S&P Takes Aim At 17 Eurozone Countries – Analysis

By VOR

By Pershkina Anastasiya

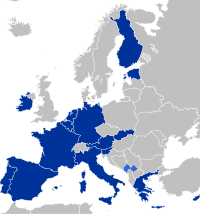

Ratings agency Standard & Poor’s has put 15 out of 17 Euro Zone nations on downgrade watch. S&P’s announcement means that there is a one in two chance that those countries will see their credit rating fall within 90 days with the ultimate decision to be taken on the 9th of December after the summit of the European Union. Analysts say that the S&P’s warning may prompt European politicians to take urgent steps to change the situation for the better.

The only two countries not put on credit watch on Monday were Cyprus, which is already under review, and Greece, whose rating has already been severely downgraded. Every downgrade will increase the borrowing costs. Germany, the strongest of Euro Zone economies, has found itself in this situation due to the immense dependence on its neighbors, says Renat Malin, the head of the asset management department of the Capital company.

“Germany is closely integrated with the distressed nations in terms of export. Some German banks also have problem assets. That is why Germany has been influenced by the problems of other nations. A general slowdown and declining demand will be a part of the pressure to which the European economies are exposed to.”

Economists and politicians doubt the wisdom of rating agencies’ activities. Their decision may be explained by the desire not to repeat their own mistakes of 2008, when the agencies were accused of upgrading the ratings of assets and enterprises which led to the recession. Now they have decided to be on the safe side. Although the latest trend is that markets will soon stop following the credit ratings, says Mr. Malin.

“The impact of agencies’ ratings on investors is decreasing. Everyone understands that only political decision will have a chance to break the current deadlock.”

Investors are more likely to pay attention to European leaders’ decisions, to their readiness to do something to overcome the crisis and to improve the situation in the region. To be honest, they are more interested in the present rather than the future.

The support of markets and banks does not solve all the problems, though. European leaders are considering several ways to overcome the recession, believes Elena Turzhanskays, an expert of the financial group Kalita-Finance.

“First, the EU is discussing an increase of the European stabilization fund up to one trillion euro to bail out the problems country’s bonds. Secondly, there is a possibility to issue unified European bonds, although this step is quite unpopular, as Germany, the leading economy in the region, will have to bear the most of the burden. Another step is a bailout of the small nations’ debts by the European Central bank.”

There is another radical step – to reform the Euro Zone.

Germany and France have already submitted proposals for more centralized control over the budgets of the Euro Zone nations. Yet they have not seen eye to eye with each other so far, as Germany wants the control to be handed over to the European authorities, while France believes only some of the countries may be in charge of this. They have also discussed the possibility to sign new deals between the Euro zone members, in line with which any member country could be expelled from the Euro Zone.