Crypto Needs Comprehensive Policies To Protect Economies And Investors – Analysis

By Tobias Adrian, Dong He, Arif Ismail and Marina Moretti

The global push for clearer policies on crypto assets has gained momentum under the Indian G20 Presidency. As this work continues, it’s important to recognize the progress already achieved, but more is needed, especially in implementing global standards.

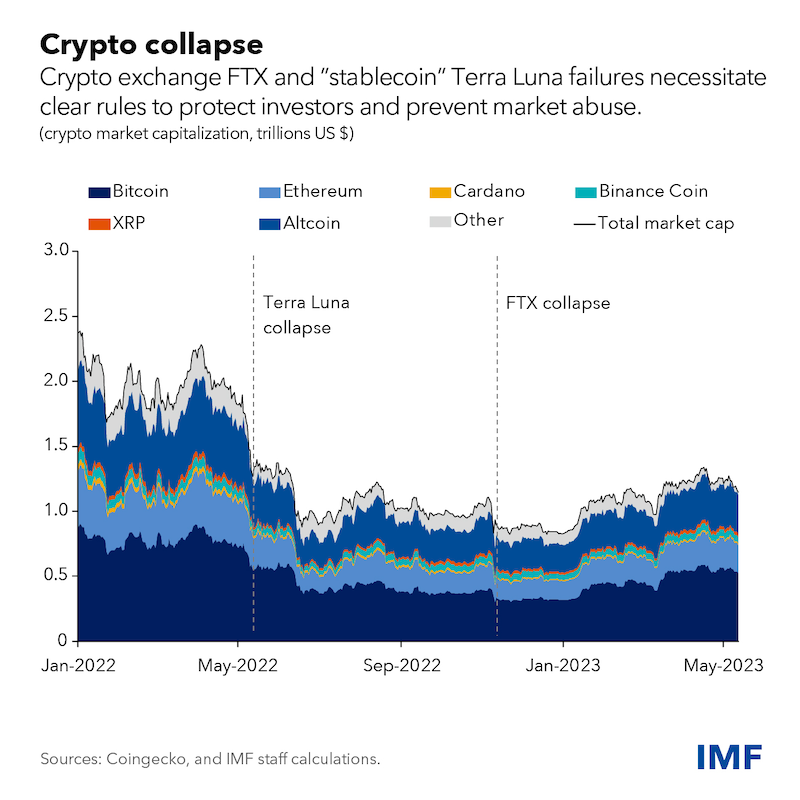

Last year’s failures of the FTX crypto trading platform and the Terra Luna stablecoin highlighted the urgency of establishing clear policies to protect investors and prevent abuse. Despite recent industry challenges, investor optimism continues to revive periodically, as evidenced by Bitcoin’s near doubling this year. Without robust safeguards, the increased risk of fraud and misconduct could adversely impact investors’ expected returns.

While some policymakers have taken necessary steps to safeguard consumers and ensure financial integrity, it is equally important to consider the broader implications of crypto. Such assets, particularly stablecoins denominated in hard currencies, could potentially replace official currencies, and significantly impact countries’ monetary and fiscal policies. This is especially true in emerging markets and developing economies, underscoring the need for a comprehensive, consistent, and coordinated policy approach to crypto.

That’s why we presented an assessment of the macro implications of crypto assets to the G20 presidency earlier this year, building on recommendations outlined in the Elements of Effective Policies for Crypto Assets endorsed by the IMF Executive Board in February.

Our approach features three key pillars: a sound macro-policy foundation, clear legal treatment and granular rules, and effective implementation.

These are our key policy recommendations:

- The defense against the substitution of sovereign currencies is the maintenance of robust, trusted, and credible domestic institutions. Transparent, consistent, and coherent monetary policy frameworks are crucial for an effective response to the challenges posed by crypto assets.

- To protect national sovereignty, it is important not to grant crypto assets official currency or legal tender status. Doing so would require accepting them in many jurisdictions for tax payments, fines, and debt settlements, and could generate fiscal risks for government finances, and could threaten financial stability or rapid inflation.

- To address the volatility of capital flows associated with crypto, policymakers should integrate them within existing regimes and rules that manage capital flows. This will help ensure stability and minimize potential disruptions.

- Finally, tax policies should ensure unambiguous treatment of crypto assets, and administrators should strengthen compliance efforts. Specific regulations are needed to clarify the tax treatment of crypto, including value-added taxes or levies on income or wealth.

Clear legal treatment

Building on a sound macro-policy foundation, clear legal treatment and granular rules are crucial. The principle of “same activity, same risk, same regulations” should guide regulatory efforts.

Consistent with the recommendations by standard setters such as the Basel Committee on Banking Supervision, Financial Action Task Force, Financial Stability Board, and theInternational Organization of Securities Commissions, our recommendations are:

- A comprehensive legal foundation is essential to effectively regulate crypto, addressing both private law and financial law aspects. This includes ensuring predictability and enforceability of rights while appropriately classifying crypto.

- Strong anti-money laundering and combating the financing of terrorism (AML/CFT),prudential and conduct rules should be implemented to cover all entities and activities related to the issuance, trading, custody, or transfer of crypto.

- For systemic stablecoin arrangements, additional requirements such as the Principles for Financial Market Infrastructures—standards that aim to ensure the safety, efficiency, and resilience of FMIs—should be applied.

Significantly, the FSB in July established a set of high-level recommendations for crypto regulation, focusing on financial stability. They include ensuring authorities’ regulatory powers and sound governance and risk management practices by providers. It also features revised high-level recommendations for effectively addressing financial stability risks associated with “global stablecoin” arrangements.

Overall, the recommendations promote the consistency and comprehensiveness of regulatory, supervisory and oversight approaches to crypto.

Effective implementation

Finally, ensuring effective policies requires several measures including strong coordination, at the domestic and international level:

- National authorities must align their frameworks to the emerging guidelines, and standards being developed by standard setting bodies. This alignment is critical to achieve consistent treatment of crypto assets and may require legislative changes.

- Developing strong supervisory capacity is vital for monitoring and enforcing rules effectively. Authorities must have the necessary skills and resources to oversee the evolving crypto asset landscape.

- Given the borderless nature of the crypto-assets ecosystem, international collaboration and information sharing are crucial. Cooperation among supervisors and competent authorities will enable the monitoring of crypto asset service providers and maintain the efficacy of regulatory policies.

- Going beyond crypto polices,public authorities should take advantage in the progress in digital technology to enhance public policy objectives and must actively collaborate to address ongoing cost, trust, and speed issues, particularly for cross-border payments. New multilateral platforms could improve the efficiency of transactions.

The IMF will continue to support the G20 by delivering to the Leaders’ Summit in September a joint IMF-FSB synthesis paper highlighting the building blocks for effective crypto policies. In addition, we are committed to providing tailored capacity building to our 190 members based on the above recommendations and emerging guidelines from standard setters. Our surveillance program will also assess the effectiveness of policy frameworks including crypto.

By embracing a comprehensive approach and implementing these recommendations, policymakers can safeguard monetary sovereignty, protect investor interests, and promote financial stability in the digital age.

About the authors:

- Tobias Adrian is the Financial Counsellor and Director of the IMF’s Monetary and Capital Markets Department. He leads the IMF’s work on financial sector surveillance and capacity building, monetary and macroprudential policies, financial regulation, debt management, and capital markets

- Dong He is Deputy Director of the Monetary and Capital Markets Department (MCM) of the International Monetary Fund. He started his career in 1993 when he joined the World Bank through the Young Professionals Program and was a staff member of the IMF from 1998 to 2004.

- Arif Ismail is currently a Deputy Division Chief in the Payments and Infrastructure Division of the IMF’s Monetary and Capital Markets Department. He is responsible for co-leading the Division on payments, financial market infrastructures, and digital money matters.

- Marina Moretti heads the Financial Crisis Preparedness and Management Division in the IMF’s Monetary and Capital Markets Department. Since joining the IMF in 1999, she has focused on crisis management and regulatory policy issues, and led Financial Sector Assessment Program missions in several countries.

Source: This article was published by IMF Blog