Europe’s Wage Rises Are Aiding Recovery But Economies Face Risks – Analysis

By Chikako Baba, Ben Park, Ippei Shibata and Sebastian Weber

Europe’s economic recovery is getting a much-needed boost from rising wages and higher incomes. But in countries where population aging is shrinking the workforce, policymakers may soon face new challenges. Short-term wage pressures could combine with longer-term tightness in labor markets to stoke inflationary pressures.

After two years of falling purchasing power, it’s not surprising that Europe’s workers are pushing for more pay. Nominal wages rose by 4.5 percent in the euro area and more than 10 percent in other parts of Europe in the first half of this year. Higher wages help alleviate cost-of-living pressures and support economic expansion.

But improved productivity, coupled with tight macroeconomic policies which limit companies from passing on higher costs to consumers, are essential if economies are to afford much higher wages without fanning inflation, as discussed in our latest Regional Economic Outlook.

Wage growth has differed across countries. Across much of Europe’s advanced economies, wages have further to rise before they catch up with prices, meaning that pressure for pay rises is likely to persist. In Central, Eastern and Southeastern Europe, wage growth has been more rapid and kept up with prices. This region has seen high wage growth in the past, but back then productivity growth was strong as well. Today it is weak. That means further high pay rises would chip away at competitiveness.

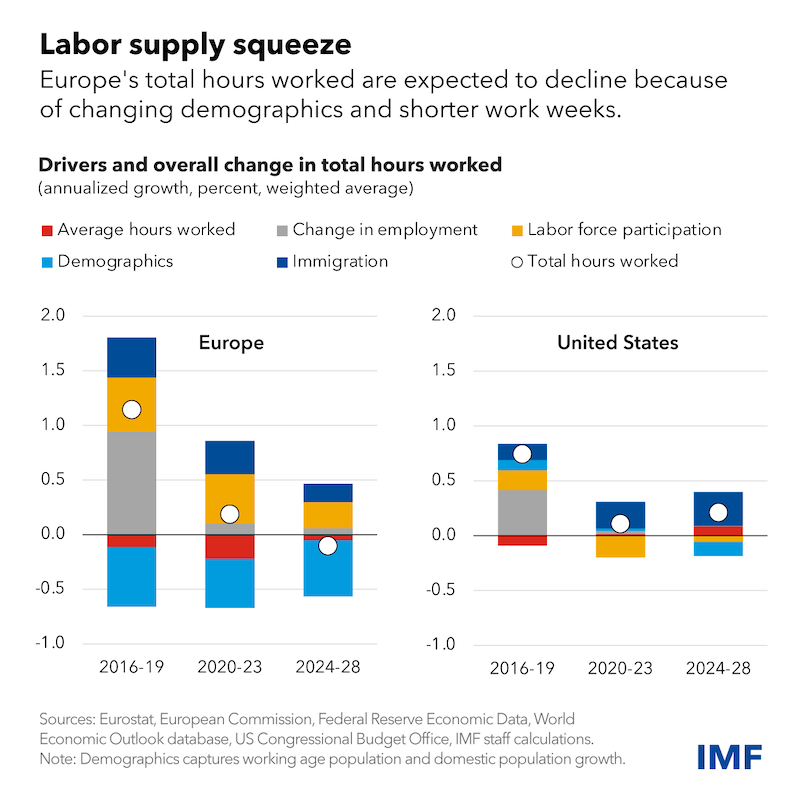

Wage pressures are unlikely to subside any time soon. As the Chart of the Week shows, longer-term trends are already squeezing labor supply (total hours worked). Demographics and shorter working weeks mean employers face fierce competition to find qualified workers and must pay more to retain them.

Over the past decade, Europe’s labor force participation grew relatively rapidly. Even if this trend continues, the labor supply could decline by 0.1 percent annually over the next five years as the population ages, population growth slows, and the shortening of working weeks continues. By contrast, the US labor supply is expected to grow by 0.2 percent as immigration and longer working hours more than compensate for a deterioration in demographics.

The scope to offset these labor market trends in Europe is limited. Proposals to increase retirement ages further may run into political opposition. There is also little scope to increase average working hours because shorter work weeks are gaining popularity.

What must policymakers do? There is a fine line between aiding economic recovery and banishing stubbornly high inflation. Central banks must watch for upside risks to inflation and closely monitor wage settlements and their consistency with productivity trends. A marked divergence would be worrisome. The mix of monetary and fiscal policy should remain appropriately tight to bring inflation back to target.

At the same time, structural reforms to increase productivity are becoming critical. Doing so would both lower inflationary labor-market pressures and raise longer-term economic growth potential. Boosting the labor supply by allowing workers to work more hours, making it simpler to transition between jobs, equipping new generations for future jobs, reskilling workers, and facilitating the integration of migrant workers all have an important role to play.

About the authors:

- Chikako Baba is a senior economist in Emerging Economies Unit of the IMF’s European Department, contributing to Regional Economic Outlook for Europe and other cross-country analytical projects. Previously, she has worked in Monetary and Capital Markets Department, focusing on topics related to capital flow management, macroprudential and monetary policies; and in African Department.

- Ben Park is a Research Officer in the IMF’s European Department. He holds a M.Sc. in Mathematics and Statistics from Georgetown University and obtained his B.A. in International Affairs and Economics from the George Washington University.

- Ippei Shibata is an Economist in the Research Department at the IMF. Previously, he worked in the Strategy Policy Review Department and the Western Hemisphere Department, where he worked on Guyana, Liberia, and Suriname. His research interests include applied macroeconomics and labor market issues (e.g. labor market mismatch and measurement errors).

- Sebastian Weber is a Deputy Division Chief in the European Department. He has previously worked in the Research and African Departments of the IMF, as well as the ECB and as a consultant for the OECD and the World Bank.

Source: This article was published by IMF Blog