$8,000,000,000,000 – OpEd

By MISES

$8 trillion represents the number of digital dollars the Fed effectively unleashed across the globe. The majority of this money went to debt; but the story doesn’t end there.

By Robert Aro*

An important milestone has recently been passed. To be exact, the latest Fed balance sheet update on June 17, 2021, shows the figure at $8.064 trillion.

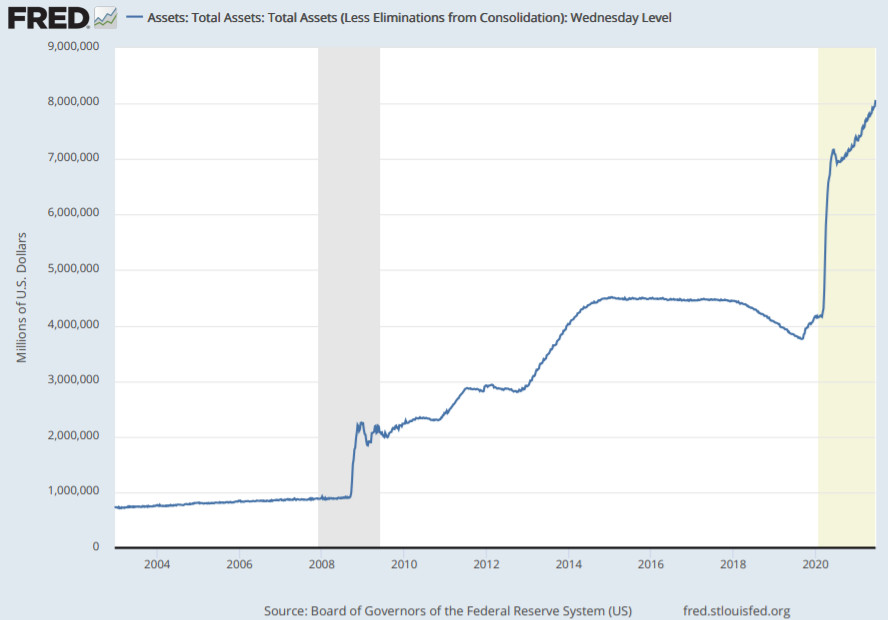

To help visualize this, the Fed provides a graph of total assets, known as the balance sheet on a weekly basis:

Assets were under 1 trillion dollars at the start of the last recession, with the following decade seeing just a minor “tapering” or shrinking of the balance sheet just prior to this new recession.

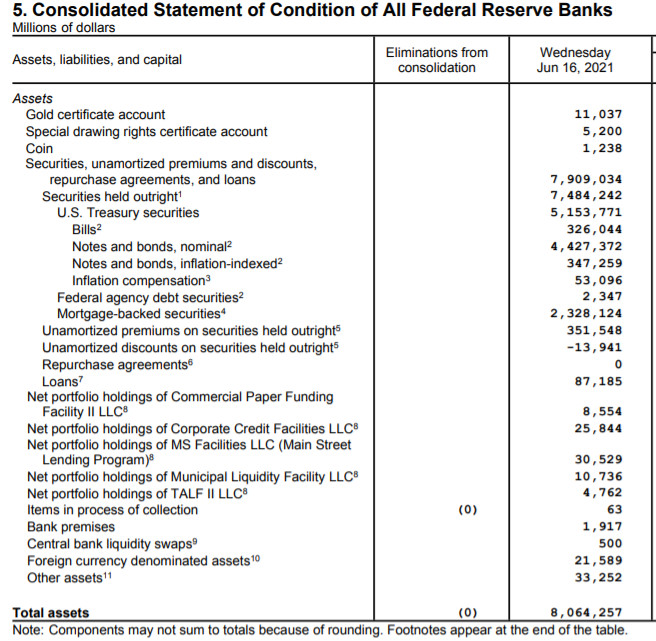

For more details, beyond the headline number, the Fed provides notes to its financial statements including comprehensive details of the components of their assets:

The two largest holdings of the Fed continue to be approximately $5 trillion in U.S Treasury securities (i.e., US debt) and Mortgage-backed securities (i.e., mortgage debt). Nothing else on the balance sheet comes anywhere close to these amounts.

For comparative purposes, the US National Debt stands at $28.4 trillion dollars, the M1 money stock is just over $19 trillion and currency in circulation is only $2.2 trillion dollars. As for the average American, according to CNBC, they are currently $90,640 in debt.

Perhaps the best way to understand the balance sheet is to consider it beyond simply a number. When the actions of the Federal Reserve are compared to the actions of the rest of the population, the difference between “us” versus “them” becomes staggering. It’s fair to say most people must “do something,” such as produce a good or service in exchange for money. However, the Fed, with a legal monopoly on the creation of US Dollars, follows a different path. Its work involves the very creation of US dollars, an act which is illegal for anyone else to do.

$8 trillion represents the number of digital dollars the Fed effectively unleashed across the globe. The majority of this money went to debt; but the story doesn’t end there. We cannot think of this money as confined in a vacuum where it’s easily contained between the Fed and whichever counterparty. Once created, this money enters the banking system, changes people’s risk tolerance, investment decisions, interest rates, asset prices and ultimately the prices of goods and services themselves.

Unfortunately, no one can adequately measure the effects, dollar for dollar, this $8 trillion has on society, nor can each dollar be adequately traced. But we can reasonably consider its impact if the Fed reduced its balance sheet to pre-pandemic levels, when it was a mere $4 trillion. Whether in one fell swoop or drawn out over several years, it would not be difficult to hypothesize that stock market and housing prices would be impacted, interest rates would be higher and various prices on assets, goods and services would be affected. If there was no effect, the Fed would have no concern shrinking the balance sheet. It would not be subject to deep contemplation.

Powell’s hesitation in tapering is normally on display, exemplified in his recent press conference. When cornered, he typically responds with non-answers, such as:

I expect that we’ll be able to say more about timing as we see more data. Basically, there’s not a lot of more light I can shed on that.

If there is a silver lining, Powell will give us the official notice prior to tapering… when the time comes:

where the balance sheet’s concerned, a lot of notice, as much transparency as we can give and as far in advance as we can to give people a chance to adjust their expectations… Again, I have nothing further on time. It wouldn’t be appropriate to say. We’re going to have to see more data.

$8 trillion has a way of altering the market in the strangest of ways. If and when a multi-trillion dollar tapering comes, we should expect prices, rates, and investment decisions to change in a manner few can hardly imagine. For their efforts, the operators of the Fed enjoy well paying jobs, pensions, and the prestige of helming a legal money-making apparatus.

As for everyone else, those average American’s who are $90k+ in debt, who must produce goods or services someone values in order to survive, not much more can be said… but someone must pay for the $8 trillion balance sheet. Who else if not them?

Source: This article was published by the MISES Institute