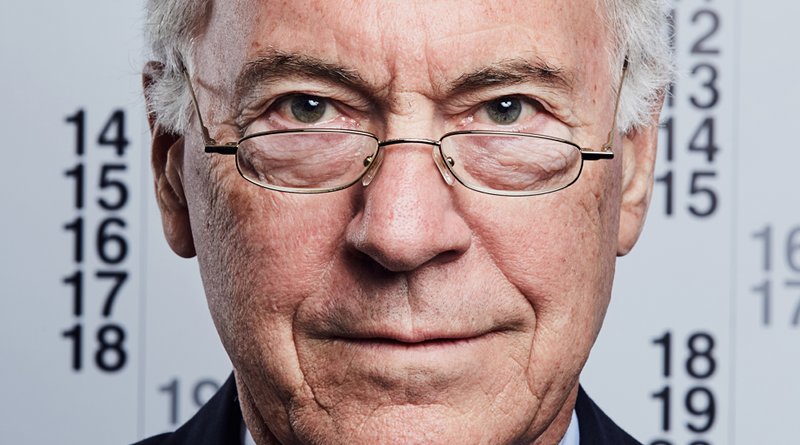

Prof. Dr. Steve H. Hanke: The Pandemic Will Embolden IMF To Grasp For More Power – OpEd

On April 10, 2020, Prof. Dr. Steve H. Hanke, published in London’s Central Banking journal an in-depth analysis on public policies, the IMF and government response within the context of ongoing worldwide public health Plague. Dr. Steve H. Hanke is a Professor of Applied Economics and Founder & Co‐Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore.

The following is the entire text of Dr. Hanke’s highly acclaimed analysis on current affairs, entitled: “Crises enliven ‘totalitarian temptations’”

“With the onset of the coronavirus, the world has become engulfed in the largest crisis it has faced since World War II. And, with each crisis – large or small – there is always an overwhelming public outcry for the government to do something. It makes no difference whether government policies and actions caused the crisis in the first place or whether governments failed to mitigate the damages generated by the crisis; the response is always the same: we need to expand the scope and scale of government. The expansions take many forms, but they all result in an increase in the exercise of power by government over society and the economy. These ‘power grabs’ often remain long after the crisis has passed. Indeed, each crisis carries with it a ratchet that increases the scope and scale of the state’s power.

At present, it is hard to pick up a publication in which editorialists are not clamoring for more government. The Economist leader of March 28 asserts that “big government is needed to fight the pandemic”. Never mind that it is the relatively small, lean and mean governments, such as those of Singapore and Hong Kong, that have been the most effective at protecting their citizens and economies. Not surprisingly, the Financial Times leader of April 4 appeared to be even more aggressive: “Radical reforms are required to forge a world that will work for all”.

And, it’s not only the British press that yearns for more power for the state. In France, there are many who are still tempted by “the totalitarian temptation” that echoes the title of Jean-François Revel’s 1976 classic. Indeed, the cries in Paris for more “state” and less “private” are deafening – never mind that government expenditures already account for more than 55% of French GDP. In the U.S., the drums for more central government are beating louder with each passing day. And that’s despite reportage about massive government failure in the face of the coronavirus pandemic.

Indeed, as I write, Reuters has just issued a special report entitled, “How federal government snafus slowed testing at a top US hospital”. It comes as no surprise that governments spend more money and regulate more actively during crises. But a more active government also attracts opportunists, who perceive that a national emergency can serve as a useful pretext for achieving their own objectives to permanently entrench and satisfy their special interests.

History has provided many examples to illustrate how damaging this is. Take the Great Depression. At that time, the organized farm lobbies, having sought subsidies for decades, took advantage of the crisis to pass a sweeping rescue package, the Agricultural Adjustment Act, whose title declared it to be “an act to relieve the existing national economic emergency”.

Almost 90 years later, the farmers are still sucking money from the rest of society. Then during World War II, when government accounted for nearly half of the US’s GDP, virtually every interest group tried to tap into the vastly enlarged government budget. Even bureaus seemingly remote from the war effort, such as the Department of the Interior, claimed to be performing “essential war work” and to be entitled to bigger budgets and more personnel.

Funds for the Fund

Smaller crises have sent the opportunists into feeding frenzies, too. The ever‐opportunistic International Monetary Fund is a classic case.

Established as part of the 1944 Bretton Woods agreement, the IMF was primarily responsible for extending short‐term, subsidised credits to countries experiencing balance‐of‐payments problems under the postwar pegged‐exchange rate system. In 1971, however, Richard Nixon, then US president, closed the gold window, signalling the collapse of the Bretton Woods agreement and, presumably, the demise of the IMF’s original purpose. But, since then, the IMF has used every so‐called crisis to expand its scope and scale.

The oil crises of the 1970s allowed the institution to reinvent itself. Those shocks required more IMF lending to facilitate, yes, balance‐of‐payments adjustments. And, more lending there was: from 1970 to 1975, IMF lending more than doubled in real terms.

With the election of Ronald Reagan in 1980, it seemed the IMF’s crisis‐ driven opportunism might be reined in. Yet, with the onset of the Mexican debt crisis, more IMF lending was “required” to prevent debt crises and bank failures. That rationale was used by none other than President Reagan, who personally lobbied 400 out of 435 congressmen to obtain approval for a US quota increase for the IMF. Once again, IMF lending ratcheted, increasing 27% in real terms during Reagan’s first term in office.

Not surprisingly, the events of September 11, 2001 did not catch the IMF flat‐footed. It swung into action to successfully obtain additional commitments.

In the US, the latest emergency has given cover to a multitude of parochial opportunists, whose proposals range from bailing out the airlines to sending millions of dollars in support to the John F Kennedy Center for the Performing Arts. The resulting ‘stimulus package’ amounts $2.2 trillion.

And, there are already plans in the works for what will be the mother of all stimulus packages, one that will be larded with many infrastructure projects destined to become ‘white elephants’.

It may be too much to expect a speedy end to the ‘law of the ratchet’, but it is time to acknowledge what is going on.”