The Zombie (Company) Apocalypse Is Here – OpEd

By MISES

By Joshua Konstantinos*

One of the most significant economic developments since the Great Recession has been the zombification of the economy.

A zombie company is a term introduced to the lexicon by an influential paper, Zombie Lending and Depressed Restructuring in Japan, by economists Ricardo J. Caballero, Takeo Hoshi, and Anil K. Kashyap. The official definition of a zombie company according to the Bank for International Settlements (BIS) “is a publicly traded firm that’s 10 years or older with a ratio of earnings before interest and taxes (EBIT) to interest expenses of below one.”

More simply put, zombie companies are companies that are unprofitable — so unprofitable they are unable to pay even the interest on their debt out of their profits. They are effectively bankrupt but kept alive by banks continuing to lend them money to pay their existing loans.

This phenomenon first began in Japan after their real estate and stock market bubble popped in the early 1990s. The Cabellero, et al have proposed that zombie companies are to blame for Japan’s Lost Decade(s), writing:

“We propose a bank-based explanation for the decade-long Japanese slowdown following the asset price collapse in the early 1990s. … Large Japanese banks often engaged in sham loan restructurings that kept credit flowing to otherwise insolvent borrowers (which we call zombies). We examine the implications of suppressing the normal competitive process whereby the zombies would shed workers and lose market share. The congestion created by the zombies reduces the profits for healthy firms, which discourages their entry and investment. We confirm that zombie-dominated industries exhibit more depressed job creation and destruction, and lower productivity.“

Scale of the Zombie Infestation

Following the Great Recession, zombie companies became a worldwide phenomenon. Even with today’s very low interest rates; more and more companies are unable to pay the interest on their debts out of profits. According to the BIS, the share of zombie companies in the US doubledbetween 2007 and 2015, rising to around 10 perceent of all public companies. And counterintuitively, as interest rates have fallen lower and lower the number of zombie companies has increased. Economists Ryan Niladr Banerjee and Boris Hofmann, writing in the BIS quarterly review, describes this seemingly paradoxical result:

Using firm-level data on listed firms in 14 advanced economies, we document a ratcheting-up in the prevalence of zombies since the late 1980s. Our analysis suggests that this increase is linked to reduced financial pressure, which in turn seems to reflect in part the effects of lower interest rates. We further find that zombies weigh on economic performance because they are less productive and because their presence lowers investment in and employment at more productive firms.

In part this may be because low interest rates signify a weak banking system. Banks may be reluctant to allow a company to fail — even if there is little hope of eventual repayment — because it would be too painful to accept the losses on the loans already lent to these companies. And of course the ultra-low interest rates created by central banks unconventional monetary policy since 2008 keeps the costs of servicing debt low.

These studies likely understate the problem of zombie companies for the economy. A company doesn’t have to be as far gone as a zombie to be at risk of default if interest rates rise. Moreover, as economist Daniel Lacalle writes:

At the end of the day, 10.5% means that 89.5% are not zombies. But that analysis would be too complacent. According to Moody’s and Standard and Poor’s, debt repayment capacity has broadly weakened globally despite ultra-low rates and ample liquidity. Furthermore, the BIS only analyses listed zombie companies, but in the OECD 90% of the companies are SMEs (Small and Medium Enterprises), and a large proportion of these smaller non-listed companies, are still loss-making. In the Eurozone, the ECB estimates that around 30% of SMEs are still in the red and the figures are smaller, but not massively dissimilar in the US, estimated at 20%, and the UK, close to 25% 77.

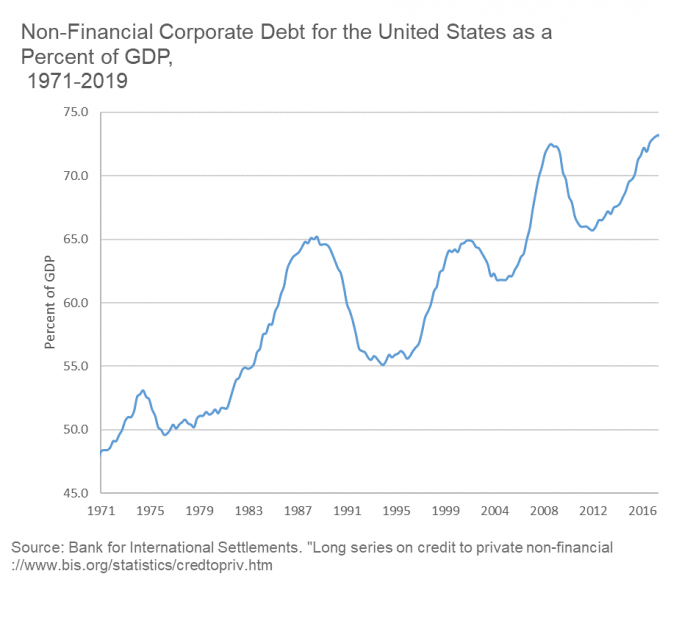

Additionally, corporate leverage has surged in the last three years since the BIS analysis. Today corporate debt is now above the levels seen before the 2008 crisis in the United States.

How Can You Kill Zombies?

In a market economy, resources are allocated according to profitably — this allows resources to flow to where they are best utilized. Keeping companies that are unprofitable alive misallocates resources and, as numerous studies have shown, slows the growth of the entire economy — potentially leading to stagnation as has been seen in Japan since the 1990s.

Zombie companies are kept alive only with low interest rates and/or lax banking regulation. But as bankers assembled last month in Stockholm for the annual meeting of the International Capital Markets Association pointed out: “The question is, with the debt level where it is, can central banks ever afford to let interest rates go back up because it will lead to a major bankruptcy wave.” Zombie companies pose a significant challenge for central banks, because in a very real sense their hands are tied — they cannot raise interest rates significantly without causing a huge number of companies to go bankrupt.

The world now has the impossible choice of permanently reduced productivity and slower economic growth — or the mass bankruptcy of a significant percentage of the economy.

*About the author: Joshua Konstantinos is the Founder and Global Macro Strategist for Cassandra Capital LLC. His analysis focuses not only on the global economy, but also on the longer demographic and geopolitical trends. Follow him on Twitter.

Source: This article was published by the MISES Institute