Bidenomics: A Boom That Awaits An Inevitable Bust – OpEd

By MISES

By Jack Watt

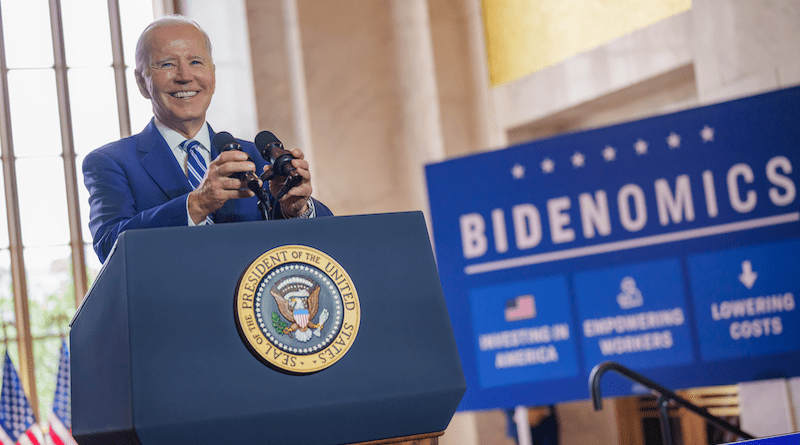

Joe Biden recently claimed on Twitter that “Bidenomics” has increased the real wages of low-income workers. A counterclaim was made through Twitter’s Community Notes that wages adjusted for inflation were actually lower at the time of Biden’s claim. But data without theory is unsatisfying, so it is worth asking if conditions of the last few years have been conducive to higher real wages, especially for lower earners.

The Boom

First, we need to establish the current situation. As the Fed has raised its benchmark rate, measures of broad money growth in the United States have been trending downward. But this comes at the tail end of an expansionary boom. In 2020–21, Fed and Treasury policies combined to provide broad money growth that was unprecedented during peacetime. While broad money growth under post–financial crisis quantitative easing (QE) was around 3 to 5 percent, this more recent episode, according to YCharts, saw year-over-year M2 growth peak at 26 percent in February 2021.

Unlike the QE that began in 2008, in which new money entered asset markets mainly via the banking system, most new money creation since 2020 has funded Treasury deficit spending. This heavy public spending has added to private and household sector balances and can only be seen as part of a state and federal antiproduction policy.

The resulting price inflation should not have been a surprise to economists at the Fed, who no doubt claim to be empiricists. But their initial fears of deflation and their later portrayal of inflation as “transitory” indicated a failure to understand it. One of the many reasons for this failure is that the quantity of money is not a metric of great interest to the post-Keynesian school, which continues to dominate among policymakers and high-profile academics. Despite all the opinion pieces and excuses, after the empirically well-founded twelve-to-eighteen-month “long and variable lag” described by Milton Friedman, the monetary expansion showed up in consumer prices and has only recently started to weaken.

Creating the Boom: Credit Expansion and Simple Inflation

Ludwig von Mises stated that “the essence of monetary theory is the cognition that cash-induced changes in the money relation affect the various prices, wage rates, and interest rates neither at the same time nor to the same extent.” Where new money enters the economy is of great importance in analyzing its perturbing effect on the productive structure.

It is difficult to distinguish the layers of monetary expansion operating right now. Credit expansion is operating through loan markets, thanks to the artificially low interest rates resulting from the Fed’s ongoing activity—its balance sheet has doubled since the start of 2020. There is also what Mises calls simple inflation, whereby the Treasury spends dollars it receives from the banking system, which in turn receives them from the Fed.

Both layers can expand production and bid up factor prices, but the beneficiaries are chosen by different parties. Credit expansion allows those who are most able—most obviously, the big and the financialized—to access loanable funds and expand production. Simple inflation benefits the economic activity of the government and transfers income to whichever parties it wants to contract with. Contra the mainstream view, fiscal spending cannot direct resources from lower- to higher-valued ends. Publicly operated services do not operate under the pressures of profit and loss, so they are value destructive by nature. Transfer payments are won by special interest lobbying rather than market competition.

Forced Saving

Whether the boom is affected by an expansion of credit, simple inflation, or both, only one force could possibly result in the increased net saving required to fund investment in more capital goods and increase the marginal productivity of labor. During inflation, all other forces will encourage consumption and discourage saving.

The one force that can increase net saving during inflationary periods is forced saving, a term Mises uses to refer to the reduced consumption of lower earners faced with prices rising faster than wages. According to Mises, “it depends on the particular data of each instance of inflation whether or not the rise in wage rates lags behind the rise in commodity prices.”

The key point is that if wages lag behind prices, higher earners will not be compelled in the same way to restrict their consumption. They may increase their savings and investments, but “it is necessary to remember that the greater propensity of the wealthier classes to save and to accumulate capital is merely a psychological and not a praxeological fact.” In other words, forced saving can overcome the tendency toward reduced net saving and investment during inflationary periods, but it is not a given that everyone will save.

If forced saving did happen during the current inflationary period, would it really be something to celebrate for lower earners? Restricting consumption for lower earners in order to win votes would be like selling a policy of taxing lower earners to pay higher earners as a path toward prosperity.

Looking at the Data

Combining the concept of forced saving with a look at the data can help to settle whether Biden’s claim is valid. The FRED database shows the Personal Consumption Expenditures (PCE) Price Index increasing about 13 percent and average hourly earnings (private) up 8 percent since September 2021. There are many issues with price indices, and these earnings numbers say nothing about unemployment, but they are what we have to work with.

Relevant to Biden’s claim about lower-paid workers, a survey of wage growth for hospitality and retail workers shows respective increases of 12 percent and 8 percent. This data is hardly all-encompassing or conclusive. On the saving side, the personal saving rate is down 3.6 percent for the same period. It seems reasonable to posit that consumption has been restricted for lower earners—consider the recent popular cries of a “cost of living crisis.” But net saving has not increased, so the conditions under which forced saving could increase net saving do not seem to have been met.

Credit expansion and simple inflation have been operating since 2020, so it makes sense that prices have led wage increases. Wages have increased more steeply toward the end of the boom in part because of the Treasury’s spending on unproductive ends and thereby bidding up factor prices like wages. But the nominal increases in wage rates have not kept up with the diminished purchasing power of the dollar. With the Fed now in a hiking cycle, the potency of credit expansion is waning for the private sector as funding becomes dearer. Meanwhile, the public sector, funded by simple inflation, does not look like it will be receding any time soon, having no political appetite for surpluses.

Conclusion

There does not seem to be any basis for the claim that forced saving has led to a greater capital intensity and higher wages—if this was what Biden’s claim implied. Even if this had occurred, it would be something for higher earners to celebrate more than lower earners. Monetary expansion, operating through both the loan market and the Treasury’s deficit spending, has increased prices ahead of wages and made most people worse off, as usual.

About the author: Jack Watt is a UK based co-founder of sovbtc.io and is an airline pilot. He is a physics graduate with long standing interest in finance and economics starting in college, where he spent a summer on bulge bracket currency and rates trading desks. He has a postgrad certificate in money, banking and central banking, which he received through the Austrian School.

Source: This article is published by the Mises Institute