Digital Technology: How It Could Transform The International Monetary System – Speech

By Tobias Adrian, Financial Counsellor and Director of the Monetary and Capital Markets Department, IMF

Good afternoon, ladies and gentlemen. It’s a pleasure to join you here today — at the 29th International Financial Congress, convened by the Bank of Russia — to explore how digital technologies could transform the international monetary system.

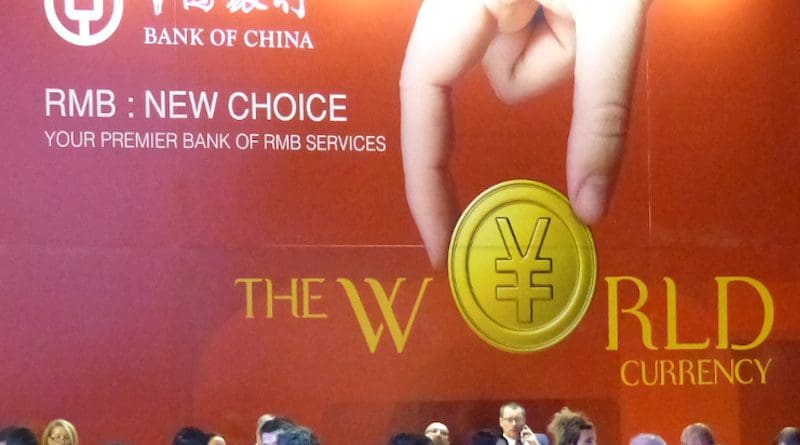

Indeed, a profound transformation is already under way. From private-sector-led innovations like cryptoassets and stablecoins — to public-sector-designed programs like the Bahamas’ issuance of the “Sand Dollar” and China’s experiment with the “digital yuan” — digitalization is changing our understanding of what a “currency” is and how it operates.

I’ll focus most of my remarks today on Central Bank Digital Currencies (“CBDC”), which are now being explored by many of the larger economies among the Fund’s 190 member countries. Approaches differ according to each country’s particular circumstances — with some countries still cautiously analyzing the policy motive for issuance, while others are actively prototyping various options in safe “sandbox” environments or launching live pilot programs. Central bankers everywhere are closely following the experience in the Bahamas, trying to discern the lessons of the actual issuance of the “Sand Dollar.”

We can already see that there are many potential benefits from CBDC — along with several likely risks. Let me describe the top three benefits — and the top three risks — and then suggest how those risks can be reduced.

Let’s start with the benefits.

First: CBDC has the potential to make payment systems more cost-effective, competitive, and resilient.

- Due to their digital nature, CBDC could reduce the cost of managing physical cash — which can be substantial, especially in countries with a vast land mass or many islands that are widely dispersed.

- By offering a low-cost alternative, CBDC can help discipline payment markets, which are often highly concentrated.

- CBDC could also improve the resilience of payment systems, through the establishment of an alternate decentralized platform.

Second: In countries that have large numbers of people who are “unbanked,” CBDC could help enhance financial inclusion, especially if they are paired with digital identifications systems. Access to payments is often the first step toward greater participation in the financial system. Not only do the unbanked gain a safe place for their savings, the digital availability of micro-payment data offers a way to gain access to credit.

Third, CBDC can be leveraged to improve cross-border payments, which are now often slow, costly, and not easily accessible. Cross-border payments largely rely on multi-layered correspondent banking relationships, which create long payment chains.

- CBDC could instead be traded more directly — by intermediaries or end-users — to the extent that they share common technical standards, and data and compliance requirements. They could thus benefit from a common platform.

- The IMF is collaborating with the Bank for International Settlements, the Committee on Payments and Market Infrastructures, and the Financial Stability Board to establish relevant guidelines.

Now, let’s turn to the risks.

First: potential banking-sector disintermediation. Deposits could be withdrawn, perhaps abruptly, from commercial banks, if people decide to hold CBDC in significant volume. Banks would then have to raise interest rates on deposits to retain customers, or they would have to offer better payment services. Banks could experience a compression of margins, or they could have to charge higher interest rates on loans.

Second: potential reputational risks for central banks. Offering CBDC requires central banks to be active along several steps of the payments value chain (including interfacing with customers, building front-end wallets, picking and maintaining technology, monitoring transactions, and being responsible for anti-money-laundering processes). The failure to satisfy any of these functions — whether it is due to technological glitches, cyber-attacks, or simply human error — could undermine public faith in the central bank’s operations.

Third: the macro-financial risks that can occur with the cross-border use of CBDC. For the CBDC of reserve-currency countries, which are available across borders, there could be an increase in currency substitution (or “dollarization”) in countries with high inflation and volatile exchange rates.

In most cases, the risks to CBDC can be restrained through appropriate design. For instance:

- CBDC holdings could offer a lower rate of interest — if they provide any interest at all — than the policy rate. Or, holdings could be capped, with surplus funds swept into bank accounts every night.

- Transaction limits could be imposed, helping reduce the risk of the disintermediation of banks.

- CBDC could also be distributed through existing financial institutions, using the customer onboarding processes that are already in place.

- In addition, countries whose central banks issue CBDC could restrain “currency substitution” by limiting the holdings by non-citizens.

Looking beyond CBDC specifically — and thinking of the broader realm of digital vehicles: As we explore the various factors — both positive and negative — that would accompany any shift into digital transactions, questions naturally arise about how cryptoassets and stablecoins are changing the global financial system. The IMF, along with the BIS and other research centers, is studying that matter closely, trying to foresee how the optimal monetary system of the future would operate.

Let’s first examine some ways that cryptoassets and stablecoins are unlike CBDC.

Cryptoassets are digital representations of value; are privately issued (rather than issued by sovereign entities); are secured by cryptography; and are units of exchange that leverage “decentralized ledger technology,” which allows for peer-to-peer transactions without an intermediary. Cryptoassets, like Bitcoin, are not backed by official government assets. Moreover — as we have seen in recent months — cryptoassets have very volatile prices.

Stablecoins, instead, are issued by a legal entity. They attempt to offer price stability by linking their value to a fixed asset — such as a fiat currency like the U.S. dollar or commodities like gold.

The share of cryptoassets and stablecoins in relation to the money supply (so-called “M1”), is currently small. Thus, their impact on the monetary and financial system is — at this point — limited.

However: The adoption and use of cryptoassets and stablecoins could increase rapidly. That’s especially true because cryptoassets are increasingly becoming an attractive investment asset, including for institutional investors. Stablecoins issued by BigTech firms have the potential to become global, given their large existing user bases, which span across countries.

If wide adoption does indeed occur, cryptoassets and stablecoins could have significant implications for the international monetary system. That could introduce a wide range of serious concerns.

- Widespread “currency substitution” would undermine governments’ control of monetary policy and would have an impact on domestic financial conditions.

- Capital Flow Measures (CFM), which are used by the majority of IMF member countries, could be more easily circumvented. Independent exchange-rate regimes could be harder to maintain.

- Capital-flow volatility could increase, as could gross foreign-asset positions. Such factors could trigger the threat of balance-of-payments problems.

- Global stablecoins in their own denomination raise significant new risks, including the lack of available safe assets and a credible safety net.

- The risk of fragmentation — and of a global “digital divide” — is stark. There could also be opportunities for further integration of payment systems — but they would largely occur thanks to CBDC, rather than cryptoassets or stablecoins.

Amid the uncertainties introduced by cryptoassets and stablecoins, let’s recall a few basic principles, which should remind us of some stabilizing factors.

The international monetary system will continue to rely on rules and conventions covering, for instance, monetary and exchange-rate arrangements; cross-border payments for capital-account transactions; and capital flows and related management measures. The system will continue to rely on mechanisms allowing for effective and timely balance-of-payments adjustments and a global safety net (including access to financing from the IMF). And the system will continue to rely on robust institutions that ensure that rules and mechanisms will be enforced.

Moreover: There is an unshakeable commitment that the international monetary system must remain stable and efficient. Digital money must be regulated, designed, and provided so that countries maintain control over monetary policy, financial conditions, capital-account openness, and foreign-exchange regimes. Payment systems must grow increasingly integrated — not fragmented — and must work for all countries, to avoid a “digital divide.” Moreover, reserve-currency configurations and backstops must evolve smoothly.

That brings us to the question of how authorities — especially central banks — should approach cryptocurrencies and stablecoins. Inevitably — with the stakes so high for international financial stability — a great deal of patience, and a strong dose of skepticism, are called for.

Some might be tempted to ask: “What would central banks need to do, to develop a global monetary system based on CBDC? What would they need to do, to prevent the risks related to the rapid development of private digital cash substitutes?” In response, I’d start off by saying: Posing the question that way, might be getting the reasoning backwards. I do not think central banks should aim to develop an international monetary system based on CBDC. Instead, they should design CBDC so that they help support a stable and efficient international monetary system.

As they consider the rewards and risks of CBDC, central banks are surely keeping some fundamental factors in mind.

- They should leverage CBDC to improve connections between countries’ payment systems, while avoiding fragmentation in cross-border payments.

- The cross-border use of CBDC can potentially solve many of the current “pain points” of cross-border payments.

- Under some conditions, CBDC can also foster financial inclusion — helping bring cross-border payments to the unbanked, and helping reduce the cost of sending remittances.

- The impact of CBDC could be direct, but it could also be indirect. The presence of cross-border CBDC will induce other payment providers to improve services and lower costs.

Cooperation among central banks will be pivotal in building CBDC with features that help contain spillovers and help facilitate backstops. For example:

- To curb currency substitution, countries that decide to issue CBDC could explore the option of limiting CBDC transactions and holdings for foreigners. Or, they could allow foreign countries to introduce such limits on their own territory.

- Capital-flow-management measures, which might involve restrictions on certain cross-border transactions, could be built directly into the CBDC specification.

- The programmability of CBDC could also be used, in a positive way, to facilitate the regional pooling and sharing of reserves, and their disbursement.

As for “private digital cash substitutes”: I also do not think that developing alluring CBDC to “crowd out” those substitutes is the answer. Instead, privately issued digital money will need to be regulated appropriately.

Let us remember that most of the money that we use today is issued by the private sector — in the form of commercial bank deposits. This form of money has been innovative, and it continues to serve users well. Moreover: It is safe, because issuers are very closely supervised; they benefit from government backstops; and they are required to adhere to clear legal and regulatory frameworks.

Those same factors must also hold firm for private issuers of digital money. Clear legal frameworks must be developed to determine whether they are (for example) deposits, securities or commodities. Clear regulations must be enacted so these forms of money fully address risks to financial stability, financial integrity, consumer protection, and market contestability.

Once those rules are clearly written, some providers will surely drop out of the market — but others will remain, and they will exist side-by-side with CBDC. We should not see the future as an either-or decision — between “either” CBDC “or” privately issued forms of money. The two will probably coexist, wherever CBDC eventually exists.

Consider, in addition, that private solutions can build functionality on top of CBDC, and potentially can even receive CBDC in exchange for a private payment token. The future is likely to see a continuum that includes various forms of money — just as we see today, within the confines of a clear legal and regulatory perimeter.

We’re at an exciting moment in the evolution of currencies — and indeed, in the evolution of our very concept of what “money” is, and what benefits “money” should deliver. If we design digital currencies with caution and with precision — and if we frame their adoption within legal and regulatory systems that maximize their benefits and minimize their risks — we could be on the verge of an era that fulfills the promise of transformation.

It’s a pleasure to join you here today to explore these exciting opportunities. Now, I’d be pleased to consider any questions you may have. Thank you very much.

This speech was presented at 29th International Financial Congress, The Bank of Russia