Fine Art’s Resurgence Offers A Refuge For Investors – Analysis

By MISES

By Marcia Christoff-Kurapovna*

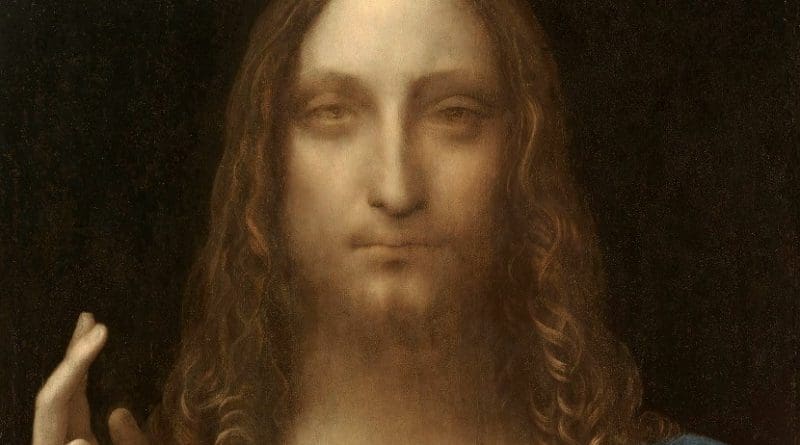

The epic sale in mid-November of the painting Salvator Mundi by Leonardo da Vinci at the auction price of more than $450 million to a Middle Eastern buyer contained within its occasion three key lessons about the difference between market value and the market for Value — a distinction that perhaps best defines the long-term difference between wealth and money.

First, the multi-billion dollar art market, though traditionally driven by very volatile, unpredictable and slightly obscene vagaries of taste, is today witnessing a renaissance in the estimation of art as a great storehouse of value based upon a centuries-old standard of Time. Second, art-as-hot-commodity, with its legions of dealers, brokers, appraisers, scholars, historians, vetting-experts, authentication-specialists, financiers, fakes, flakes, charlatans and money-launderers, is shifting to a highly privatized model in which micro-entrepreneur dealers of outstanding reputation and sole proprietorship are leading the forefront of the market’s growth. Third, and most importantly, is that the return of Old Master painting (as refers to works dating from between 1250 to about 1850) and those categorized as Classic Modern (works through the first half of the 20th century) to market prominence highlights the growing significance of the hard-asset ‘mentality’ that is coming to dominate the long-term view of wealth security.

This last point cannot be underestimated. The turn towards a more serious, less trend-based, less commercial-celebrity view of the art market follows upon a very resilient recovery of that market overall since the 2008 financial crisis. The shift is also an important statement about the current attractiveness of hard-assets in general and of the massive movement of wealth in the direction of investment outside of the stock market.

According to one of the most authoritative art market reports in the industry, that of The European Fine Arts Fair (TEFAF), the premiere international art fair gathering, total sales in 2016 were $45 billion dollars, up 1.7% since 2015; art dealers report an ‘extremely positive’ outlook for the results of 2017. The bulk of these sales took place within the private sector–that is to say, away from public action, with preference for privately-brokered auctions at the major houses like Sotheby’s and Christie’s. Throughout, Old Masters, (and “Classic Modern”) works have stolen the show.

Old Masters as an art category was dismissed for decades for not offering as much excitement or controversy as contemporary works. These paintings, except for the occasional, odd, super-sale tended not to command the incredible prices of contemporary painting. Yet, all that changed last year. The sale of Lot and His Daughters by Peter Paul Rubens (1577-1640) for $58 million at Christie’s London in July 2016 was, until this November, the most expensive Old Master painting to sell at Christie’s entire 250 year-old history. (It was the second-most expensive work by Rubens to be sold at auction after the 2002 sale of The Master and the Innocents for $78 million at Sotheby’s London). Other great sales of late include a Claude Monet (1840-1926), Meule for $87 million in 2016; Danaë by Orazio Gentileschi (1562-1647), which fetched $30 million that year; a John Constable (1776-1837), View on the Stour Near Dedham, went for $19 million also last year, and several others.

In February 2017, a ravishingly gorgeous Parmigianino (1503 -1540) entitled Virgin and Child with Saint Mary Magdalene was the subject of a $30 million tug of war between the United Kingdom, which wanted to keep the painting in the country, and the J. Paul Getty Museum, which sought to obtain it. (The UK has thus far won out). In July 2017, the Getty Museum in Los Angeles spent over $100 million for sixteen Old Master paintings–its biggest acquisition ever–while the U.S. has also experienced a 4.85% increase in the price of Old Masters and Impressionist Art over the course of 2016.

Key here is that the total sales value of the Old Master market exceeded that of the modern art market for the first time in the last five years. The fact that these older works–lacking the glamor of the “new” and of trend-setting names–reached a peak at auction in 2016 underscores the unease on the part of the mega-wealthy with regard to the state of the economy and highlights their under-the-radar desire for “sure thing” safe haven investments. It is a highly significant wealth trend, in which the return to investment in such works is the attraction to those works having endured the test of time–a clear demonstration of the longing for stable, solid value.

The country to watch in all of this is that of the biggest art market of all: China. In the past couple of years, high-net worth Chinese collectors began to move away from young contemporary artists to embrace Chinese Old Master and post-war artists, many of these latter being those collectors’ generational counterparts. Statistics confirm this cultural trend: the total sales volume of Old Masters in China increased 36% in 2016, reaching a peak at $1.25 billion. Meanwhile, in 2016, the average price of Old Master works sold in China saw a steep increase of 45%, compared with those in 2015.

This hard-asset psychology is underscored by the new trend of dealers as well. For years, a kind of flash-in-the-pan art broker dominated the scene to buy and sell contemporary works or to set up online auction houses and galleries (which have only had partial success and only for far lower-priced works). Of late, competitive advantage has come to those dealers with esteemed attributes such as reputation, credibility, and ultimately taste– all of which denote longevity, stability and resilience in the art world. These well-established experts are the moving force in the art dealer market today.

As if suddenly, that which was once hip to own in terms of ‘name’ has begun to fade quite drastically. Contemporary art — the art of ‘today’ or of highly commercial pop-art — has begun to wobble in terms of market sales. For example, Andy Warhol, traditionally a heavy-weight, experienced a 68% drop in auction sales volume, from $525 million in 2015 down to $168 million in 2016 worldwide. Francis Bacon and Cy Twombly also saw their auction sales drop by more than 60%. Pablo Picasso is himself experiencing a kind of saturation-fatigue, and his sales have decreased in volume by nearly 50%.

Of course, despite the favorable turn towards long-term value and the primacy of reputation, the art market is not a sector that is by any means free of controversy and corruption. The desire for privacy, financial opacity and the ability to remain anonymous in buying and selling have propelled buyers at the top-end of the market into privately-brokered deals—with all the safe-havens, off-shore accounts, hidden wealth and countries with easier financial regulations to accommodate the business. It is perhaps unsurprising that the world’s largest auction markets, where cross-border trade is at its highest, occur where Freeports are strategically situated.

Nonetheless, the art market is undergoing a genuine game-changing dynamic for the better that any follower of the hard-asset world of investment should observe at close range. This search for known value, for a connection to history and tradition; to see great works of art that transcend the vicissitudes and whims of fad, tastes, trends, serves as a critical study of how wealth sees itself and where its sees itself over the long-term. It is, too, a most welcome breath of fresh air in a world that seems ever intent on debasing its own cultural standards — as much, perhaps, as it has its own currencies.

About the author:

*Marcia Christoff-Kurapovna contributed feature pieces and op-eds on Swiss and Liechtenstein banking issues for The Wall Street Journal Europe while based in Vienna, Austria; she also authored a column, ‘Swiss Watch.’ She currently lives in Washington, DC where she is a speech and op-ed writer to foreign dignitaries.

Source:

This article was published by the MISES Institute.