Decoding India’s Upward Trend In Defense Exports – Analysis

By Observer Research Foundation

By Suchet Vir Singh

For a country usually referred to as the world’s largest arms importer, India has incrementally been increasing its tally of arms exports over the last few years. By prioritising the development of its domestic defence manufacturing capacity, introducing a more liberal export regulatory framework, and incorporating a whole-of-government approach (WGA), New Delhi has gradually enhanced its defence export trajectory.

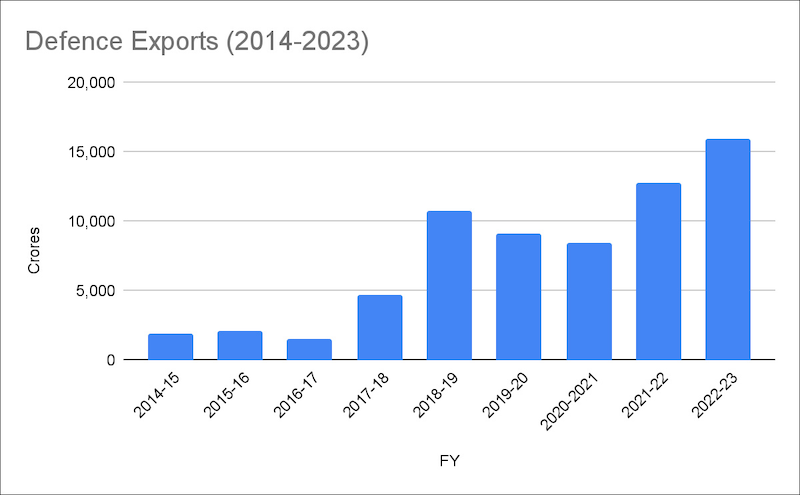

In 2023, India clocked its highest defence export value of INR 15,920 crores or roughly US$5 billion—10 times more than INR 1,521 crores, the revenue generated through defence exports in 2016-2017—marking a pivotal moment for the country’s burgeoning military-industrial complex. In 2013-14, the country had defence exports worth a feeble INR 686 crores.

Measures adopted to increase defence exports

Fundamental to the change has been an institutional attempt towards harnessing defence exports and challenging the country’s dependence on imports. The erstwhile status quo prioritised the purchase of military platforms over manufacturing. This rationale has now been challenged with the government doubling down on a philosophy to build a robust domestic defence manufacturing base and, through this, enhance exports in the long term.

Central to the gradually rising export graph has been the Defence Production and Export Promotion Strategy (DPEP) (2020). The DPEP has set the tone and tenor for the government’s focus on this agenda by clearly laying out frameworks for enhancing domestic defence manufacturing and setting definitive export targets. Specifically, the government wants US$5 billion in defence export revenue by 2025.

Alongside the DPEP, there has also been the introduction of multiple positive indigenisation lists, which mandate procuring certain types of military equipment by only indigenous manufacturers. This is primarily seen as a chance to enhance opportunities for domestic manufacturers. Another push for domestic military manufacturing capacity has been the reservation of 75 percent of the defence capital procurement budget for domestic industry.

While these measures have been implemented to enhance the scale and capacity of the domestic defence industry, the government has also introduced liberalised licensing and certification norms to facilitate defence exports and prevent bureaucratic red-tapism from thwarting them.

Further, a semblance of a whole-of-government approach to push defence exports is also developing. The Ministry of External Affairs has also been roped in to coordinate and promote the sale of Indian defence equipment abroad through their embassies. The government has also initiated lines of credit to African countries to boost defence exports from India.

As a consequence of these measures, the defence export graph is on an upward trajectory. Government data shows India’s defence exports revenue totalled INR 1,910 crores in 2014-15. The revenue increased to INR 2,059.18 crores in 2015-16 but fell in the following financial year to INR 1,521 crores.

Consequently, the export revenue graph surged to INR 4,682 crores in 2017-18 and then jumped significantly to INR 10,745 crores in 2018-19. There was a minor dip in export value during the COVID-19-affected years of 2019-20 and 2020-2021 at INR 9,115 crores and INR 8,434 crores, respectively.

However, despite these measures and New Delhi’s rising defence exports, it is still the global leader in arms imports. The country is still outside the top-20 global arms exporters list. According to data from the Stockholm Peace Research Institute (SIPRI), between 2013-17, India accounted for 12 percent of global arms imports.

In the ensuing period between 2018-22, the country accounted for 11 percent of global imports, reflecting a fall of only one percentage point. This depicts that while there has been a movement in the right direction, there is still a long way to go in reducing the import dependency.

Sustaining the upward trend in exports

Certain mitigating factors need to be dealt with to continue the export trajectory in the right direction. There is a need for more cohesion between the Ministry of Defence, the three-armed services, private manufacturers, and the Defence Public Sector Undertakings on defence exports, specifically in terms of coordinating arms export processes and earmarking domestic defence products that can be effectively marketed in external markets.

Further, there has been a traditional institutional and policy adhocism towards defence exports. Multiple committees and reports have published recommendations on the theme in the past with minimal execution and delivery. With the current structure, there seems to be more execution. However, the current policy focus must remain and not diminish.

While India has made incremental gains in its defence export trajectory, there is still a far way to go in becoming a global defence export leader. Currently, India has formulated an enabling institutional framework to push through its agenda of enhancing defence exports. However, it must continue ideating and implementing reforms to achieve its target of US$5 billion in exports and move into the top 20 defence exporters globally—for both its economy and national security.

About the author: Suchet Vir Singh is an Associate Fellow with the Strategic Studies Programme

Source: This article was published by Observer Research Foundation