Will The Eurozone Survive The Winter? – OpEd

By VOR

By Alexander Artamonov and Natalya Kovalenko

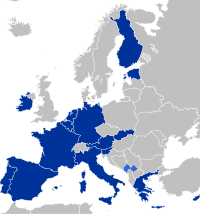

According to Jacques Sapir, the European Union should admit the failure of the eurozone, which will most likely not survive this winter.

“First of all a distinction should be made between the EU and the eurozone. I am pessimistic about the latter’s future. I think that in its current state the eurozone will have tremendous difficulty surviving this winter and next year. This does not mean that the EU will die. It will most likely go through a period of reforms and continue its development. The real issue lies in the development of the European economy. If we continue with the budget cuts, it will certainly drag our economy into a 4-6 year recess, which will in turn significantly weaken the EU’s position on the world political arena and lead to multiple crises within the European Union. If, on the other hand, we undergo major economic growth starting from 2013-2014, the EU will preserve its significance as a strong union attracting other economies.”

Speaking about the fate of the eurozone, Jacques Sapir said that in the near future it would be hardly possible to find means of saving it:

“Should the eurozone be given the right to continue its existence and if yes, should it be provided with the means necessary for that? In other words, is Germany capable of paying for eurozone’s existence? The question is not whether it wants to do it, but can it really do it. I have doubts about that. Another scenario is that the EU admits that the project has failed. In that case a decision would have to be made on saving what could still be saved, on political and economic integration in the single economic space.”

Economist Jacques Sapir hopes that the governments of the EU countries will give their preference to economic growth rather than the policy of budget cuts that are inevitable when attempting to save the eurozone.

Controversies regarding involvement in the Syrian crisis could complicate the relations between the key EU players, namely France and Germany, Jacques Sapir notes.

The EU is going through an acute phase of the economic crisis. After socialist Francois Hollande was elected president, France and Germany have been finding it increasingly difficult to come to an agreement on anti-crisis measures. Foreign policy issues could further complicate the disagreement. Hollande is continuing Sarkozy’s policy and insists on a military solution to the Syrian problem. So here we see yet another factor that is having a negative influence on internal EU processes, economist Jacques Sapir pointed out in an exclusive interview with the VOR:

“It seems like indirectly the events in the Middle East could harm the European Union. It is known that with respect to that issue the views of the French and the English are fundamentally different from those of other countries, including Spain, and especially Germany. The pressure inflicted by Paris in favor of a military intervention in Syria does not coincide with Germany’s interests. So Germany is capable of turning this issue into a new apple of discord. On its own this factor cannot be a key one. However, it should be taken into account that this problem will add to the list of controversies that currently exist in Europe, be it the eurozone issue or the problem of bank and financial regulation. The latter is an issue with Germany and the UK. Europe clearly doesn’t need any more problems.”

Right now the main question is whether the EU is capable of achieving further economic integration, because further successful functioning of the European project depends on it. And any additional issues that prevent the leaders of the countries from coming to an agreement are the last thing the European Union needs, Jacques Sapir concludes.

US Federal Reserve on the wrong track?

The US Federal Reserve’s third round of quantitative easing will not get the country out of the crisis, Jacques Sapir, economist and director of studies at the School for Advanced Studies in the Social Sciences told the VOR. According to him, reindustrialization would’ve been more effective in the current situation:

“I would like to remind that the US Federal Reserve has decided to launch a third round of quantitative easing, or QE3. Bond-buying has already begun and the limit was set at 500-700 billion dollars.

What will be the consequences of this program? An increase in working capital should stimulate economic activity. But today, when we see the results of previous attempts to implement such programs, we can say that such measures, to a certain extent, help banks, but hardly benefit the population and private enterprises. Why? Because when banks get money they use it for speculative operations but abstain from giving out industrial and consumer loans.

There is a risk of QE3 leading to inflation, even if a minor one. But that would happen in the conditions of almost total economic stagnation. Right now what the US needs the most is a policy of reindustrialization that would realize itself in the implementation of major federal projects. But that’s nowhere in sight.”

Jacques Sapir is sure that the US will see inflation and the weakening of the dollar. But at the same time, worries about the euro will remain. So, most likely, the two currencies’ reserve status will be shaken. The expert believes that other currencies of the Middle East-Pacific region, especially Singapore and Australian dollars, will come to the fore. Precious metals and raw materials are also attracting a lot of attention.