Countries Can Tap Tax Potential To Finance Development Goals – Analysis

By Vitor Gaspar, Mario Mansour and Charles Vellutini

Emerging market and low-income economies have a significant untapped tax potential of 8 percent to 9 percent of GDP

Emerging markets and developing economies need $3 trillion annually through 2030 to finance their development goals and the climate transition. That amounts to about 7 percent of these countries’ combined 2022 gross domestic product and poses a formidable challenge, particularly for low-income countries.

Our new research finds that many countries have the potential to increase their tax-to-GDP ratios—enabling them to provide critical government services—by as much as 9 percentage points through better tax design and stronger public institutions. Making use of this potential would also contribute to financial development and private sector entrepreneurship. Easier financing, in turn, together with efficient and well-targeted spending, including to strengthen social safety nets, would go a long way toward delivering sustainable development.

Stalled progress

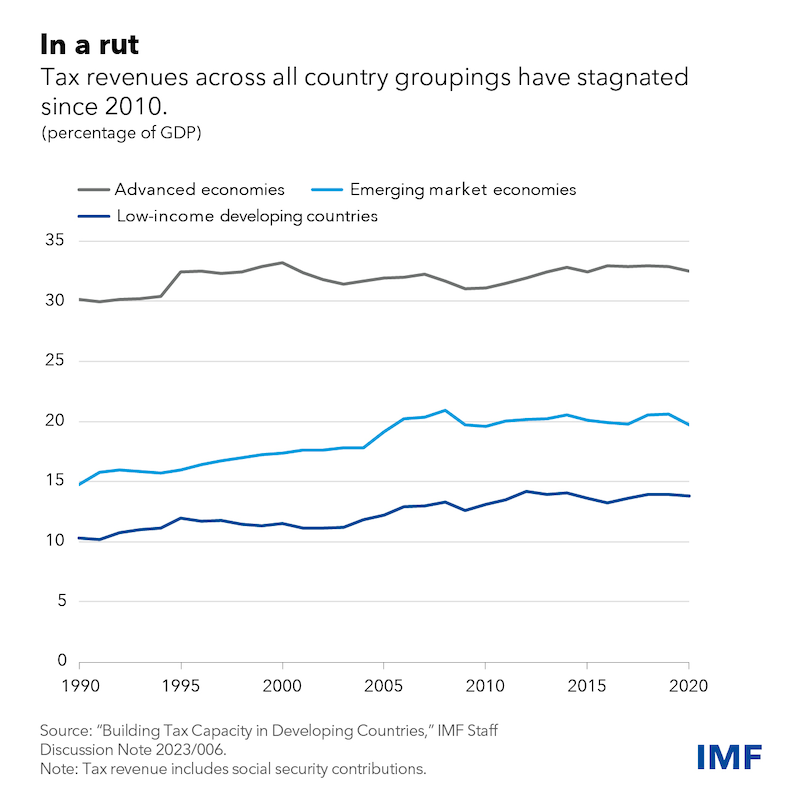

The average tax-to-GDP ratio in emerging market and developing economies has increased by about 3.5 percentage points to 5 percentage points since the early 1990s,driven primarily by taxes on consumption such as value-added and excise taxes.

Some countries have been remarkably successful in raising revenue, such as Albania, Argentina, Armenia, Brazil, Colombia, and Georgia—all of which mobilized more than 5 percentage points of GDP. Much of this increase occurred before the 2008 global financial crisis, however, suggesting that progress has been difficult and fragile in the face of recent shocks.

Moreover, progress on raising revenue since the early 1990s has varied widely across countries. Half of emerging market economies and two-thirds of low-income countries had a tax-to-GDP ratio in 2020 that was lower than 15 percent— a tipping point above which growth has been found to accelerate. And resource-rich countries have typically generated less tax revenue, as some governments reduced taxes as a result of higher revenue from natural resources.

Countries have considerable room to collect more revenue based on their tax potential—the maximum a country can collect given its economic structure and institutions. We find that low-income countries could raise their tax-to-GDP ratio by as much as 6.7 percentage points on average.

Improving public institutions, including reducing corruption, to the level of those in emerging market economies would result in an additional 2.3-point increase. The total revenue-raising potential, at 9 percentage points of GDP—a staggering two-thirds increase relative to their tax-to-GDP ratio in 2020—would go a long way toward enabling the state to play its crucial role in development.

Similarly, emerging market economies can raise their tax-to-GDP ratio by 5 percentage points on average, while improving their institutions to the average of advanced economies could raise an additional 2 to 3 points.

Some policymakers hope for additional revenue from the ongoing international collaboration on taxing profits of large multinational corporations. But the direct revenue impact of this initiative is likely to represent only a tiny fraction of the overall revenue needs, as shown in a February policy paper.

Essential reforms

To build tax capacity, governments will need to take a holistic and institution-based approach that focuses on leveraging core domestic tax policies. We offer the following concrete advice:

- Improve the design and administration of core domestic taxes—value-added taxes, excises, personal income taxes, and corporate income taxes. VAT revenue in low-income countries, for instance, could be doubled by limiting preferential treatments and improving compliance without increasing standard tax rates. And the widespread adoption of digital technologies would result in higher revenue collection and narrow compliance gaps.

- Implement bold reform plans and focus on tax base broadening through the rationalization of tax expenditures, more neutral taxation of capital income, and better use of property taxes. Headline tax rates are generally not the main concern. Excise taxes—particularly fuel excises and forms of carbon pricing—can mitigate domestic health and climate-related costs. This multi-pronged approach, over the long term, can balance equity and efficiency considerations—the Achilles’ heel of managing the political economy of tax reforms.

- Improve the institutions that govern the tax system and manage tax reform. The political economy of tax reform has proven to be hard. Policymakers need evidence to convince the public of the gains and show progress in policy implementation over time. This requires adequate staffing to forecast and analyze the impact of tax policies on the economy, greater professionalization of public officials working on tax design and implementation, better use of digital technologies to strengthen compliance, and transparency and certainty in how policy and administration are translated into legislation.

- Carefully prioritize and coordinate reforms across government agencies, because the broader institutional context matters. This creates a virtuous circle by which enhanced institutions improve state capacity, which in turn increases the quality of tax design and its acceptance by citizens. This is in a nutshell the IMF’s approach to supporting countries in tax system reform and raising domestic revenue.

About the authors:

- Vitor Gaspar has been Director of the Fiscal Affairs Department at the IMF since 2014. He was Portuguese Minister of State and Finance from 2011–13, and has held various positions in European and Portuguese institutions, including head of BEPA at the European Commission, Director-general of Research at the European Central Bank, Director of Economic Studies and Statistics at the Central Bank of Portugal, and Director of Economic Studies at the Portuguese Ministry of Finance.

- Mario Mansour is Division Chief in the IMF’s Fiscal Affairs Department (FAD), where he oversees tax policy work in Francophone Africa, Europe, Middle East, and Central Asia. Prior to this, he held several positions in FAD (2004-2018), including Deputy Division Chief of Tax Policy, and was Director of the IMF’s Middle East Regional Technical Assistance Center (2018-2021).

- Charles Vellutini is a senior economist in the Fiscal Affairs Department of the IMF. He has advised governments on tax policy and trade for over 15 years. He has assisted on improvements on the personal income tax, the VAT, SME taxation, tax expenditures and other tax policy topics. His research has covered the redistributive capacity of taxation, tax policy in fragile states and general equilibrium analysis of tax policy. He has consulted for the European Commission and the World Bank and taught at Toulouse School of Economics.

Source: This article was published by IMF Blog