Design Banking: A New Era Of Financial Services

By IESE Insight

Digitization, falling demand, fintech startups (e.g., the increasingly powerful PayPal)….The banking world is confronted by change — and threats to its traditions — on all sides. Experts believe that about 20 percent of banking revenues will be at risk in coming years.

But it doesn’t have to mean the end of the banking sector, conclude IESE’s Josemaria Siota and Thomas Klueter, together with co-authors Dieter Staib, Sam Taylor and Iñigo Ania from the Oliver Wyman consultancy. Design thinking — based on designers’ methods to match client needs with innovation in offerings — is set to change the way we bank forever.

Banks know that in a competitive industry, innovation is essential, and about 95 percent of the analyzed banks have rushed to create innovation labs. This trend has often meant thinking outside the box and hiring outsiders, such as designers and artists (more than 15,000 design-related jobs in financial services were posted in the United States in September 2016).

Design-led companies that are publicly listed in the U.S. are outperforming the benchmark S&P index by an eye-opening 211 percent. Many in the finance sector have already looked to design thinking for a solution to disruptive change. Even so, a recent survey in the financial sector found that 63 percent of those involved with innovation projects declared their dissatisfaction with the process. What is the difference between successful and unsuccessful cases?

Success Stories: From Australia to the U.S.

Design thinking, when properly implemented, has a proven track record. The co-authors note that Singapore’s OCBC Bank increased sales of a new investment product by 150 percent and also increased customer trust after developing and prototyping via design thinking. And Auckland Savings Bank reduced costs after moving to mobile, also via design thinking. Meanwhile, Bank of America increased online-banking registration by 45 percent after a user-centered redesign of its process, and Barclays PLC increased engagement through innovation, implementing 80 percent out of the 100,000 received comments from users to improve its mobile banking application.

What’s more, in a case study examined in detail in the report, the National Australian Bank successfully leveraged the techniques of design thinking to see themselves from their clients’ point of view. This led to the six-month, concept-to-launch creation of their QuickBiz loan, a new product to ease financing applications for small and medium-sized businesses.

How can these success stories be extended to the near two-thirds surveyed who were dissatisfied?

The Devil’s in the Details

Design thinking occurs where analysis meets intuition. In practice, it employs a deceptively simple five-step process:

- Empathize: The client is the be-all and end-all. Tools such as “Day in the Life Of” (DILO) allow teams to get into the heads of their customers.

- Define: The team reviews their information and homes in on the problem. They set specific goals.

- Ideate (i.e., form ideas): Potential solutions and other ideas are rapidly generated, often using techniques such as “bodystorming” (roleplaying) and “brainwriting” (recording all ideas that pass through an individual’s mind and relating them to the next person to trigger solution ideas).

- Prototype: The idea needs to get out there, fast, to start receiving feedback immediately.

- Test: Directly seeking feedback from the end-users.

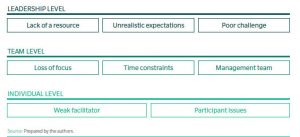

So far, so clear. But the co-authors identify some common problems in the application of design thinking to financial services. They find that a loss of focus, lack of resources or undetailed definition of the problem to solve, among other factors, often undermine results and lead to unfulfilled expectations across the levels of the organization — leadership, team and individual. (See figure, below.)

Working through these problems one by one, the authors suggest three layers of solutions to make the process go more smoothly:

- Leadership level: Ensure awareness and buy-in from those in leadership roles. Leaders need to know that output may not be scalable, or not immediately so. The definition of the problem needs to be clearly detailed, as does the scope of the exercise.

- Team level: Keep the focus not on what customers say but on what they do. On a practical application side, design thinking needs to be structured, with frequent deadlines and constant feedback, to prevent its becoming an ongoing brainstorming exercise.

- Individual level: Team members should be from diverse backgrounds and that means team facilitators should have a hybrid profile. To combat a loss of focus among participants, there should be few but clear rules.

A New Era

Innovation in banking is essential, yet factors such as digital disruption, increased regulatory demands and the post-crisis pinch make it anything but plain sailing. Meanwhile, customers are adamant that they need simpler and more personalized access to financial products.

Design thinking, with its customer-centered focus and constant prototyping, is uniquely placed to help banks maintain growth in the fintech era, and respond to clients’ spoken — and unspoken — needs.

Methodology, Very Briefly

Out of an initial pool of 47 banks, 17 from 11 countries were chosen to analyze in more depth, looking to public financial information, media reports, indexes and more. Then, eight groups of senior executives were observed over the course of a year applying design thinking to a management challenge. Several interviews and a literature review were also carried out.