Why Did Libya’s NOC And Italy’s Eni Sign An $8 Billion Gas Deal? – OpEd

When Vladimir Putin turned off Europe’s gas taps, most EU countries feared a winter of blackouts due to their sole reliance on Russian gas, which had left this industrial nation woefully exposed.

Russian gas provides 45% of Europe’s total gas imports. Russia is also Europe’s main supplier of crude oil (3.1 million b/d, or 29%) and refined products (106 MMT per year, or 51%). But fast forward a few months, and, as lights sparkle in 2023, Libya and Italy signed a 25-year-long agreement worth $8 billion so that Libya would supply Italy with gas to boost energy supplies to Europe. The signing came during the visit of Italian Prime Minister Georgia Meloni, the Chairman of the National Oil Corporation (NOC), Farhat Bengdara, and the CEO of Eni, Claudio Descalzi.

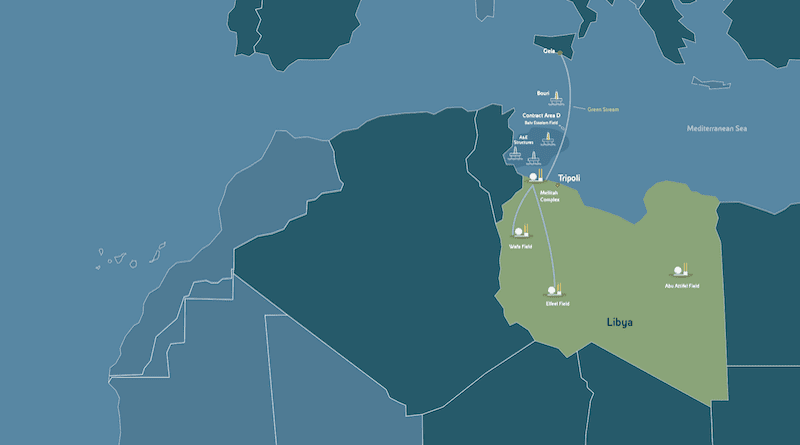

The agreement included an investment of $8 billion over 3 years, especially in offshore installations “A” and “H.” Those were investments that the Libyan oil sector had not seen in the last 25 years. Further, the agreement also included the development of gas fields with reserves of close to 6 trillion cubic feet of gas and a production capacity of between 750 and 800 million cubic feet per day.

Europe did not depend on the spare capacity of oil production in Saudi Arabia and the United Arab Emirates. They believe that US administrations are turning away from the Middle East and becoming resentful of US policies since former President Barack Obama was seen as disregarding the interests of America’s long-term Sunni Arab partners during 2011.

The European Union countries depend heavily on Russian supplies, of which Russia accounts for 60% of gas imports to the Czech Republic, Latvia, Hungary, Slovakia, Bulgaria, Finland, and Germany. It decreases to 40% for Italy and 20% or less for France, Sweden, Spain, and Portugal. And now Italy is searching for other sources in its neighbouring country, Libya. But France is in a dilemma because of its reliance on nuclear energy as its main source of energy, and Spain has a large proportion of Algeria, from which it has been buying gas since 1969.

There are other alternative plans under which Spain can contribute more to securing gas in Europe if the links between the Iberian Peninsula and Europe are developed, as Spain has a third of the capacity to import natural gas from Algeria through two main pipelines. But there is a refusal from France to allow any increase in the 7 billion cubic metre gas pipeline that transports gas north. France protects its nuclear industry. Algeria has 4,500 billion cubic metres of proven reserves and 20–25 trillion cubic metres of unconventional gas reserves, the third largest. reserves in the world after the United States and China (Argentina’s reserves are similar to Algerian reserves).

Libya is currently facing turmoil with two rival leaders, and now will be the time for European countries like France and Italy to invest real money and political capital through stabilization and economic reconstruction in Libya. It is in their financial as well as geostrategic interests that Italy’s ENI and France’s Total Energy will be the main winners of the largest Libyan gas exports to Europe.

The agreement with Eni shows a clear indication that Libya’s oil sector is safe from any risks, which is a way for the country to rise again and compete. Libya would return to the ranks of the world’s most prominent oil and gas producing countries, and it was described as the most significant new investment in Libya’s energy sector in a quarter-century.

Italy has already taken a lead in sourcing gas from Algeria, building a new strategic partnership there that includes investment to help state energy company Sonatrach reverse years of declining output. Libya already sends gas to Italy via the Green Stream pipeline total and Eni Ready billion-dollar energy projects in Libya. Eni is also looking to invest more in gas fields in Algeria and Egypt.

Libya has some of Africa’s biggest oil and gas reserves and is in close proximity to Europe, which is the continent’s biggest energy supplier. Eni’s investment is the largest in Libya for years, and the company, which has operated in Libya since the 1950s, wants to make oil, gas, and solar investments there. The political situation remains tense, and two rival governments claim power. One is based in Tripoli, while the other is located in Sirte.