US Inflation Moderates Slightly In June – Analysis

By Dean Baker

The overall Consumer Price Index (CPI) rose 0.1 percent in June, bringing its rate of increase over the last year to 2.9 percent. The core index rose 0.2 percent in the month, bringing its rate of increase over the last year to 2.3 percent. The jump in energy prices, mostly from last year, is the major factor in the higher rate of inflation in the overall CPI, with the energy index up 12.0 percent year-over-year.

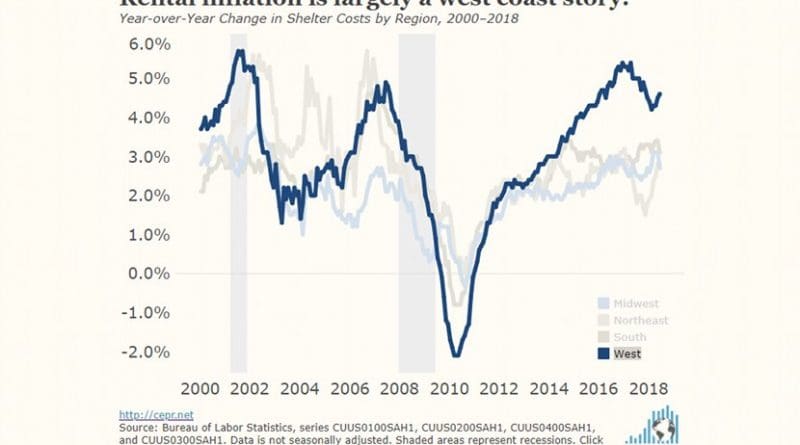

Shelter costs continue to be the main factor driving core inflation. The core excluding shelter rose just 1.4 percent over the last year. Insofar as rising inflation can be viewed as a problem, it is overwhelmingly a story whereby a limited supply of land combined with building restrictions creates a shortage of housing. This is largely a West Coast phenomenon, where inflation in the shelter index has been in the 4 to 5 percent range. The rate of increase in rents has been considerably lower in other regions of the country.

It is worth noting that in spite of 4.0 percent unemployment, the rate of inflation actually appears to be decelerating slightly. Comparing the average for last three months (April, May, and June) with the average for the prior three months (January, February, and March), the annualized rate of inflation in the overall CPI was 1.7 percent. For the core index, the annualized inflation rate for this period was 1.8 percent, and for a core that excludes shelter, it was just 0.4 percent.

There are few problem areas outside of shelter. Medical care costs continue to be well contained. The overall index rose 0.4 percent in June, but is up just 2.5 percent over the last year. The prescription drug index rose 0.3 percent in June, but at 3.2 over the last year, somewhat outpaced the overall medical care index. It is important to recognize that the prescription drug index tracks the prices of drugs already on the market, so if a high-priced new drug enters the market, it does not affect the index.

The cost of college tuition rose 0.3 percent in June and is up 1.7 percent over the last year. New vehicle prices rose 0.4 percent in June, but are still down 0.5 percent over the year. It’s possible that the June increase is reflecting higher input prices due to the tariffs imposed by the Trump administration, but the monthly data are erratic, so this could just be noise. Used vehicle prices jumped 0.7 percent in June, but are down 0.7 percent over the last year.

The tariffs almost certainly were a factor in a 1.8 percent increase in the price of laundry equipment, which brought the year-over-year increase to 13.1 percent. This category accounts for less than 0.1 percent of the overall CPI. Apparel prices fell 0.9 percent in June, but are up 0.6 percent over last year.

Airline fares fell by 0.9 percent in June and are now down by 5.9 percent over the last year. This seems surprising, given the jump in fuel prices over the last year and the enormous consolidation in the industry over the last two decades.

Auto insurance prices may be moderating. They rose 0.3 percent in June and are up 7.6 percent over the last year. In the last couple of years, auto insurance has been a more important contributor to inflation than medical care.

There also is little evidence of inflationary pressure at earlier stages of production. The core final demand index of the Producer Price Indexes rose 0.3 percent in June and is up 2.7 percent over the last year. The year-over-year increase had been slightly higher earlier in the year.

The overall picture is that inflation remains relatively stable with as much evidence of slowing as acceleration. The one major risk to this picture is the impact of tariffs or other restrictions on trade. By design, these will raise prices, the only question is how far-reaching the tariffs will be and how much of the cost is passed on to consumers.