In Asia Liquid Natural Gas Can’t Compete With Pipelines – Analysis

A gas pipeline network connecting Australia to China, Japan and South Korea would be cheaper and more efficient than environmentally-damaging Liquid Natural Gas (LNG) projects.

The misallocation of resources has been worst in Australia.

There, roughly $150 billion has been invested in LNG. It has little prospect of either making money or lasting a full working lifespan.

Carbon pricing, the termination of fossil fuel subsidies and the shift to renewable energy ensures most of this LNG investment will be written off prematurely.

Measured by collective investment ($US150 billion), capacity (66 cbm/yr of natural gas) and distance from markets (8,000 km) Australia’s LNG projects stack up poorly as a capital allocation.

A far better, long-term economic outcome could be achieved by a flexible, multi-fuel, common-carrier pipeline network of the same capacity. It would stretch from Australia to China, Japan and South Korea.

It would be constructed to carry both natural gas and hydrogen. Hydrogen is tomorrow’s fuel. Natural gas isn’t.

The benefits of such multifuel flexibility are compounded when the advantages of laying long distance power lines and fiber optics along the same routes are considered.

A bundled infrastructure capable of carrying gas, electricity and data unlocks enormous efficiencies spanning the entire energy and data value chain.

These range from upstream energy production through midstream energy transmission to downstream energy trading and consumption.

Such a flexible, integrated, future-proof regional delivery network capable of carrying natural gas, hydrogen and electricity as well as data will increase regional supply security and reward political cooperation through the arbitration of markets and prices.

The result: fewer investment misfires like LNG.

With an integrated regional energy market in Asia solar, wind, nuclear or even coal-fired carbon capture and storage could properly compete on a level playing field arbitrated by price, distance, availability and carbon load.

Bundled together, power lines and gas pipelines represent an immensely powerful energy infrastructure combination.

In Asia they would follow the pathways already laid down by fiber optic cables over the last 20 years.

The benefits of the data revolution to Asia have been indisputable. The global energy industry is a laggard. Worsening climate change has been the result.

In coming years, the transition in Asia from capital-wasting, negative-value LNG to a more productive pipeline era will get underway.

This will be enabled by — among others — catalytic investments made by China’s newly created Asian Infrastructure Investment Bank. In coming months, the AIIB is expected to announce its first loan.

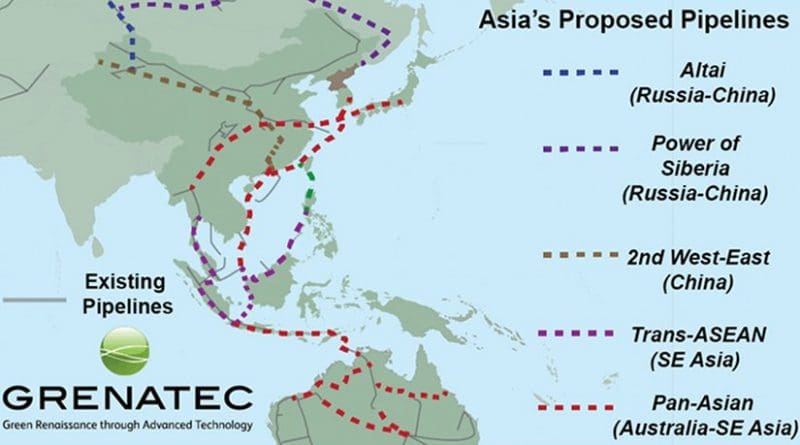

Its best choice would to fund the Association of Southeast Asian Nations (ASEAN) Trans-ASEAN Gas Pipeline (TAGP) project.

The proposed $7 billion TAGP will more deeply integrate ASEAN’s natural gas markets through extending and deepening cross border natural gas pipeline links between the organization’s 10 members.

This would create both upstream and downstream benefits. Downstream, it would ease the flow of natural gas from producing countries (such as Vietnam, the Philippines, Indonesia and Malaysia) to consuming countries.

Upstream, it would open the way for China and her southeast Asian neighbors to negotiate Joint Development Areas (JDAs) in the politically-contested South China Sea.

Under Joint Development Area agreements, contesting claimants to an offshore area freeze claims indefinitely while they cooperate to develop the resources within them. Final territorial determination is postponed until the stakes are lower.

JDAs connected to an AIIB-funded TAGP serves everyones interests. Southeast Asia gets investment. China gets a ‘social license.’

All countries support peaceful resolution of South China Sea offshore territorial claims. All countries support the concept of joint developments areas.

Over time, the core TAGP network could be extended northward to China, Japan and South Korea and south to Indonesia, East Timor and Australia.

The result would be Pan-Asian Gas Pipeline (PAGP) network that — properly constructed — would span the transition from dirty coal-fired power to medium-dirty natural gas to zero emission solar and wind energy transported to market either as electricity or hydrogen.

The technology to do this already exists. Incorporated into pipeline specifications, the transition period from natural gas to hydrogen could be determined by market conditions.

LNG offers no such potential, which is a major flaw. Omitting this from net present value calculations has resulted in misdirected investment and industry markdowns of LNG infrastructure value in Asia. Asia should heed the signal.

Source: Grenatec