The Oakland A’s Stadium Shenanigans – OpEd

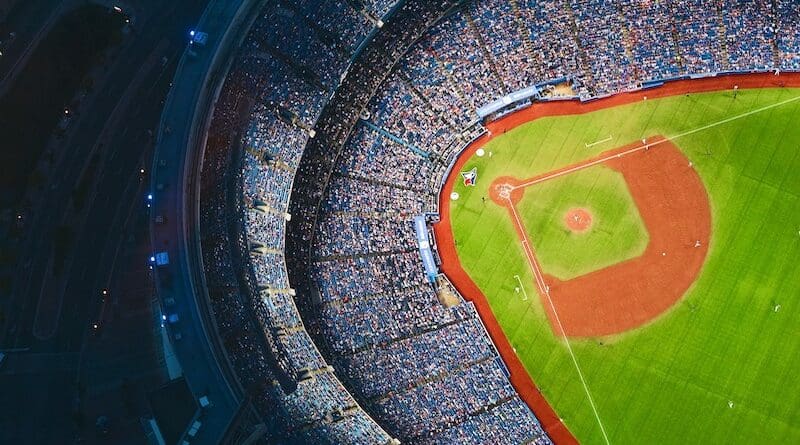

The story of where the Oakland Athletics baseball team will play after they leave the Oakland Coliseum this season has taken some surprising turns.

If you’ve been following that story, you already know that as the 2023 MLB season ended, there were real questions about where the team would play its next several seasons. Its deal to play at the city’s stadium had come to an end. Still, it will be years before it has a new stadium built in Las Vegas at the site of the old Tropicana Resort and Casino, which closed in early April 2024. The buildings on the landmark site claimed by the A’s still must be demolished before any construction begins.

The Oakland A’s ownership burned its bridges with the City of Oakland, which presented a problem. They could make a deal to keep playing at the Coliseum, but at the cost of Oakland city officials making them truly pay for the privilege. They could play at Las Vegas Ballpark in Summerlin, Nevada, where the team’s AAA minor-league franchise currently plays. Or they could strike out to find another minor-league ballpark where they could play as a third option.

They’ve chosen the third option, which provides a new case study of why taxpayer-funded sports stadiums for professional teams are a bad deal for taxpayers. This new chapter in the A’s saga starts with what looks like a sweetheart deal for the Athletics’ owner and the town where they will play their next three to four seasons—a town that happens to be California’s state capital.

A Sweetheart Deal for the Oakland A’s

Things had looked bleak for where the Athletics baseball team would play its next seasons, but that changed when another billionaire professional sports team owner shook the scene.

Vivek Ranadivé, the owner of the Sacramento Kings NBA franchise who purchased the Sacramento River Cats minor-league baseball team in August 2022, came to the rescue. As he did, Ranadivé offered the A’s a deal that neither they nor the City of Sacramento could afford to refuse.

The Mercury News’ Shomik Mukherjee describes the deal:

There is no lease agreement; the A’s won’t pay a dime in rent. For now, they also won’t worry about representing a city in their branding, keeping the “Athletics” moniker alone until legal and logistical hurdles are cleared in Las Vegas.

In an interview Thursday, Kaval laid out the details of the new partnership with the River Cats: The A’s will pay to upgrade the batting cages, weight rooms and field itself at Sutter Health Park, plus additional seating, premium sections and advertising for the stadium.

Kaval provided no details of the projected costs of such a deal, but the money spent would likely still fall far short of what Oakland officials had proposed: a five-year lease that would cost the team $97 million.

Ranadivé, as the private owner of Sutter Health Park, gets the benefit of upgraded facilities that will benefit the team he owns long after the Athletics have moved on. More importantly, he also benefits by bailing out the Sacramento city officials who made a major public policy error in providing taxpayer funds to build an arena for his NBA franchise.

Sacramento City Officials Big Bet on Professional Sports

To understand why Sacramento city officials need a bailout, we have to go back to when the Golden 1 Center was foolishly held up as a success story for the public funding of sports stadiums.

The Golden 1 deal was relatively straightforward, according to assistant city manager John Dangberg and Desmond Parrington, the city’s project manager for Golden 1. Sacramento provided land and promised to cover a fixed portion of the construction costs of the new arena, which ended up totaling $559 million. The Kings covered the rest of the construction costs and purchased land for the stadium and associated developments, including the mostly vacant Downtown Plaza mall as well as 1.5 million adjoining square feet across six square blocks. The city would get a new multipurpose arena, a magnet for downtown redevelopment, and, ideally, increased tax revenue and economic activity.

In August of 2015, the city issued a $273 million bond to cover its share, with a 35-year repayment term. That means an expected city payment, with interest, of $578 million by 2050.

That money won’t come from Sacramento’s general fund. According to Dangberg and Parrington, the city will be able to pay back its $578 total investment without tapping into the general fund. Repayment breaks down like this: $354 million comes from the lease payments from the Kings, $193 million comes from downtown parking revenue, $25 million comes from the property taxes on the arena, paid by the Kings, and $6 million comes from a general hotel tax. Dangberg actually expects additional parking revenue to exceed expectations and cover the hotel tax.

What Could Go Wrong For Sacramento?

Sacramento city officials found out their tax-dollar funded wager had gone bad the hard way. Their first clue came early, as the Sacramento Bee’s Randy Diamond explains:

Critics back in 2014 had argued that the city’s plan was too risky because it relied on growing parking revenue.

City officials acknowledged they would have to tap the general fund if the parking revenues fell short—but insisted it wasn’t likely to happen.

“I feel comfortable we’re on track to hit these targets,” said then-Assistant City Manager John Dangberg shortly before the arena opened in 2016.

But that optimism didn’t align with reality.

City officials estimated that parking revenue would jump from around $15.5 million to more than $26 million after Golden 1 Center opened in 2016. However, the revenue only rose to $20.3 million and then slightly dropped over the subsequent years, according to an examination of city figures.

Already disappointing, the lack of revenue from charging people to park in downtown Sacramento worsened after the pandemic. Many local businesses realized remote working technology made it possible to reduce their expensive bills for renting or owning real estate for their employees to work downtown. Consequently, the city’s parking revenues fell further. In 2023, city officials had to start paying the debt they took on to build the Golden 1 Center for Ranadivé’s NBA franchise with money from the city’s general fund.

Ranadivé’s deal with the former Oakland A’s to play their next several seasons at his minor-league baseball team’s stadium is nothing less than a billionaire-funded bailout for the City of Sacramento. The additional attendance they provide will increase the city’s parking revenues as several city-owned garages and parking lots are within easy walking distance of Sutter Health Park on both sides of the Sacramento River. Even though the stadium has less than a third of the typical seating for a major league baseball venue, it may increase that revenue by enough to keep the City of Sacramento from falling into the deep fiscal hole it made for itself.

To put it bluntly, Sacramento’s city officials now owe Ranadivé a lot without taking out any new debt. How do you suppose that will affect their decisions regarding anything involving the billionaire’s interests over the next several years?

This article was published by The Beacon