Why It’s A Great Thing That US Tax Revenue Set A Record – OpEd

By Mitchell Blatt*

A week before America’s tax day, the Washington Free Beacon reported that the U.S. Treasury collected a “record-high” amount of taxes in nominal terms in the first half of fiscal year 2016. Cause to celebrate?

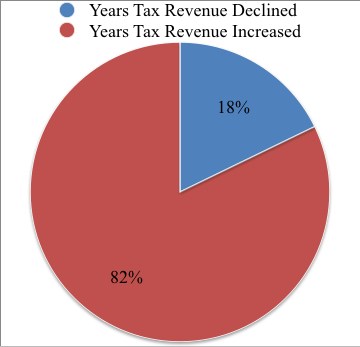

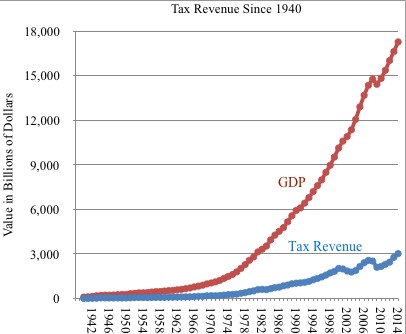

Not so fast. The U.S. federal government collects record taxes almost every year. That’s because the economy grows almost every year, as the population grows and innovation moves along, so the amount of taxes in nominal terms increases most years. In fact, in the 73 years between 1941 and 2014, federal tax revenue increased in 60 of those years and only decreased over the previous year 13 times, according to data from the Tax Policy Center.

But there is still reason to celebrate an increase in tax revenue because increases in tax revenue are tied to increases in GDP. If the GDP rises, then tax revenue usually increases. Tax revenue cannot increase without a greater base of economy production to draw from.

But there is still reason to celebrate an increase in tax revenue because increases in tax revenue are tied to increases in GDP. If the GDP rises, then tax revenue usually increases. Tax revenue cannot increase without a greater base of economy production to draw from.

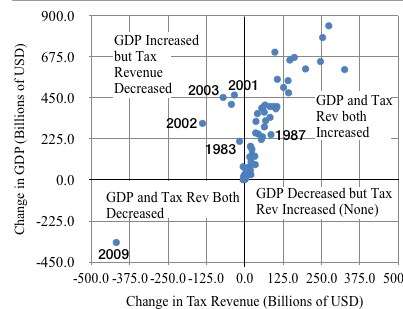

The few times that tax revenue decreased while GDP increased were mostly connected to tax cuts. President George W. Bush signed major tax cuts into law in 2001 and 2003, and tax revenue declined from the previous year every year from 2001 to 2003. Tax revenue in 2002 was $138 billion less than in 2001.

Despite the good news, conservatives greeted this level of tax revenue growth–which includes corporate taxes, payroll taxes, income taxes, and all other federal tax revenue–with concern.

“Don’t tune this out. Unless we do something, taxes will continue to rise until they become an almost unbearable burden for our children and grandchildren,” the activist group Convention of the States, which calls for a new constitutional convention, bemoaned.

Conservatives do think the government is too big and support low taxes. Grover Norquist, founder of Americans for Tax Reform, who claims inspiration from President Ronald Reagan, said that he wanted the government to be small enough so that it could “drown in a bathtub,” and one aspect of their strategy is to “starve the beast.”

Conservatives do think the government is too big and support low taxes. Grover Norquist, founder of Americans for Tax Reform, who claims inspiration from President Ronald Reagan, said that he wanted the government to be small enough so that it could “drown in a bathtub,” and one aspect of their strategy is to “starve the beast.”

Reagan explained in 1980:

“John Anderson tells us that first we’ve got to reduce spending before we can reduce taxes. Well, if you’ve got a kid that’s extravagant, you can lecture him all you want to about his extravagance. Or you can cut his allowance and achieve the same end much quicker.”

Still, even Reagan didn’t decimate federal revenue with his tax cuts. In only one year during his two terms–1983–was less tax revenue collected than the previous year, and there was only $17 billion less that year.

One problem with this strategy, however, is that the deficit increases with less revenue. Republicans have stated that they want to decrease spending in order to cut the deficit, which goes along with their small government agenda. Yet when Congress and President Obama couldn’t agree to a compromise to cut spending and raise the debt ceiling in 2011, mandatory across the board spending cuts (budget sequestration) kicked in in 2013, and Republicans complained about its impact on military spending.

One problem with this strategy, however, is that the deficit increases with less revenue. Republicans have stated that they want to decrease spending in order to cut the deficit, which goes along with their small government agenda. Yet when Congress and President Obama couldn’t agree to a compromise to cut spending and raise the debt ceiling in 2011, mandatory across the board spending cuts (budget sequestration) kicked in in 2013, and Republicans complained about its impact on military spending.

Democrats (especially of the Sanders variety) and socialists, however, may need to rethink their priorities, too, after looking at the tax data. As tax revenue is linked to GDP, increasing the country’s GDP (while maintaining or raising rates) may be the best way to increase revenue for social programs. Socialist-style welfare programs can’t survive without a vibrant capitalistic economy.

For this reason, conservatives should be happy about higher tax revenue. They themselves have argued (rhetorically) for higher tax revenues as a basis for arguing for tax cuts on the grounds that they argue tax cuts help grow the economy. Jeb Bush, in defending both Reagan and his brother’s tax cuts, said, “They created a dynamic effect of high growth. And that’s what we need.”

For the conservatives who also argue that taxes should be cut to starve the federal government, Bush did an okay job with that, but there was one year where taxes declined by almost even more–$400 billion. The problem is that the GDP also declined by $342 billion. Recession and crisis like that of 2008 and 2009 (the year in question) sure can starve the federal government and the households of its citizens.

Data source: Federal Receipt and Outlay Summary – Tax Policy Center.

About the author:

*Mitchell Blatt moved to China in 2012, and since then he has traveled and written about politics and culture throughout Asia. A writer and journalist, based in China, he is the lead author of Panda Guides Hong Kong guidebook and a contributor to outlets including The Federalist, China.org.cn, The Daily Caller, and Vagabond Journey. Fluent in Chinese, he has lived and traveled in Asia for three years, blogging about his travels at ChinaTravelWriter.com. You can follow him on Twitter at @MitchBlatt.

Source:

This article was published at Bombs and Dollars