Africa Development Bank Mobilizes Funds For Projects Using Integrated Platforms – OpEd

The African Development Bank (AfDB), which sets its primary tasks of contributing the continent’s economic and social development by providing the necessary concessional funding for projects and programmes, as well as offering and coordinating assistance in capacity-building activities, has now embarked on various post-Covid-19 initiatives throughout the continent, especially in the least developed African countries.

In the latest was the mid-March event where potential investors have examined more than US$50 billion of curated bankable projects in key priority sectors identified in the Africa Investment Forum’s 2020 Unified Response to Covid-19 initiative.

The sectors include agriculture and agro-processing; education; energy and climate; healthcare; minerals and mining; information and communications technology and telecommunication; and industrialization and trade. Nine of these projects are women-led, with a potential value of $5 billion.

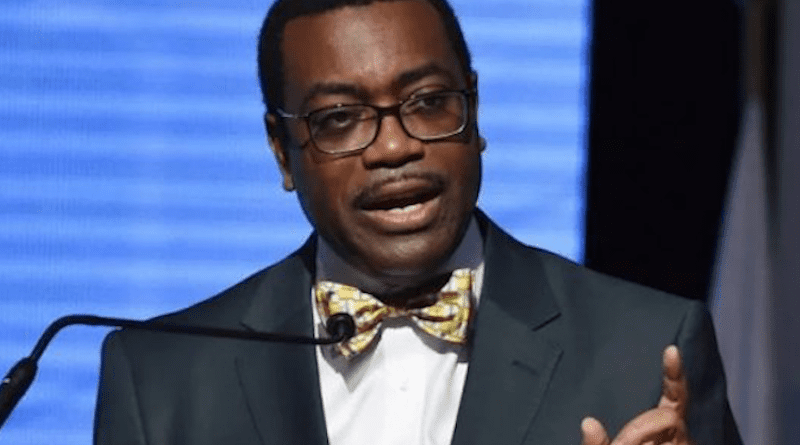

The AfDB has secured $32.8 billion in investment commitments for projects in Africa. The largest deal secured at the three-day Africa Investment Forum was $15.6 billion for the Lagos-Abidjan mega highway of about 1 200 km (745 miles) will have four to six lanes, connecting West Africa’s two major cities in Nigeria and Ivory Coast, said AfDB President Akinwumi Adesina.

“Africa is a very bankable continent. We’ve gone through hard times because of the Covid-19 situation but here we are on a rebound,” said Adesina. “Africa is back for investments.” The projects, part of the bank’s Covid-19 response, touch on sectors including agriculture and agro-processing, education, energy and climate, healthcare, minerals and mining, and information and communications technology.

Adesina said that on the health side, projects include a new medical city in Accra, Ghana, a fund for health services for low-income populations in South Africa, and two platforms for manufacturing pharmaceutical products: one in West Africa and one in Kenya.

The African Continental Free Trade Area (AfCFTA), launched under the African Union, provides a unique and valuable access to an integrated African market of over 1.3 billion people. In practical reality, it aims at creating a continental market for goods and services, with free movement of businesspeople and investments in Africa.

The bank together with health giants have also set eyes on capitalizing on the advantages and conditions to push for healthcare issues. It, as well, is expected to advance the integration of African markets and standards for pharmaceuticals and other goods.

As a result, the Africa Investment Forum is curating several investment-ready transactions that align closely with the three healthcare pillars outlined by African Development Bank Group president Dr. Akinwumi A. Adesina.

The investor boardroom sessions feature a $49 million transaction involving the construction of a pharmaceutical and biomedical hub in West Africa. The hub will incorporate a logistics platform, research and development facilities and an academic institution that could serve the region and the wider continent in vaccine manufacturing and drug and medical development.

A second vaccine-related transaction is a $45 million production plant in East Africa, which the World Health Organization (WHO) has pre-qualified. The plant will routinely produce three vaccines, including one for Covid-19.

It was no surprise that the WHO recently announced that Kenya, Senegal, Tunisia, South Africa, Egypt and Nigeria would be the first participants in its mRNA technology transfer hub initiative. The initiative paves the way for the manufacture and licensing of a range of pharmaceuticals in these six countries. It is likely to trigger strong investor interest in Africa’s burgeoning pharmaceutical sector.

The Africa Investment Forum and the African Development Bank Group have championed two initiatives that are driving trade integration and regulatory harmonization throughout Africa. These are the African Medical Agency and the Africa Continental free Trade Area.

In order to realize further its set goals, the AfDB has approved funding of $127.8 million to Niger. The funds approved by the Board of Directors of the African Development Fund, the Group’s concessional arm, will be used for a project to open up access to farming and pastoral lands in the east of the country, along its border with Nigeria.

It has also approved a $125.3 million loan to finance the first phase of the Dodoma Resilient and Sustainable Water Development and Sanitation Program in Tanzania. Specifically, the loan from the African Development Fund, the concessional window of the African Development Bank Group, will cover the construction of a dam and water treatment plant to address supply challenges in Dodoma City and the towns of Bahi, Chemba and Chamwino.

As a lead partner of the 9th World Water Forum, it plans to earmarked more than $5.6 million to support the forum, billed as the world’s largest international water-related gathering. The event will be an opportunity for attendees to gain a deeper insight into how the bank provides technical and financial support to regional member countries to ensure water security for sustainable development in their territories through its Water Development and Sanitation Department.

“As one of the leading financing institutions on the continent with a commitment to the development of Africa’s water and sanitation sectors, it is a natural fit for the African Development Bank to support the Government of Senegal in co-hosting this Forum,” said Beth Dunford, the Bank’s Vice President for Agriculture, Human and Social Development. “Failure is not an option when it comes to mitigating the imbalance between water needs and water availability to boost economic development and stability,” she added.

Last month for instance, it approved a $1.4 million grant for enhancing private sector engagement and capacity building for refugees and internally displaced persons in fragile areas of northern Mozambique. The project will be implemented by the global refugee agency UNHCR, collaborating with the Government of Mozambique. The grant is from the Transition Support Facility Pillar III.

Mozambique is host to 28,000 refugees and asylum seekers and over 735,000 people displaced by ongoing violence in Cabo Delgado Province. The majority of the internally displaced people remained in the province. An estimated 69,000 people moved to Nampula, and the remaining moved to the provinces of Niassa, Sofala, and Zambezia.As the United States and European sanctions broadened due to the “special military operation”, largely directed at “demilitarization” and “denazification” in Ukraine, there are, undoubtedly, terrible impact on the African economy: increase in the price of gas, oil, agricultural raw materials…et cetera.

There is also some African ambiguity about Russia, with the public seeing Putin as a strongman who would therefore have the right to decide on a country’s future security alliances, while being very concerned about their sovereignty.The Russia-Ukraine crisis that started February 24, to a considerable extent, has affected a number of African countries. The AfDB plans to raise $1bn (£759m) to support agricultural production in Africa and shield the continent from potential food shortages arising from the Russia-Ukraine crisis.

Agricultural trade between the continent’s countries and Russia and Ukraine is significant. African countries imported $4 billion worth of agricultural products from Russia in 2020.About 90% of these products were wheat, and 6% were sunflower oil. The main importing countries were Egypt, which accounted for almost half of the imports, followed by Sudan, Nigeria, Tanzania, Algeria, Kenya and South Africa.

The UN also says at least 15 African countries get more than half their wheat from the two warring nations. Somalia, Benin, Egypt and Sudan are the most dependent. “The AfDB sees these increases in prices of wheat, maize and soya beans as potentially going to worsen food insecurity and raise inflation,” Akinwumi Adesina, the bank’s president, said.

The bank intends to organize a meeting of African finance and agriculture ministers to roll out that plan. Through the fund, AfDB wants to increase production of wheat rice, maize and soya beans using climate-resilient technologies, including heat-tolerant and drought-tolerant crop varieties. The heat-tolerant wheat variety has already been experienced in Sudan and Ethiopia.

The Africa Investment Forum, launched in 2018, is a multi-stakeholder, multi-disciplinary platform that advances private and public-private partnership projects to bankability. It raises capital and accelerates deals to financial closure.

The Africa Investment Forum is an initiative of the eight founding partners including the African Development Bank; Africa 50; the Africa Finance Corporation; the Africa Export-Import Bank; the Development Bank of Southern Africa; the Trade and Development Bank; the European Investment Bank; and the Islamic Development Bank.