Financial Crimes Hurt Economies And Must Be Better Understood And Curbed – Analysis

By Carolina Claver, Chady El Khoury and Rhoda Weeks-Brown

The fight against financial crime isn’t lost, but the world needs to do more to limit the economic impact of crime.

Money laundering is a necessary component of the organized crime that too frequently spans borders, skirts taxes, funds terrorism and corrupts officials—and it comes with hefty macroeconomic costs. Bad actors are also embracing new technologies on top of their traditional techniques, all of which makes economic growth less inclusive and sustainable, fueling inequality and informality.

The international community has made significant progress toward strengthening safeguards against money laundering and terrorist financing, with help from the IMF and other organizations. We decided a decade ago to take a more bespoke approach to identifying key risks, working with member countries and international partners, particularly, the Financial Action Task Force, the international standard-setter in this area.

But the overall efforts are still broadly insufficient. For example, as the FATF noted last year, there is still a major gap between progress countries have made on technical compliance, such as enacting new laws, and on the effectiveness of these efforts. For example, very little laundered ill-gotten proceeds are ever confiscated.

Accordingly, the IMF recently reviewed our strategy on anti-money laundering and combatting the financing of terrorism (AML/CFT). The goal is to better help our 190 member economies address these critical financial integrity issues.

High costs

We must first recognize that financial crime affects lives and livelihoods, especially those of the most vulnerable, and that the costs it imposes are very high—and increasing. Direct costs vary and can include lower revenues, higher expenditures, sanctions, lost banking services, and even increased financial instability.

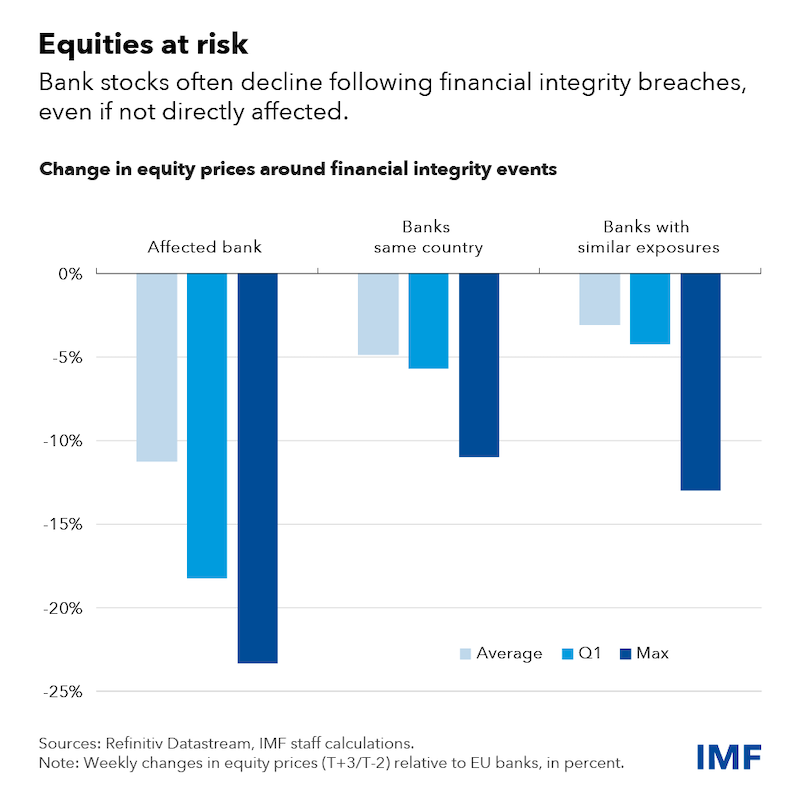

For example, and as recent IMF work has shown in the Nordic Baltic Region, AML/CFT deficiencies are associated not only with large drops in stock prices for the most directly affected banks, but also declines in share prices of other lenders who simply happen to be in the same country, as well as banks in the region that have similar cross-border exposures.

The indirect costs are even greater because they are imposed across an economy, whether by fueling boom-and-bust cycles or making home prices unaffordable. Potential financial stability impacts include bank runs and lost foreign investment. Large-scale money laundering can even spur volatility in international capital flows, undermine good governance, spark political instability, and just generally erode trust—in governments and institutions.

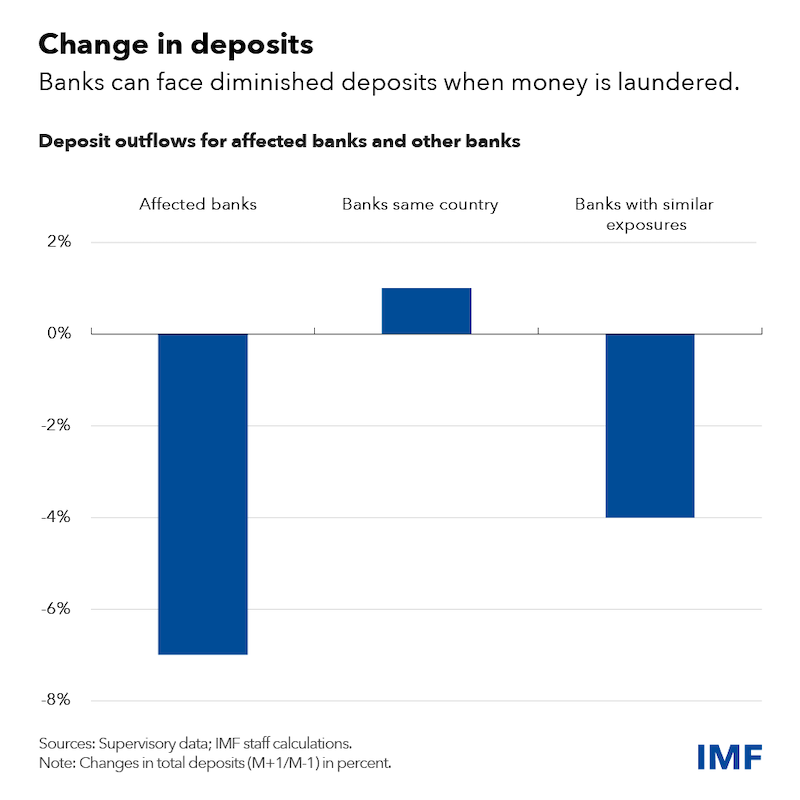

Liquidity, as measured by deposit flows, tends to deteriorate around financial integrity events for the affected bank while other domestic banks’ liquidity could benefit from positive substitution effects in the short-term.

Another important consideration is that illicit financial flows are a global problem. Insufficient AML/CFT frameworks in some countries, including international financial centers, can attract criminal proceeds from abroad. In countries exporting illicit flows, we see there is less opportunity, higher inequality, higher poverty, more illegal immigration, misused resources, and environmental degradation. For example, one study shows that illicit financial flows in Africa (an estimated $1.3 trillion since 1980 has left sub-Saharan Africa) drain domestic revenues that could be used for the continent’s development, have a strong and negative effect on investment rates, notably private investment, and are curtailing Africa’s savings rate. These effects can also have a cascading effect on countries transiting or receiving the illicit proceeds.

This underscores why we must better understand how money laundering and terrorist financing can hurt individuals, countries, and even the global economy. And because of the wide-ranging consequences, we are deepening AML/CFT considerations across all the work that we do, while urging our members to safeguard their financial sectors and broader economy to help ensure global financial stability.

Deeper understanding

Analysis of money laundering and terrorist financing historically focused on threats and vulnerabilities. Both are central to gauging and containing risks, but more is needed. Knowing the full extent of consequences for economies requires being able to understand the fiscal, monetary, financial sector and structural costs of illicit flows. This is needed to document just how financial integrity affects both a given country’s financial stability and broader economy, plus how global financial stability might be affected.

Accordingly, the IMF Executive Board has endorsed a plan for the institution to expand its data analytics capacity to focus on these issues and deepen the coordinated approach across all of our key work areas, including IMF surveillance, lending engagements, capacity development and Financial Sector Assessment Programs. This new approach will also give the IMF new evidence to answer key questions including:

- Which sectors are most vulnerable for money laundering, from banks and real estate to virtual assets and precious metals?

- What countries export illicit flows, allow them to transit, and what countries integrate them?

- How do these illicit flows affect the economy, including its prospects for inclusive and sustainable growth and development?

Even after decades of progress in financial integrity, the Fund and the international community must persist and press on in this fight. Crime is a moving target, but we can—and must—broaden and deepen our containment efforts. This includes improving cooperation among stakeholders, including governments, international bodies, and civil society. For our part, the IMF will use its strength as a macroeconomic institution with global reach to help its members assess the impact of financial crimes and illicit flows and design and implement policies to address them. The cost of failure is simply too high.

About the authors:

- Carolina Claver is a Senior Financial Sector Expert of the Financial Integrity Group in the Legal Department at the IMF. Her areas of expertise include anti-money laundering and combating the financing of terrorism (AML/CFT), financial sector regulation and supervision, including for AML/CFT and broader financial integrity issues.

- Chady El-Khoury is Deputy-Unit Chief of the Financial Integrity Group in the Legal Department of the IMF. His areas of expertise include anti-money laundering and combating the financing of terrorism (AML/CFT), anti-corruption, and broader governance and integrity issues.

- Rhoda Weeks-Brown is General Counsel and Director of the IMF’s Legal Department. She advises the IMF’s Executive Board, management, staff and country membership on all legal aspects of the IMF’s operations, including its lending, regulatory and advisory functions. Over her career at the IMF, she has led the Legal Department’s work on a wide range of significant policy and country matters.

Source: This article was published by IMF Blog