Trading With Political Connections During The Crisis

By IESE Insight

Analyzing the stock market trades of more than 7,000 insiders in the banking industry reveals a pattern that, in some respects, surprised four professors — Alan D. Jagolinzer, David F. Larcker, Gaizka Ormazabal and Daniel J. Taylor. The four, who were together at Stanford University as the financial crisis unfolded, decided to research how corporate insiders (that is, company officers and directors) traded leading up to and during the market turmoil of 2007-9.

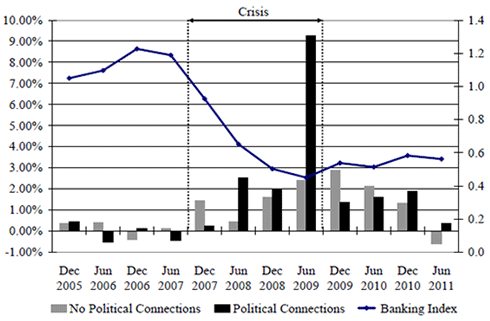

Thanks to the filing requirements of the U.S. Securities and Exchange Commission (SEC), anyone can see when a company officer or director trades in the company’s shares. As described in the professors’ working paper, titled “Political Connections and the Informativeness of Insider Trades,” an analysis of trading data reveals that, around the height of the crisis, insiders with political connections at key banking regulatory agencies gained financial benefits to the tune of 8.89 percent. Specifically, these gains came from anticipating the multibillion-dollar bailout known as the Troubled Asset Relief Program (TARP) rolled out in October 2008 and again in early 2009.

The authors describe their results as “both economically and statistically significant.”

Crisis and Bailout

The financial crisis of 2007-9 was the worst since the Great Depression and today still casts a long shadow over a weak recovery. In the midst of the turmoil that threatened the collapse of large financial institutions, U.S. congressional leaders met with Treasury Secretary Henry Paulson and Federal Reserve Chairman Ben S. Bernanke to hash out a rescue plan. The result was TARP, a plan to purchase $250 billion worth of toxic assets and equity from a “broad array of financial institutions” including “too-big-to-fail” banks. Eventually, a total of 707 financial institutions benefited from hundreds of billions in the bailout, between October 2008 and June 2009. In total, TARP created between $86 billion and $108 billion in value.

Who You Know

IESE’s Ormazabal and fellow researchers from Stanford, Wharton and the University of Colorado wondered how industry insiders traded up to and during the crisis. Because the TARP’s bailout was a market-moving event, they wondered if insiders who had rubbed elbows with TARP’s creators traded differently. The SEC data that are publicly available show not only which banking insiders traded their companies’ shares, but also point to which insiders served on boards or worked with key banking regulators and government officials — including those at the Federal Reserve, Federal Deposit Insurance Corporation (FDIC), Treasury and Congress. Here the study looked at whether there was at least one board member with current or previous work experience at TARP-connected agencies. If so, all of that bank’s insiders were considered “politically connected.”

In the end, they examined 497 publicly traded financial institutions between 2005 and 2011. In particular, they wanted to contrast how bankers traded in the years leading up to the crisis, during the financial crisis bailout period, and after the crisis. Running a final sample of several cross-sectional tests, they looked at 7,301 corporate insiders across the institutions in the study.

Catching Wind of the Bailout

On the aggregate, the results clearly show that bankers with political connections traded differently, presumably anticipating that some sort of bailout would occur. In the 30-day period prior to the announcement, they bought much more intensely than before and much more than their colleagues who did not work at banks with board-level political connections (as seen in the public databases).

“During the period TARP funds were dispersed, we find the predictive ability of insiders’ trades for future performance is greater than during any other period in our sample,” they write. The authors also find that “the information advantage of politically connected insiders is conditional on receiving TARP money — and is concentrated entirely among politically connected insiders in banks that received TARP.”

Source: Figure 3, page 41 of the working paper.

Several specific findings support these conclusions:

- A change in trading pattern, especially just before the bailout: Political insiders tended to be net sellers before the crisis (i.e., they sold more stock than the bought). They became net buyers during the crisis, with their bullishness peaking in the 30 days leading up to the TARP infusion. During these 30 days, 74 percent of their transactions were purchases.

- Insiders benefited from significant price increases because of the bailout: The difference in one-month-ahead returns between purchases and sales of politically connected insiders is 8.89 percent during the period when funds were dispersed.

- Insiders benefited significantly more than outsiders: The value of sales by insiders with political connections is $4.5 billion versus $1.6 million for those who didn’t have political connections.

Insider Trading?

Whether or not the political insiders acted illegally, however, is unclear. Insider trading cases are notoriously difficult to prove in court. Hunches, hints and outright information is hard to untangle. “Our analysis casts suspicion on trades of politically connected insiders during the crisis, especially those that occurred in close proximity to TARP infusion announcements,” they write. “It is likely to be the case that the trades we study fall into a legal gray area.”

Networks Key to Trading Decisions

In sum, politically connected bankers bought intensely in anticipation of the multibillion-dollar bailout, predicting price increases, and sold those shares for a significant benefit.

“Collectively, our findings suggest that political connections provided corporate insiders with an important information advantage during the financial crisis, that a significant portion of this advantage related to knowledge about government intervention, and that some insiders traded to exploit this advantage,” the co-authors write.

Tracking the trading data, and using algorithms to link variables and find statistically significant relationships, help expose the hidden connections that benefit some, but not all.

Methodology, Very Briefly

The data come from a comprehensive sample of all open market purchases and sales by insiders (i.e., corporate officers and directors) at 497 publicly traded financial institutions between 2005 and 2011. The co-authors measure insiders’ political connections based on whether at least one board member has current or previous work experience at the Federal Reserve, a bank regulator (e.g., FDIC, Office of Thrift Supervision or Office of the Comptroller of the Currency), Treasury or Congress. They measure the “informativeness” of insider trades based on their predictive ability for future performance.