Drop In Investment Pushes US GDP Growth Below 2.0 Percent – Analysis

By Dean Baker

GDP grew at a 1.9 percent annual rate in the third quarter. This brought the rate over the last year to 2.0 percent, roughly the same as the pre-tax cut rate of growth, indicating that the stimulus provided by the 2017 tax cut has withered.

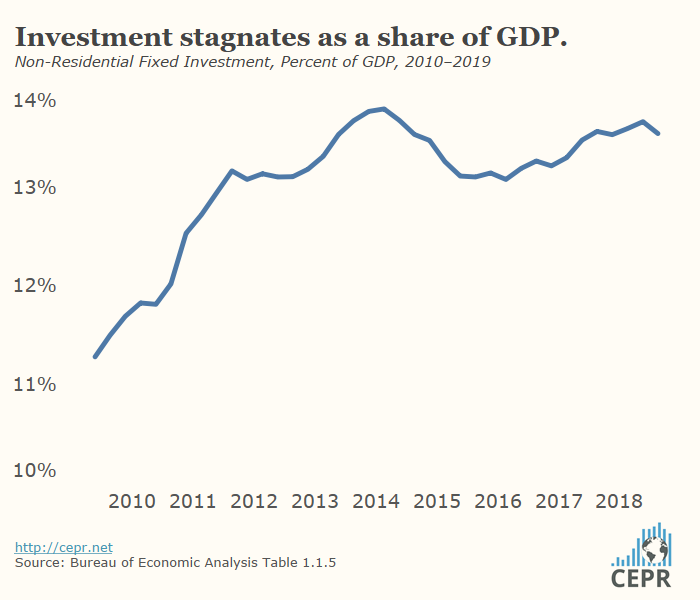

A major factor slowing growth in the quarter was a 3.0 percent decline in nonresidential investment. This is the second consecutive quarter of declining investment, which is now up just 1.3 percent over the last year. The ostensible rationale for the corporate tax cut was that it would lead to a boom in investment. This clearly is not happening, as investment has actually been declining as a share of GDP over the last year.

Trade was also a small drag on growth in the quarter. Imports grew at a 1.2 percent annual rate, while exports grew at just a 0.7 percent rate. The difference chopped 0.08 percentage points off the quarter’s growth rate. To date, the trade war has not reduced the country’s trade deficit. The resulting uncertainty is undoubtedly a major factor in the weakness in investment.

Consumption grew at a 2.9 percent annual rate in the third quarter, driven largely by a 7.6 percent rise in durable goods consumption. This was in turn driven largely by a 17.5 percent annual rate of increase in spending on recreational goods and vehicles, as spending on cars and trucks was nearly flat. Consumer spending on nondurable goods increased at a 4.4 percent annual rate, while spending on services rose at a 1.7 percent rate.

Nominal spending on health care services increased somewhat more rapidly than the 3.5 percent rate of nominal GDP growth, rising at a 4.3 percent annual rate in the third quarter. Spending on prescription drugs continued to hugely outpace nominal GDP growth, rising at a 8.1 percent annual rate.

The increases in consumption are very much in line with income growth, as the savings rate edged up slightly to 8.1 percent for the quarter. This is considerably higher than the savings rate in prior years, which directly contradicts the idea that consumption is being supported by an unsustainable surge in borrowing.

Residential construction increased at a 5.1 percent annual rate, the first positive numbers in this category since the fourth quarter of 2017. Residential construction had been hit hard by the Fed’s decision to increase interest rates. With long-term interest rates now back to near their post-recession lows, residential construction is likely to maintain at least a modest growth rate for the foreseeable future.

Government spending increased at a 2.0 percent annual rate in the quarter, adding 0.35 percentage points to the growth rate. Nondefense federal spending was the biggest factor in this growth, increasing at a 5.2 percent annual rate and adding 0.14 percentage points to growth. While nondefense spending also grew rapidly in the second quarter, this reflects adjustments from the shutdown earlier in the year. Over the last year, nondefense spending is up just 2.5 percent. State and local government spending increased at a 1.1 percent rate in the quarter, adding 0.12 percentage points to growth.

Inflation continues to be well under control. The core personal consumption expenditures (PCE) deflator rose at a 2.2 percent annual rate in the third quarter, but this brought its increase over the last year to just 1.7 percent, well below the Federal Reserve’s 2.0 percent target.

The basic story in this report is that the economy seems positioned to continue to grow, albeit at a very modest pace. The tax cut provided a temporary boost to growth last year, but its impact has now essentially dwindled to nothing. Furthermore, the growth was overwhelmingly driven by consumption, not investment, as investment growth was modest even in the quarters immediately following the tax cut.

Inflation continues to remain well under control, with no evidence of acceleration, in spite of the unusually low unemployment rate. The Fed has little reason to be concerned that further rate cuts will cause inflation.