The US Dollar As The World’s Dominant Reserve Currency – Analysis

By CRS

By Rebecca M. Nelson and Martin A. Weiss*

The U.S. dollar is the world’s dominant reserve currency, among other such currencies including the euro, the yen, the pound, the renminbi (RMB), the Canadian dollar, the Swiss franc, and the Australian dollar. A reserve currency is a currency held by central banks in significant quantities. It is widely used to conduct international trade and financial transactions, eliminating the costs of settling transactions involving different currencies.

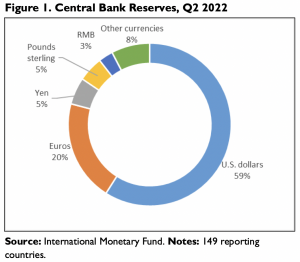

The dollar has functioned as the world’s dominant reserve currency since World War II. Today, central banks hold about 60% of their foreign exchange reserves in dollars (Figure 1). About half of international trade is invoiced in dollars, and about half of all international loans and global debt securities are denominated in dollars. In foreign exchange markets, where currencies are traded, dollars are involved in nearly 90% of all transactions.

The dollar is the preferred currency for investors during major economic crises, as a “safe haven” currency. During the global financial crisis of 2008-2009, for example, and amidst the economic turmoil associated with the Coronavirus Disease 2019 pandemic in 2020, investors sought U.S. dollars, expecting the dollar to retain its value. In both crises, the U.S. Federal Reserve adopted extraordinary monetary authorities and currency swap lines with other central banks to provide liquidity and dollars.

Implications for the United States

The U.S. economy generally benefits from the dollar’s status as the world’s dominant reserve currency, once famously referred to as the United States’ “exorbitant privilege” by France’s finance minister in the 1960s. Because many central banks and financial institutions around the world want to hold U.S. dollars and dollar-backed securities like U.S. Treasury bonds, there is strong demand for U.S. dollars. That demand, in turn, allows the United States to borrow more cheaply (at lower interest rates) than it would otherwise.

Strong demand for dollars also allows the U.S. government, firms, and consumers to borrow from foreign creditors in dollars rather than foreign currencies. As a result, the value of that debt does not depend on fluctuations in exchange rates. When other governments, firms, and individuals borrow in foreign currencies, they incur the risk that swings in exchange rates will cause their real debt level (the size of the debt in the borrower’s national currency) to increase, potentially quickly and significantly. U.S. firms and consumers also benefit by saving on transaction costs.

The widespread use of the dollar entails economic risks. Low borrowing costs can lead to the accumulation of debt, and the funds borrowed may not be channeled into productive investments. Additionally, the demand for the dollar associated with its position as a reserve currency can lead to a stronger U.S. dollar. A strong U.S. dollar generally makes it harder for U.S. producers to compete in global markets and can lead to persistent trade deficits, although U.S. consumers may benefit from less expensive imports. For example, the dollar has strengthened since mid-2021 as the Fed tightened monetary policy to combat rising inflation. In addition to the impact of a rising dollar on U.S. exporters, it will create challenges for many other countries servicing their debts amidst higher interest rates and slowing global economic growth.

Challenges to the U.S. Dollar’s Global Role?

Historically, shifts from one dominant international currency to another occur over many years. For example, in the 20th century the U.S. dollar replaced the British pound sterling as the dominant international currency over many decades (including two World Wars and the Great Depression) after the United States overtook the United Kingdom as the world’s largest economy and exporter. The U.S. dollar has persisted for seven decades as the world’s dominant reserve currency through a number of major shifts, including the collapse of fixed exchange rates, trade and financial globalization, technological development, and geopolitical changes.

Some observers have speculated whether changes in the global economy, and geopolitical shifts more generally, could cause a shift from the dollar to other currencies. Focus in particular is centered on China’s economic rise, U.S. sanctions, and digital currencies.

China’s Global Economic Role

China’s growing role in the global economy since the 1990s has prompted China’s government to consider how to promote the use of China’s currency, the RMB, in global trade. To date, this push has been limited by the government’s own caution in liberalizing China’s capital account, as well as investor concerns about potential risks associated with the lack of transparency and predictability of the government’s role in the market.

The RMB plays a marginal role in international finance. According to the Bank for International Settlements (BIS), the RMB is the 8th most traded currency. It is the 6th most active currency for global payments by value, with a share of 1.66 %. By contrast, the U.S. dollar and the euro combined account for 75% of all transactions. China’s central bank is developing a digital currency to try to influence global finance and e-commerce, and diversify from U.S. dollar financing. While such an effort may take time to develop, it could allow China to challenge U.S. sanctions and dollar leadership in certain instances.

U.S. Financial Sanctions

Through economic sanctions that impede access to the U.S. financial system (financial sanctions), the United States leverages the role of the dollar to advance foreign policy objectives. Access to the U.S. financial system is generally needed to settle transactions denominated in dollars, even when both parties on the transaction are located outside the United States. The U.S. government has increasingly restricted access to U.S. dollars and the U.S. financial system in an effort to alter the objectionable behavior of foreign governments. Most recently, the United States and allies have imposed significant sanctions on Russia that impede the country’s ability to conduct many cross-border transactions.

Treasury officials in the Obama, Trump, and Biden Administrations have cautioned that extensive use of financial sanctions could threaten the central role of the dollar and U.S. financial system. Many foreign governments targeted by U.S. financial sanctions and their economic partners are increasingly exploring and creating ways to reduce their reliance on the U.S. dollar. Countries are doing so through a variety of tools: contracts denominated in non-dollar currencies, currency swap lines, digital currencies, and non-dollar payment processing systems.

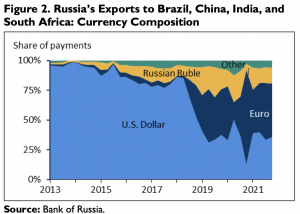

For example, the share of Russian exports to Brazil, India, China, and South Africa invoiced in U.S. dollars fell from 85% in Q2 2018 to 36% in Q4 2022 (Figure 2), although these countries account for a relatively small share of total Russian exports. Additionally, European countries created a special-purpose vehicle in 2019, the Instrument in Support of Trade Exchanges (INSTEX), to facilitate non-dollar, humanitarian transactions with Iran to sidestep U.S. sanctions. INSTEX has completed one transaction to date.

The Race to Create Widespread Digital Currencies

Over the past decade, the private sector has developed thousands of cryptocurrencies. A cryptocurrency is a digital representation of value generally administered using distributed ledger technology and has no status of legal tender. Cryptocurrencies remain a small, volatile, and niche market, but some large multinational corporations seek to create more stable digital currencies for use on a larger scale. For example, JP Morgan issued a digital coin (JMP Coin) in 2019; and in 2018 a consortium of companies led by Facebook sought to create a new global digital currency, the libra, since abandoned. The JMP Coin is tied to the U.S. dollar; libra was to be tied to a basket of currencies, including the dollar.

Many central banks are also researching, piloting, or have launched their own digital currencies. Unlike privately- issued digital currencies, digital currencies issued by central bank serve or would serve as legal tender. According to a 2021 BIS survey, 90% of central banks are engaged in work relating to the creation of digital currencies. Among major economies, China is the furthest along in its development, with several successful domestic and cross-border trials. The U.S. Federal Reserve is currently evaluating a potential central bank digital currency, but has not made a final determination.

Some policymakers have expressed concerns about an international race to create a digital currency with widespread adoption, arguing that the United States should create a U.S. digital currency to maintain the dollar’s prominence in international payments. Legislation pending in the 117th Congress relates to the possible creation of a digital dollar (for example, H.R. 2211, H.R. 3506, H.R. 6415/S. 3954,).

Potential Policy Issues for Congress

To date, there is no evidence of a shift away from the U.S. dollar as the dominant reserve currency. However, Congress may wish to:

- analyze the benefits and costs to U.S. economic and foreign policy interests from the dollar’s status in the global economy;

- continue monitoring how broad economic, political, and technological shifts may affect the U.S. dollar’s status as the dominant reserve currency;

- consider implications of recent dollar appreciation on U.S. and international monetary policy; and

- consider how legislation in a range of policy areas, including sanctions and digital currency, might impact the dollar’s dominant reserve currency status.

*About the authors:

- Rebecca M. Nelson, Specialist in International Trade and Finance

- Martin A. Weiss, Specialist in International Trade and Finance

Source: This article was published by CRS