US: GDP Grows 2.1 Percent In Fourth Quarter, Driven By Trade And Government Spending – Analysis

By Dean Baker

Gross Domestic Product (GDP) grew at a 2.1 percent annual rate in the fourth quarter, bringing its growth rate for the year to 2.3 percent. That is a fall from the 2.5 percent growth rate in 2018 and 2.8 percent in 2017. The 2.5 percent average for the first three years of the Trump administration is almost identical to the 2.4 percent average for the second term of the Obama administration.

The biggest factors driving growth were an improvement in the trade balance and an increase in government spending. The reduction in the trade deficit added 1.48 percentage points to the quarter’s growth. Most of this gain was accounted for by a decline in imports, which fell at an 8.7 percent annual rate.

This drop in imports accounted for more than 60 percent of the growth in the quarter. This drop may be reversed in the next quarter since it coincided with a sharply lower rate of inventory accumulation, which subtracted 1.09 percentage points from growth in the quarter. In the next quarter, we are virtually certain to see the pace of inventory accumulation accelerate, which will be accompanied by an uptick in imports.

Government spending rose at a 2.7 percent annual rate, adding 0.47 percentage points to the quarter’s growth. Military spending was the fastest growing component, rising at a 4.9 percent rate and adding 0.19 percentage points to growth. State and local spending increased at a 2.2 percent rate and added 0.23 percentage points to growth.

Housing grew at a 5.8 percent rate, adding 0.21 percentage points to the quarter’s growth. This is the second consecutive increase in residential construction, after six straight quarterly declines. This is explained by the sharp drop in mortgage interest rates in the spring, following the Fed’s rate cuts.

Nonresidential investment fell by 1.5 percent, its third consecutive decline. Its current level is slightly below its year-ago level. The main rationale for the corporate tax cut in 2017 was that it would lead to a surge in investment, which would increase productivity and thereby increase wages. This is clearly not happening.

Ironically, structure investment has been weakest. As a long-lived investment, structures should benefit most from the lower cost of capital implied by a reduced tax rate. Structure investment fell at 10.1 percent rate in the quarter and is now 7.5 percent below its year-ago level.

Consumption grew at a modest 1.8 percent rate in the quarter. Durable goods consumption grew at a 2.1 percent annual rate, while consumption of services grew at a 2.0 percent rate. With the savings rate at a relatively high 7.7 percent, there is little reason to be concerned that this pace of consumption growth cannot be sustained.

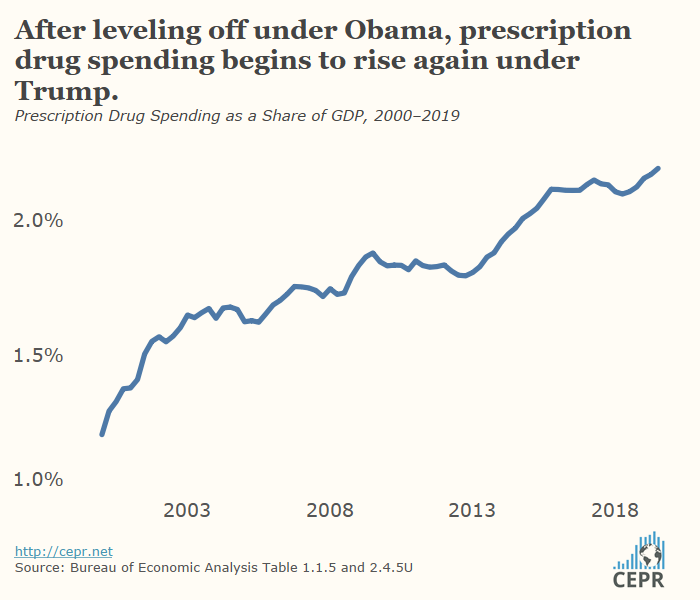

Nominal spending on prescription drugs rose at a 10.7 percent annual rate in the fourth quarter. Spending on prescription drugs has begun to increase rapidly as a share of GDP in the last year, after stabilizing at the end of 2015. Many observers have missed this rise in drug spending since they focus on the consumer price index (CPI) measure of inflation in prescription drug prices. This index only measures the increase in the price of drugs already on the market; most of the increase in drug costs comes from the entry of new and more expensive drugs.

Inflation appears to be slowing slightly, in spite of the low unemployment rate. The core Personal Consumption Expenditure (PCE) deflator rose at just a 1.3 percent annual rate in the fourth quarter and is now up just 1.6 percent over the last year. This is well below the Fed’s 2.0 percent target, which as an average, should imply some periods above 2.0 percent.

This report shows the economy continuing to grow at a healthy pace with no major imbalances. The sharp fall in imports in the quarter was associated with a sharp slowing in the pace of inventory accumulation. Both are likely to be reversed in the next quarter, leaving the overall growth rate little affected. Any positive effect of the tax cut on growth seems to have dissipated, with the economy growing essentially at its pre-tax cut pace. The slowing of inflation suggests that there could be room for additional stimulus.