The Long Arm Of Kazakhstan’s Kleptocracy – OpEd

The Kazakh government’s recent attack on Nevada based Jysan Holding is not simply another move by a kleptocrat consolidating power. Rather, it demonstrates the ambition of Kazakhstan’s new regime. The Kazakh government seeks to co-opt any independent financial means within the country and, even more critically, control in toto the Kazakh educational system. This case, then, is a crucial test of the international community’s reaction, who must respond and stand up to Kazakhstan’s pressure.

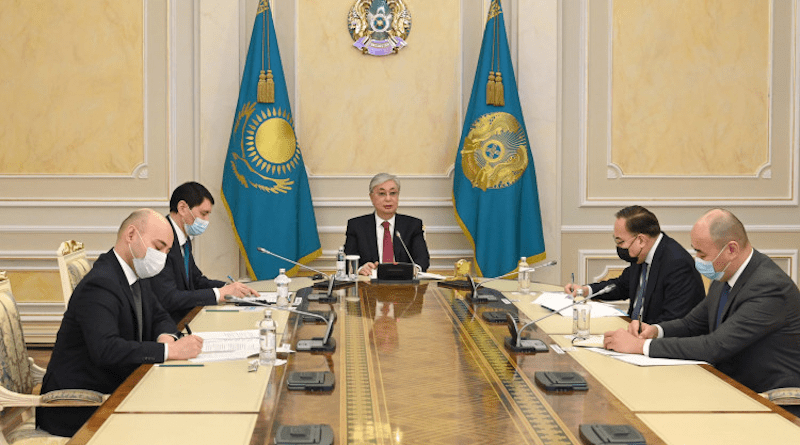

Since the unrest in Kazakhstan in early 2022, Kazakh President Kasym-Jomert Tokayev has engaged in an aggressive campaign of regime consolidation. He removed his predecessor, Nursultan Nazarbayev, from his position as Head of the Security Council, replaced a number of high-ranking officials with his own appointees, staged an early presidential election to solidify his power, and most recently stripped Nazarbayev’s immediate family of their immunity from prosecution. Nazarbayev, the country’s long serving autocrat ruled with an iron fist for the better part of 30 years. He was known as a serial violator of human rights, stealer of elections (which he “won” with 98% of the vote on average) and violently suppressed Kazakhstan’s already limited freedom of expression.

These are all standard kleptocratic tactics, designed to ensure the new regime faces no threats from predecessor cronies. Moreover, like its Russian neighbor, Kazakhstan is a petrochemical giant in particular, and resource heavyweight in general, exporting massive quantities of oil, gas, coal, and uranium, making it strategically consequential to China, Russia, and Europe. Any resource-focused economy with a personalized or closely-held leadership system is likely to devolve into kleptocracy. The new regime’s actions are, by comparison to similar states, the price of kleptocratic business.

The issue, however, is that the Kazakh government’s kleptocratic actions spill well beyond its borders. Most recently, the Jysan Holding case has seen Kazakhstan seeking to expand its reach into the United States. Nevada based Jysan Holding serves as the parent company to UK-based Jusan Technologies Limited, which owns First Heartland Jusan Bank based in Kazakhstan, one of Kazakhstan’s largest financial institutions. Western jurisdictions, specifically the US and the UK, were chosen by the parent companies as their bases due to the significantly higher levels of corporate transparency and accountability provided.

Now the new government of Kazakhstan has set its sights on Jusan. It seeks to confiscate the investment company’s assets, with an ultimate goal of partitioning them amongst Tokayev’s supporters, as has been standard procedure by the governing Kazakh elite. This is in order to gain control of funds and to bring the control of assets under governments jurisdiction. Tokayev’s policy announced last year is being used as cover, while oligarchs with vast foreign wealth have not been touched, nor have investigations about their ill-gotten wealth even commenced.

None of these attempts are particularly surprising in a regime like Kazakhstan’s. Naturally however, aggressive “anti-corruption” prosecution of a foreign-owned bank will spook potential investors and further hollow out Kazakhstan’s economy in the long-term. But given that Kazakhstan is locked in the heart of Central Asia and more closely affiliated to China and Russia than to any state with legitimately transparent financial institutions, major reforms are unlikely.

The issue, however, is the government’s internationalization of its pressure by targeting assets located outside Kazakhstan. Tokayev has employed every organ of the Kazakh state to pressure Jusan abroad and ultimately take control of the bank, seeing an opportunity for self-enrichment too good to pass up. Kazakhstan has resorted to intimidation, blackmail, and other acts of questionable legality, to bully US and UK entities Jysan Holdings and Jusan Technologies Limited into forcefully handing over their holdings.

A poorly-organized Kazakh financial sector, alongside attempts such as these at state capture of any and all successful private entities, explains the country’s unmet economic potential. Indeed, Kazakhstan posted only a four percent GDP growth rate, similar to Madagascar, Uruguay, Tunisia, and Tanzania, despite its massive resource strengths. The issue has been that of investment. Major Kazakh banks have been unstable since the early 2010s, when falling oil prices undermined economic prospects.

The government has intervened multiple times to support struggling financial institutions – although in a distinct public policy failure, it has also unexpectedly cut off financial assistance, triggering a near-collapse in 2018. First Heartland Jusan Bank is one of few success stories in the Kazakh financial sector. Like all other major financial institutions in Kazakhstan, the company received state assistance several times to prevent its collapse in the past. However, since the late 2010s, First Heartland Jusan Bank has been one of the few private financial institutions in Kazakhstan to post positive returns. This is despite the severe economic disruption COVID-19 caused in country.

The new Kazakh government cannot be allowed to succeed in its pressure campaign. Jusan is a key cog in the country’s financial system. Its private, international ownership based in the West must continue to ensure that it remains free of extreme state pressure, thereby allowing it to undergird a broader banking network in Kazakhstan. Furthermore, allowing the government to repossess its assets would destroy the credibility of private Kazakh finance.

Moreover, Jusan Technologies also funds the Nevada-based New Generation Foundation (NGF), a charity that sponsors high-profile Kazakh educational initiatives. NGF finances Kazakhstan’s flagship English-medium higher-educational institution that is designed to support a new generation of Kazakh leaders with an international outlook. Equally critical, NGF supports the NIS network of 20 primary and secondary schools in Kazakhstan that provide high-aptitude students with advanced instruction in mathematics, the natural sciences, and foreign languages, employing a qualification system similar to British A-Levels. The goal of both educational initiatives is to create a legitimate Kazakh intellectual environment that has the support to compete internationally and drive the country forward.

The very fact that Jusan funds both initiatives is of no interest to the current government, nor the harm they will be causing to the Kazakh education system if they were successful in their state capture efforts. The impact of this would be felt directly by pupils, as the company’s funds would be at risk for misappropriation, instead of providing for tens of millions of dollars in university endowments and grants. More fundamentally, the fact that these institutions are designed to create internationally minded students – and the fact that graduates are all English speakers – is what troubles the current regime the most. A vibrant intellectual environment that fosters adventurous academics and business leaders who venture beyond Kazakhstan and internationalize the country’s economy pose an obvious threat to a kleptocracy.

Hence the current Kazakh government is targeting Jusan not only because of its financial potential, but also because it represents a Kazakh future beyond the current kleptocratic model. The US and its allies – in this case particularly the UK – must grasp the fundamentals of this situation. The government cannot be allowed to destroy an independent financial institution in Kazakhstan, especially one that sustains independent western-oriented Kazakh intellectual life.

Marat Suleymanov is a student in Manchester pursuing graduate studies in global communications and IR. His areas of research include UK-Asia Relations, with an emphasis on UK-Kazakhstan international cooperation and economic ties.