VC And Private Equity: Where In The World To Invest Post-COVID?

By IESE Insight

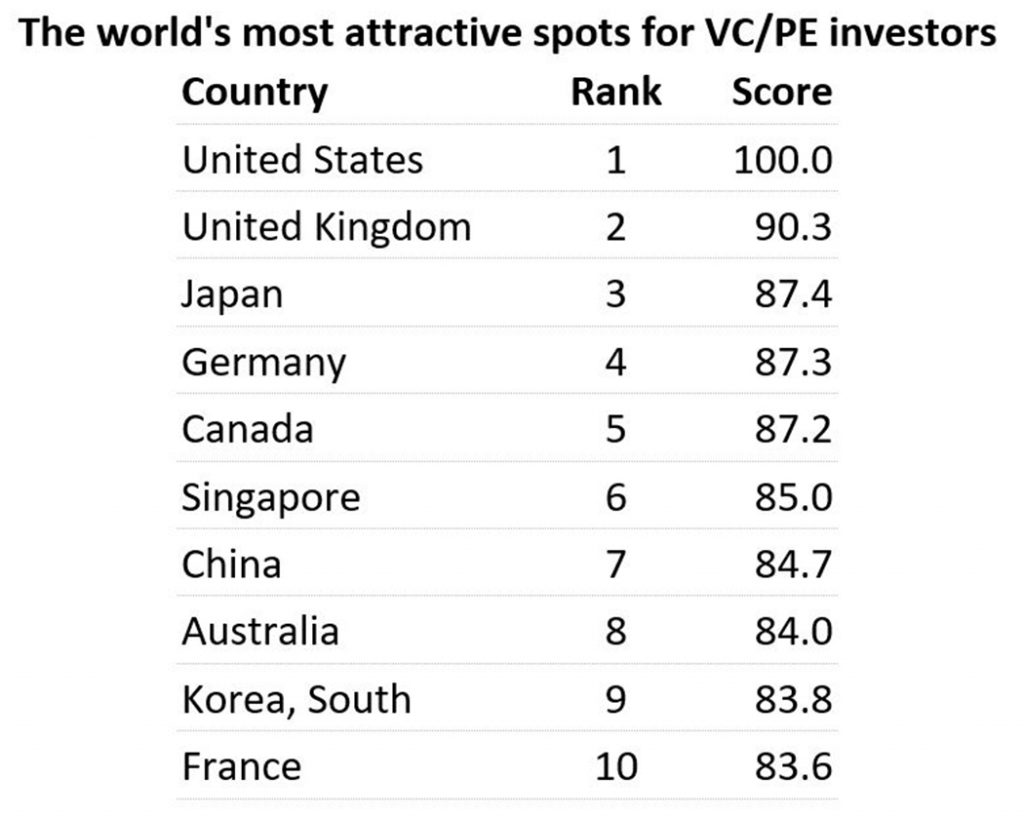

The 2021 Venture Capital and Private Equity Country Attractiveness Index sees the U.S. hold on to the world’s No. 1 spot, followed by the U.K. (2), Japan (3), Germany (4) and Canada (5).

Within the top 10, the most remarkable gains were seen for China, South Korea and France, which entered the top 10 for the first time. All top-ranked countries are expected to make swift recoveries from the COVID-related recession, especially China.

In its 10th edition, this year’s report also includes a five-year historical comparison, pointing out which economies are moving in the right direction in terms of their VC/PE attractiveness.

The United States remains unparalleled as a magnet for investors, according to the 10th edition of the Venture Capital (VC) and Private Equity (PE) Country Attractiveness Index, which ranks 125 countries according to the quality of their investment environment for VC and PE investors.

In terms of regions, North America, Australasia and Western Europe are the most attractive for capital allocations, as the heat map above shows. (Visit the VC/PE Country Attractiveness Index 2021 website for an interactive map to drill down for individual country analyses.) With some exceptions shown in gray, economies around the globe are analyzed and ranked according to thousands of weighted data points covering six key drivers:

- economic activity, including the economy’s size, expected GDP growth and employment levels

- depth of capital markets, including the market’s size, liquidity and IPO activity as well as M&A activity, lending and the health of the banking system

- taxation, focused on entrepreneurial incentives and burdens

- investor protections and corporate governance, including property rights protections and the quality of legal enforcement

- human and social environment, including measures of education, labor practices and corruption

- entrepreneurial culture and deal opportunities, including indicators of innovation, scientific output, the ease of starting (and closing) a business, as well as corporate R&D

Based on its strong performance in all six areas, the United States continues to be the index benchmark with a score of 100. It is followed by the United Kingdom, Japan, Germany, and Canada to round out the top five. All top-ranked countries are expected to make swift recoveries from the COVID-related recession, especially China (now 7th), where GDP growth is already recorded.

The United Kingdom stays on top in Europe

In the previous edition, published in 2018, all eyes were on the United Kingdom to see how much its position might change due to Brexit. However, the analysis finds that, “Potential Brexit effects are not (yet) visible in the data and have been somewhat superimposed by the COVID-related damages.”

Nevertheless, the gap between the United States in first place and the United Kingdom in second has widened, while the gaps between the others in the top five have narrowed. These changes are partly driven by the pandemic’s impact on financial markets everywhere, reducing the differences between many countries in terms of their “depth of capital markets” indicators.

Notable changes

Within the top 10, the most remarkable gains compared with previous years were seen for China, South Korea and France, as these three entered the top 10 for the first time. Spain, meanwhile, entered the top 20, having climbed seven places in the ranking since 2015. Its success is due to increasing capital market activity and a professionalism of its financial community, as well as a more entrepreneur-friendly culture.

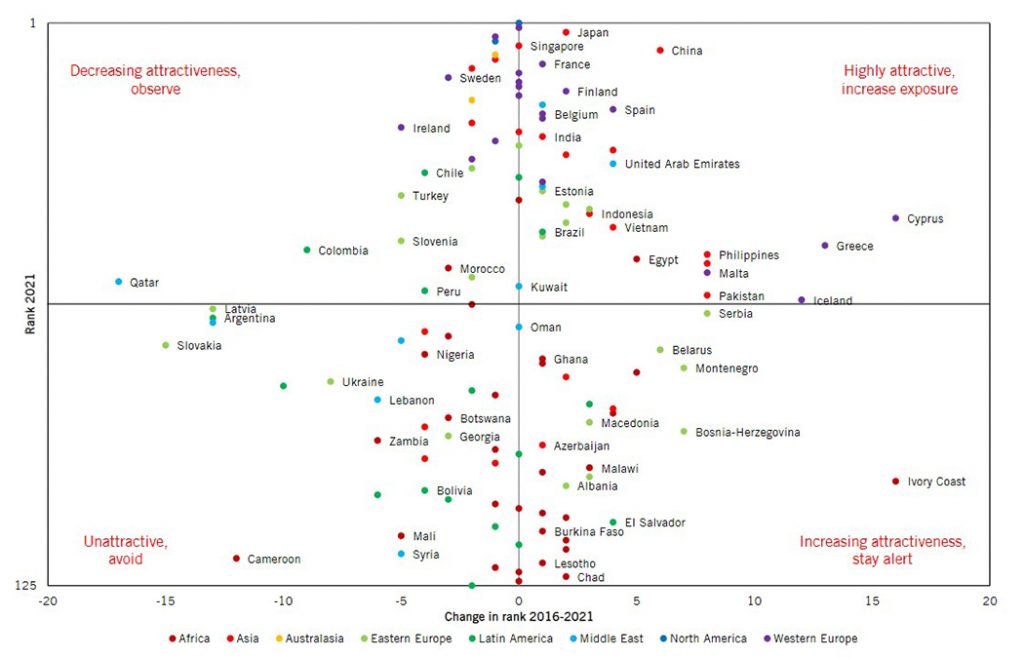

In the VC and PE arena, many investors are looking to emerging economies for faster growth. While many emerging economies are promising, the index creators warn that underdeveloped markets or other risk factors should be taken into account. That said, tracking five-year trends can reveal which economies are moving in the right direction in terms of their VC/PE attractiveness. Tracking changes in the index can be useful for investors watching developments in countries’ institutions and socio-economic situations over the years.

About the report

Designed and elaborated by IESE’s Center for International Finance, working in conjunction with emlyon business school and eXapital, the VC/PE Country Attractiveness Index and accompanying report were prepared by Alexander Groh (emlyon), Heinrich Liechtenstein (IESE), Karsten Lieser (eXapital) and Markus Biesinger (guest researcher at IESE). This year, the index celebrates its 10th anniversary and the research team plans to release a series of additional alternative investment indices covering real estate, infrastructure and impact investing.

The results are presented on the VC/PE Country Attractiveness Index 2021 website which includes dynamic features for ad-hoc analyses and the full report with additional information.