Key Transatlantic Implications Of US Inflation Reduction Act – Analysis

This analysis sets out the key transatlantic implications of the US Inflation Reduction Act (IRA).

By Pau Ruiz Guix*

Summary

The US Inflation Reduction Act (IRA), which earmarks approximately US$370 billion for clean energy, has important climate, trade, security and foreign policy implications for Europe and the world. It has a substantial impact on GHG emissions mitigation in the US and raises the country’s standing in climate talks. It targets the diversification of supply chains, currently heavily dependent on China, from clean energy manufacturing to critical minerals and EV batteries. Furthermore, it raises broader questions on European green industrial policy, the Western vision for developing countries’ decarbonisation pathways, and the future of transatlantic relations.

Analysis

The Inflation Reduction Act (IRA) directs new federal spending towards accelerating the energy transition, lowering healthcare costs, funding the Internal Revenue Service and improving taxpayer compliance. The IRA will raise a total of US$739 billion and spend US$433 billion, of which nearly US$400 billion will be directed at energy security and climate policies. Primarily through tax credits, the Act will catalyse investments into increasing clean electricity production, on-shoring the manufacture of key energy transition components currently heavily controlled by China, accelerating the electrification of transport and deploying leading-edge technologies such as carbon capture and clean hydrogen, among others (see Figure 1). Critically, this is the third piece of legislation approved since 2021 that seeks to reinvigorate US (industrial) competitiveness. Together, the Bipartisan Infrastructure Law, the CHIPS and Science Act, and the IRA, which have partially overlapping priorities, introduce US$2 trillion in new federal spending over the next 10 years.

Figure 1. Summary of IRA investments

| Energy and climate investments | Amounts (US$ bn) |

|---|---|

| Clean Energy Tax Credits | 161 |

| Air Pollution, Hazardous Materials, Transport & Infrastructure | 40 |

| Individual Clean Energy Incentives | 37 |

| Clean Manufacturing Tax Credits | 37 |

| Clean Fuel & Vehicle Tax Credits | 36 |

| Conservation, Rural Development & Forestry | 35 |

| Building Efficiency, Electrification, Transmission, Industrial, DOE Grants & Loans | 27 |

| Other Energy & Climate Spending | 18 |

Months after the passing of the Inflation Reduction Act, Europeans have mounted a reactionary response based on fear of European deindustrialisation and a perceived sense of unjustified betrayal from its most important economic and political partner during a particularly fragile time for Europe, myopically focusing, at first, on the challenges of the IRA –and not on its opportunities–. While European policy shares the goals of the IRA, accelerating the transition to a low carbon economy and diversifying away from China, European leaders have voiced concerns that the IRA discriminates against European companies, could shift green investments from the EU to the US and ultimately lead to protectionism in disguise. The EU and the US set up the EU-US Inflation Reduction Act Task Force and used the framework of the Trade and Technology Council to address such concerns, while Europeans are ultimately coming up with an EU-wide response, the Green Deal Industrial Plan and the Net Zero Industry Act (NZIA).

(1) The IRA puts the US closer to meeting its Paris Agreement objectives, finally matching words with action

With approximately US$370 billion earmarked for clean energy, which given the uncapped nature of tax credits can become over US$800 billion, the IRA substantially increases US climate spending and suggests the country is truly ‘back’ in the international climate arena after years of defaults. Increased levels of spending will certainly have an impact on the emissions reduction trajectory of the US, which is responsible for 13% of global emissions and has one of the largest per capita CO2 emissions in the world. The question is by how much.

Early estimates suggest the impact of the IRA is substantial and can bring the US closer to meeting its pledge to cut US emissions by 50%-52% by 2030 from 2005 levels. A number of analyses estimate that while under baseline conditions (ie, without the IRA) US GHG emissions would decrease by 24%-35% by 2030, the IRA can bring emissions reductions to 31%-44%. Therefore, the IRA represents a once-in-a-lifetime policy that brings certainty to US emissions reductions after the Trump Administration abandoned climate policy and decades of inability to pass any significant climate legislation to match words with action.

There are two minor caveats. A 40% GHG emissions reduction by 2030 is an imperfect estimate –and projections might be underestimating or, more critically, overestimating the impact of the IRA–. Even assuming the 40% figure, the path to reaching 50% emission reductions is uncertain, mostly relying on state action. With Republicans controlling the US House of Representatives, further climate legislation is unlikely, and the federal Administration is increasingly under Congressional and court scrutiny for its climate actions.

(2) Climate leadership at home reinforces the US in global climate negotiations, representing a stronger partner for the EU in advancing global decarbonisation efforts, but challenges still remain

In climate diplomacy, credibility and legitimacy are key. It is difficult to convince others to lower their emissions faster and get to net zero earlier when one is unable to showcase a roadmap on how to get there. While climate change has been a top foreign policy priority for the Biden Administration, a lack of concrete domestic action and continued shortfall in its international climate finance disbursement have limited US climate diplomacy clout in global forums. This is so despite Biden re-joining the Paris Agreement on day one of his presidency, highlighting climate in its National Security Strategy, and creating a new position –the US Special Presidential Envoy on Climate, John Kerry– to push for higher climate ambition across the world.

The IRA partially changes that. It gives the US much-needed credibility in its efforts to encourage others to raise their ambition, makes the US a stronger partner for the EU in global climate negotiations and, if the law lives up to its potential, can have positive spill-over effects for industrial decarbonisation around the world and can help put pressure on China, the top global emitter, to step up its game.

Nonetheless, the IRA will not be a silver bullet. Despite enhanced US credibility at climate talks, developing countries, with very limited contribution to GHG emissions, are demanding developed ones to live up to their promises to deliver US$100 billion annually in climate finance, while they push to establish new funds to address the loss and damage caused by climate change in their territories. Neither climate finance nor loss and damage are addressed by the IRA, and a divided Congress makes it unlikely the US will be able to come up with a solution to these issues any time soon. In this context, the effects of the IRA in lowering global costs of clean technology and, especially, US efforts to reform multilateral development banks to channel climate finance and energy transition investments to developing countries with the appointment of a new World Bank President will be key to get developing economies on board. Nonetheless, the mid-term threat to climate policy of Republican majorities in both chambers and the White House continue to be an issue for the predictability and credibility of US climate diplomacy.

(3) The IRA can make the US benefit from abundant cheap clean energy, with implications for the EU’s green hydrogen ambitions

The IRA can make US electricity from solar and wind the cheapest globally between 2025 and 2030, reaching US$~5/MWh by 2029 (though quickly recovering back as tax credits are phased down in 2032). IRA investments in clean electricity can also increase the US share of carbon free electricity to 66% by 2030. If apprenticeship and prevailing wage requirements are met, the IRA offers a technology neutral clean electricity production tax credit amount of 2.6 cents per kilowatt-hour (kWh) or full investment tax credit of 30%. Projects can receive stackable 10% bonus credits if domestic manufacturing requirements are met, or if the projects are located in energy communities –raising the investment tax credit, for example, to 50%–.

Cheap and abundant clean electricity in US power markets is not necessarily that consequential for foreign policy, but once electricity is transformed into hydrogen or liquid fuels, it changes from a regional to a global market, having potential implications for other players like the EU. Apart from electricity production or investment tax credits, the IRA also introduces a US$3/kg credit for clean hydrogen with less than 0.45kg of CO2e per kg of H2, and up to US$1.75/gallon for sustainable aviation fuel. Credit ‘stackability’, or the combination of these credits with others, can have an outsized impact on the value chain economics of these green fuels. Take clean hydrogen: if clean electricity and clean hydrogen credits are combined, hydrogen subsidies could stack up to around US$4.50/kg H2. Taking into account renewables powered electrolysis hydrogen production costs can drop below US$3.00/kg H2before 2030, US production costs of clean hydrogen could be sub-zero by the end of the decade.

New US hydrogen economics can affect investment decisions in the hydrogen industry, shifting investment across the Atlantic and potentially making the EU an importer of subsidised hydrogen. With the US heavily subsidising the deployment of green hydrogen, and if the EU wants to achieve its goal and produce 10 million tonnes of green hydrogen by 2030, the IRA should help European leaders carefully recalibrate how to lure investors into the European hydrogen industry by moving from limited, bureaucratic support for specific projects within a complex regulatory and taxonomic environment to creating a simplified market framework for hydrogen.

(4) The IRA will help transatlantic partners shift clean energy manufacturing supply chains away from China

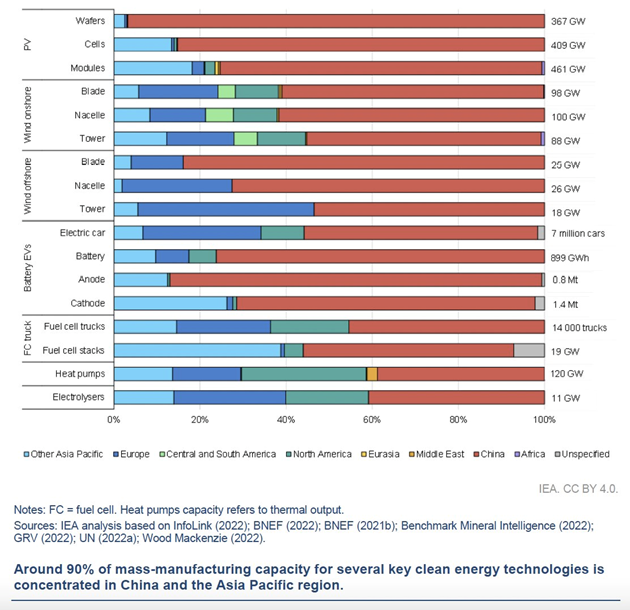

The overconcentration of clean energy manufacturing and material supply capacity in one country is a key energy security concern for both the EU and the US. Today, around 90% of mass manufacturing for several key clean energy technologies is concentrated in China and the Asia-Pacific region. For example, China accounts for 79% of global polysilicon capacity, controls 97% of global ingot and wafer manufacturing, and produces 85% of the world’s solar cells. Such a concentration is the result of massive investments in the solar supply chain –over US$50 billion since 2011–. In a context where production capacity for solar panels and their inputs needs to at least double by 2030 to meet global climate goals, a lack of diversified supply chains and transatlantic overdependence on China is a key national, economic and even climate security concern.

The IRA seeks to address that. The bill includes over US$60 billion to on-shore clean energy manufacturing, with tax credits for investments in advanced manufacturing facilities and production tax credits for domestic manufacturing of certain solar and wind energy components, among others. The legislation also rewards the use of domestic components in clean energy projects. Eligible clean energy projects can claim up to 10% (20% for offshore wind) in extra credit value if they use steel, iron or >40% manufactured products in the US. Combined, IRA tax credits can reduce solar module costs by 20%-40% and wind turbine costs by 50%, and could make the US an exporter of the technology.

Nonetheless, the current market, heavily concentrated in China, is already a distorted one, and domestic content requirements, although potentially a trade violation, are ‘additions’ to an otherwise equally available tax credit and by themselves might have limited impact. Most importantly, aggressive actions to de-risk dependency on China and build diverse clean energy manufacturing supply chains, in the US and other allied countries, is a necessary and positive development for Europe’s energy security. Financial incentives and manufacturing support will inevitably be needed to increase the security of supply of clean energy technologies, with an European green industrial strategy focused on building reliable and diversified supply chains not only in the EU but also across allied countries.

Figure 2. Regional shares of manufacturing capacity for selected mass-manufactured clean energy technology and components, 2021

(5) The IRA will reshape EV supply chains, with potentially significant implications for EU manufacturers, but China is still a key concern

The US lags way behind the EU and China for both EV sales and production. While in 2021 China accounted for 51% of global EV sales (up from 42% in 2020) and Europe 34% (down from 42% in 2020), North America accounted for only 15%. In terms of production, China produced 44% of all EVs in 2020, with Europe having a 25% market share. The US accounted for 18% of global production in 2020, a decrease from 20% in 2017. While China and Europe have introduced supply and demand policies to stimulate EV markets, from government mandates to vehicle emissions standards, a lack of policy has been the primary hold-up behind the US lag –until now–.

The IRA seeks to increase EV sales and production in the US. It modifies existing tax credits to up to US$7,500 for new electric vehicles, thus addressing consumer price concerns. Eligibility for the tax credit is contingent on final assembly of the vehicle occurring in North America, specified percentages of the vehicles battery’s critical minerals originating from a US free trade agreement (FTA) partner, and specified percentages of the battery’s components being manufactured in North America. Together with the US$15 billion earmarked for electric vehicle infrastructure included in the bipartisan infrastructure plan, new incentives hope to deliver on President Biden’s goal to grow the US EV market to 50% of new car sales by 2030.

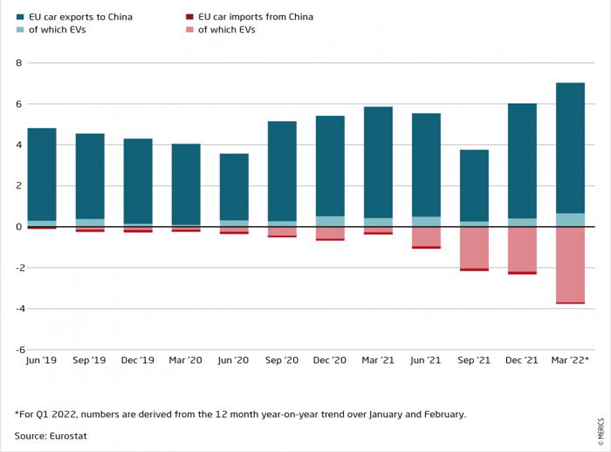

The new final assembly requirements in the IRA immediately made many electric vehicles made overseas which previously qualified for US EV tax credits ineligible. The EU, home to big automakers like Volkswagen, BMW and Mercedes-Benz, has been concerned that credits will move investment in EV assembly from the EU to the US. Critically, this comes in a context of increased exports of Chinese EVs into the European market, with China’s export of EVs into the EU potentially becoming larger than all car exports from the EU to China soon. While EU-US negotiations seem to have achieved some wins for European industry –leased EVs mightqualify for commercial EV credits even if not assembled in North America–, a change on final assembly provisions is unlikely. The IRA is a further sign that European automakers might need more regulatory incentives to reduce the risk of losing market share to foreign, particularly Chinese, rivals.

Figure 3. Made in China EVs could turn Sino-EU automotive trade on its head, 2019-22 (€ bn)

(6) The IRA can reshape battery and critical mineral supply chains to de-risk China exposure

EU and US dependence on China for critical minerals and batteries is staggering. If the world is to meet its climate objectives, total mineral demand from clean energy technologies will quadruple by 2040. Mineral demand from EVs and battery storage, which accounts for about half of mineral demand growth over the next two decades, will grow over 30 times. Nonetheless, minerals and their supply chains are concentrated in a few countries. Australia and Chile produce 70% of the world’s lithium, the Democratic Republic of Congo around 70% of global cobalt, Indonesia 30% of nickel, and Chile and Peru around 40% of copper. Critically, China dominates the refining of these metals, at 59% of the globe’s lithium, 73% of cobalt, 68% of nickel and 40% of copper. The country accounts for 98% of EU imports and 80% of US imports of rare earths. Its centrality has led China to dominate downstream manufacturing capabilities, too –it currently holds 78% of the world’s manufacturing capacity for EV batteries, and 70% of announced battery capacity through 2030 is projected to be in the country–.

Eligibility requirements for the IRA’s EV tax credit seek to address these dependencies. To be eligible for the IRA’s EV tax credit, at least 40% of the value of the critical minerals contained in the vehicle’s battery must be extracted or processed in any country with which the US has an FTA or be recycled in North America, gradually increasing to 80% by 2027. Similarly, at least 50% of the battery components must be manufactured or assembled in North America, increasing to 100% by 2029. The IRA prohibits the application of the tax credit if any components of the battery are manufactured or assembled by a ‘foreign entity of concern’ (read: China) from 2024 and excludes all vehicles whose battery contains any critical minerals extracted, processed or recycled from foreign entities of concern from 2025.

Since the term FTA is not defined in the IRA or any other statute, the US should take such an opportunity to include not only the EU, but also other key countries where EU and US companies are heavily investing in critical minerals to diversify away from China, like Indonesia or Argentina –a demand that is politically feasible–. The recycled minerals and EV batteries from friendly countries should also be eligible for the credits, but the IRA text gives the US government less leeway to re-interpret such requirements. Critically, the EU should double down on a European approach, fast tracking European projects, streamlining, permitting and increasing funding support for both domestic battery manufacturing and critical minerals –with the new Critical Raw Materials Act, and a potential new European Sovereignty Fund, playing a key role–. The EU and the US will also need to find a common transatlantic approachto global diversification, especially in Africa and Latin America, including on ESG standards, and manage potential Chinese retaliation, which is already devising new tools to defend its dominance.

(7) The IRA is a wake-up call for an EU green industrial policy

The IRA is fuelling, as Bruno Le Maire and Robert Habeck put it, a renewed impetus in European industrial policy. Over the past few months European leaders quickly realised that the response of the IRA was ultimately, necessarily domestic. The White House will not go to Congress to seek legislative changes, a Republican House majority is very unlikely to take European considerations into account, and the leeway that the Internal Revenue Service has to provide implementation guidelines more favourable to the EU is limited. A simple, forceful and consequential answer to the IRA is to celebrate its achievements –having EU’s most important partner interested in leading climate policy and diversifying clean energy supply chains in the world– and address its challenges by doubling down on EU’s vision to become a green powerhouse, as European industry demands.

Speaking at the World Economic Forum in Davos in January 2023, Ursula von der Leyen announced the creation of an EU Green Deal Industrial Plan focused on accelerating permitting processes for strategic projects, an adaptation of EU state aid rules, a new European sovereignty fund, a focus on skills and talent, and an open and ambitious fair-trade agenda. The legislation linked to the plan, the Net Zero Industry Act (NZIA), is a recognition that the EU desperately needs a new narrative and new instruments that keep European industry attractive. A realisation that heavy investment in the energy and clean technology sector is key to ensure the EU tackles the energy trilemma –the security, affordability and sustainability of our energy systems– head on, avoiding trading current dependencies for others. And an acceptance that re-synchronising, as Macron put it, our economic policies with the US is key to ensure Western unity in front of systemic rivals.

(8) New approaches to green industrialisation in the EU and the US call for a new transatlantic, global vision on trade, development and the energy transition

The IRA, and the EU response to it, represent the emergence of a new consensus on strategic economic nationalism put forward not only to reduce Western overreliance on Chinese supply chains, but also to protect and foster industrial competitiveness in the midst of an energy transition taking place at different speeds in a globally interconnected world. With it comes the acknowledgement that the heretofore idealist attempt to build a liberal economic and trade system with a unified set of rules for all is failing, and a transition towards a fragmented globe with a competing set of partners that pursue à la carte economic cooperation is emerging, picking how, when and with whom to cooperate.

This new approach to global trade and competitiveness needs a new set of (arguably loose) rules among partners. Allied countries must recognise that securing clean technology supply chains needs openness and mutually beneficial economic policies among them. This will require a new political vision between the EU and the US, which can extend to the G7 and the OECD, to build sufficient alignment on economic policy and create large harmonised markets with common standards, including fair and equal access to both subsidies and public procurement, that investments in the energy transition require.

In such a pursuit, there is an added layer of complexity that, so far, remains completely unaddressed: developing countries. Moving away from a set of unified rules with an enforcer, the WTO, to a loose set of voluntary regional rules will never create a level playing field, taking us back to ‘might makes right’. And, as Dr Ngozi Okonjo-Iweala, WTO Director-General, put it: re-shoring or friend-shoring never means Africa. What is the path to green industrialisation for countries battling poverty and energy access? With the domestic focus of the IRA and the NZIA, what is our value proposition for developing economies to commit to steep decarbonisation objectives –and what financing instruments, like the emerging Just Energy Transition Partnerships, can be mobilised at scale? –. What rules apply, and how do we incorporate them in this new global economic system marked by fierce global economic competition?

Conclusions

The IRA, and the transatlantic trade spat and European response that ensued, has important transatlantic and global climate, trade, security and foreign policy implications that will guide international cooperation and competition on decarbonisation over decades to come. At its core, the IRA is about two highly politically salient issues for Europe: the diversification of supply chains away from China and the swift transition to a low carbon economy. The IRA is a durable milestone for US climate policy that will lower US emissions, increase its global footing in climate diplomacy, and create more resilient clean energy supply chains –clear wins for Europe–. Notwithstanding critical concerns on the text, especially on EVs, where the EU should continue to push in defence of European companies, the IRA also fuels renewed attention on European green industrialisation –a push that recognises the importance and difficulty of squaring industrial competitiveness, openness and climate action–.

From July onwards, the Spanish presidency of the Council of the EU is particularly well positioned to steer the conversation. At home, the country should strengthen European support for key clean energy industries, from hydrogen to EVs, including through canvassing support for a new, more agile European Sovereignty Fund. Abroad, the task at hand is even larger. The EU and the US not only have to come up with a new set of acceptable rules for green industrialisation, including through new sectoral agreements such as for green steel, but they also have to come up with a global green industrial diplomatic strategy for developing countries, all while limiting potential Chinese pushback. The Spanish presidency will be particularly well positioned to ensure that we move from on-shoring to friend-shoring, and that ‘friends’ means Latin American and African countries. The position and commitment that the EU takes on these set of issues will profoundly mark the coming global system and the place of Europe in it –an opportunity Spain, and Europe, cannot miss–.

*About the author: Pau Ruiz Guix, Fulbright Program at Georgetown University

Source: This article was published by Elcano Royal Institute