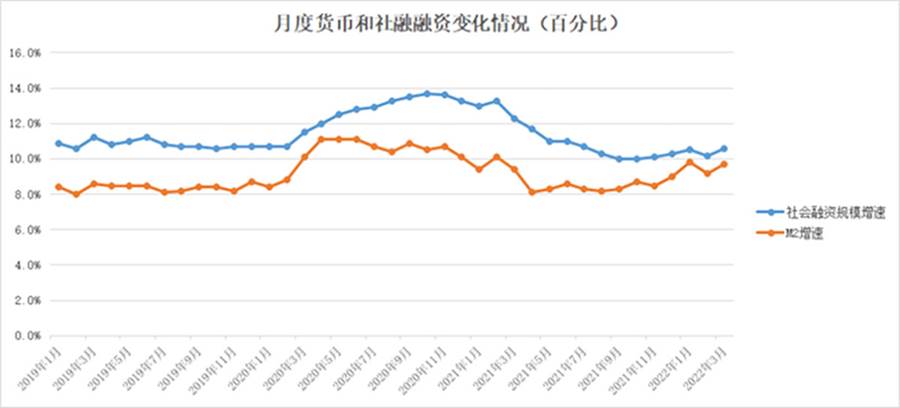

The latest monetary and financial data for March and the first quarter of this year show that China’s financial sector started to pick up again after the decline in February. Both the growth rate of the M2 broad money supply and the total social financing exceeded market expectations, which sent a positive signal for the economic situation in the first quarter. However, in terms of the intrinsic structure and subsequent trends, researchers at ANBOUND believe that on the one hand, economic structural problems implied by financial data may continue to bring about a discrepancy between macro data and actual perception. On the other hand, in terms of trends, it remains very difficult to achieve the economic growth target this year. Appropriate monetary policy is still needed to maintain stable and accommodative financial environment.

Data from the People’s Bank of China (PBoC) showed that at the end of March, the M2 broad money supply amounted to RMB 249.77 trillion, up 9.7% year on year, 0.5 and 0.3 percentage points higher than at the end of last month and the same period of last year respectively. The M1 money supply amounted to RMB 64.51 trillion, up 4.7% year on year, unchanged from the end of last month and 2.4 percentage points lower than the same period last year. Although the M2 growth rate has picked up compared with that in February, reflecting the effect of the cross-cycle adjustment of monetary policy, the M1 growth rate was still significantly lower than that of the same period last year, reflecting that market economic activities have not been effectively recovered and the foundation of economic growth was not solid.

Monthly M2 money supply and total social financing growth

In March, RMB-denominated loans increased by RMB 3.13 trillion, an increase of RMB 395.1 billion from a year earlier. This was actually the effect that monetary policy is required to maintain the increase in RMB-denominated loans at present. RMB-denominated loans increased by RMB 8.34 trillion in the first quarter, an increase of RMB 663.6 billion year on year. It also reversed a decline in loan growth in February. By sector, household loans increased by RMB 1.26 trillion, with short-term loans increasing by RMB 194.3 billion and medium- and long-term loans by RMB 1.07 trillion. Loans to enterprises and public institutions increased by RMB 7.08 trillion, of which short-term loans increased by RMB 2.23 trillion, medium- and long-term loans by RMB 3.95 trillion, and bill financing by RMB 802.7 billion. Loans from non-banking financial institutions decreased by RMB 8.1 billion. It can be seen from this data that the increase in loans was mainly due to the significant growth of corporate loans. This signifies that corporate investment contributes more to economic growth. As for households, compared with the situation in the first quarter of 2021, household loans increased by RMB 2.56 trillion during the same period (the first quarter of 2021), among which short-term loans increased by RMB 582.9 billion and medium- and long-term loans increased by RMB 1.98 trillion. The noteworthy decline in the increase in household loans suggests that consumption growth in the first quarter of this year is not encouraging, and the demand for housing, which corresponds to medium- and long-term loans, is falling.

In terms of the increase in total social financing, the scale of social financing increased by RMB 4.65 trillion in March, RMB 1.28 trillion more than the same period last year. This change also exceeded market expectations. In the first quarter of 2022, the cumulative increase in total social financing was RMB 12.06 trillion, RMB 1.77 trillion more than the same period last year. This is partly related to last year’s base effect, when the monetary policy stance began to shift, resulting in a decline in the growth of total social financing. Monetary policy this year has transited to moderate easing, thus bringing about a change in the scale of social financing. In the first quarter, the amount of RMB-denominated loans to the real economy increased by RMB 8.34 trillion, an increase of RMB 425.8 billion. The amount of foreign currency loans to the real economy increased by RMB 175 billion, RMB 9.5 billion less than last year. The amount of entrusted loans increased by RMB 46 billion, RMB 51 billion more than last year. The amount of trust loans decreased by RMB 169 billion, RMB 187.9 billion less than last year. The amount of undiscounted banker’s acceptances increased by RMB 79.1 billion, RMB 245.4 billion less than last year. The amount of net financing of corporate bonds reached RMB 1.31 trillion, RMB 405 billion more than last year. The amount of net government bond financing totaled RMB 1.58 trillion, RMB 923.8 billion more than last year. Non-financial companies raised RMB 298.2 billion in the domestic stock market, RMB 51.5 billion more than last year. From these sub-data, the significant growth of bank loans and corporate bond financing indicates that overall credit has expanded in the context of monetary easing, reflecting the optimistic expectation of “credit easing”. In addition, government bond financing contributed the most to the increase in total social financing, with an increase of over RMB 900 billion. This has a lot to do with the fiscal policy this year, and it also means that government-related investment will be the main driver of economic growth in 2022.

However, financing instruments such as trusts and notes continued to contract, which has a lot to do with factors such as the sluggish real estate market and policy restrictions, indicating the real estate market is still being adjusted, which may continue to weigh on economic growth. For SMEs, which tend to rely on shadow banking financing, there are still difficulties in improving financing conditions. If the impact of COVID-19 in March and April is taken into account, SMEs will face more difficulties in the future, which may bring intuitive feelings to the market in contrast to the overall macro data. Researchers at ANBOUND also warned that although financial data reflect an optimistic situation for the overall macro economy, changes in the economic structure may be overshadowed by the overall data, and it is more necessary to coordinate structural and comprehensive policies so as to avoid micro factors dragging down the overall economic ecology.

On the whole, the improvement of financial data reflects that the macro policy of “monetary easing” is being transmitted to “credit easing”, which is good news for the stable growth situation in the first quarter and the realization of this year’s economic growth target. However, in terms of the economic structure, on the one hand, financial data show that investment demand played a significant role in driving economic growth, while consumption remained in a relatively sluggish state. On the other hand, the impact of the pandemic on the economy was not fully reflected in the first quarter this year, and the difficulties faced by SMEs may further deteriorate in the future, which will not only bring about a discrepancy between macro data and actual perception, but also affect the stability of the entire economic ecology. In this regard, monetary policy in China still needs to continuously push for further easing in the hope of a “soft landing” for the overall economy.

*Wei Hongxu, A researcher at ANBOUND, graduated from the School of Mathematics at Peking University and has a PhD in economics from the University of Birmingham, UK