Slowing Money Supply Growth May Trigger A Recession – Analysis

By MISES

By Frank Shostak*

A slight strengthening in the momentum of consumer expenditure has prompted many commentators to suggest that as long as the US consumer continues to spend there is no risk of a recession ahead. The yearly growth rate of consumer expenditure at current prices stood at 4.1% in July against 4% in June.

Notwithstanding still buoyant consumer expenditure, commentators have expressed concern due to a fall in the consumer sentiment index as compiled by the University of Michigan. The sentiment index fell to 89.8 in August from 98.4 in July and 96.2 in August last year.

In this framework of thinking, economic activity is depicted as a circular flow of money. Spending by one individual becomes part of the earnings of another individual, and spending by another individual becomes part of the first individual’s earnings.

It is held that if people become less confident about the future they will cut back on their outlays and hoard more money. Therefore, once an individual spends less, this worsens the situation for some other individual, who in turn also cuts his spending.

A vicious circle then emerges — the decline in people’s confidence causes them to spend less and to hoard more money. This lowers economic activity further, thereby causing people to hoard more, etc.

The cure for this, it is argued, is for the central bank to pump money. By putting more cash in people’s hands, consumer confidence will increase, people will then spend more and the circular flow of money will reassert itself.

All this sounds very appealing, and various surveys of business activity show that during a recession businesses emphasize the lack of consumer demand as the major factor behind their poor performances.

It would appear that what impedes economic prosperity is the scarcity of demand. However, is it possible for the general demand for goods and services to be scarce?

Most people want as many things as they can think of. However, what weakens their demand is the availability of means. Hence, there can never be a problem with demand as such, but with the means to accommodate demand. In the real world, one has to become a producer before one can demand goods and services. It is necessary to produce some useful goods that can be exchanged for other goods.

Demand cannot stand by itself and be independent, it is limited by prior production. What limits the production growth of goods is the introduction of better tools and machinery (i.e. capital goods), which raises workers productivity. Tools and machinery, are not readily available, they must be made.

In order to make them, people must allocate consumer goods that will sustain those individuals engaged in the production of tools and machinery. The allocation of consumer goods is what real savings is all about.

Note that real savings become possible once some individuals agree to transfer some of their consumer goods to individuals that are engaged in the production of tools and machinery. Obviously, they do not transfer these goods for free, but in return for a greater quantity of consumer goods in the future. Since real savings enable the production of capital goods, obviously real savings are at the heart of the economic growth that raises people’s living standards.

Money Printing and Economic Growth

When money is printed (i.e. created “out of thin air”) by the central bank and the fractional reserve system it sets in motion an exchange of nothing for money and then money for something (i.e. an exchange of nothing for something).

An exchange of nothing for something amounts to consumption that is not supported by production. Since every activity has to be funded, it follows that an increase in consumption that is not supported by production must divert funding from wealth generating activities. This in turn diminishes the flow of real savings to the producers of wealth, which weakens the flow of production (i.e., sets in motion an economic recession).

For instance, when money “out of thin air” gives rise to consumption that is not supported by a preceding production, it lowers the amount of real savings that supports the production of goods and services of the first wealth producer. This in turn undermines his production of goods, thereby weakening his effective demand for the goods of another wealth producer.

The other producer is in turn forced to curtail his production of goods thereby weakening his effective demand for the goods of a third wealth producer. In this way money “out of thin air” destroys real savings and sets up the dynamics of the consequent shrinkage of the production flow.

Observe that what has weakened the demand for goods is not the sudden capricious behaviour of consumers, but the monetary injections of the central bank that has weakened effective demand. Every dollar created “out of thin air” amounts to a corresponding dissaving by that amount.

At the heart of a recession is the liquidation of various activities, which emerged on the back of a rising trend in the growth rate of money supply. These activities, which we label as bubble activities are bad news for the process of wealth generation.

They weaken the wellbeing of the economy, so to speak. What triggers the recessionary process is the decline in the trend of the growth rate of money supply.

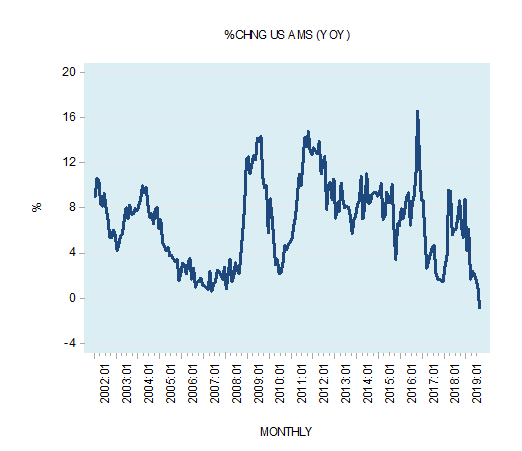

Slowdowns in money supply appear to have a real effect. In fact, the downtrend in the yearly growth rate in the adjusted money supply (AMS) during 2002 to 2007 was responsible for the economic slump of 2008. An uptrend in the growth rate of AMS during 2008 to 2011 provided a support for the strengthening in economic activity until very recently. A visible decline in the annual growth rate in AMS since 2012 has set in motion an economic slump. This slump is likely to strengthen as time goes by.

Note again that by popular thinking, a recession is associated with the so-called strength and weakness of various key economic indicators. Consequently, policies that can strengthen these indicators are most welcomed. The key variable that most commentators pay attention beside consumer expenditure is gross domestic product (GDP). Given that this indicator is monetary turnover, obviously then, changes in money supply after a time lag are followed by changes in the GDP. Given that most macro indicators are derived from GDP it is not surprising that changes in monetary policy of the Fed supposedly can navigate the economy.

Meanwhile, policies that are aiming at preventing the emergence of a recession make things much worse. These policies not only provide support to bubble activities but allow the emergence of new bubbles thereby undermining the wealth generating process further.

Note that by means of loose monetary policy, the Fed does not help the economy. The central bank only sets in motion a further diversion of real wealth from wealth generators to various bubble activities thereby making things much worse for wealth generators.

As long as wealth generators can still generate sufficient amount of real savings to support all the activities in the economy, then loose monetary policy of the Fed which appears to strengthen GDP seems to be a success. Observe that the increase in GDP just reflects monetary pumping and the weakening of the wealth generation process. Once the ability of wealth generators to support overall economic activity i.e. bubble activities and wealth generating activities weakens significantly central bank pumping cannot lift the economy even in terms of GDP.

One of the channels for monetary pumping is the fractional reserve banking. Once banks realise that various loans issued by them are likely to become bad assets, then banks begin curtailing the expansion of lending out of thin air. This result in a decline in the growth rate of money supply and after a time lag, the growth rate of GDP follows suit.

The best way to revive the economy is to allow wealth generators to run the show without any intervention by the central bank or the government. Those commentators that demand that the central bank and government should interfere in order to help the economy must realise that neither the central bank nor the government are wealth generators. All that they can do is to redistribute real wealth from one individual to another individual. As a rule, this results in the diversion of real wealth from wealth generators to various inefficient bubble activities.

If policies of the central bank and the government could grow an economy by now then most third world economies would have eliminated poverty and would now be classified as wealthy economies. Whenever various commentators argue in favour of central bank and government policies to provide support to the economy what they imply is a support for bubbles. The question that these commentators ought to ask is at whose expense will these bubbles be supported?

*About the author: Frank Shostak‘s consulting firm, Applied Austrian School Economics, provides in-depth assessments of financial markets and global economies. Contact: email.

Source: This article was published by the MISES Institute

This analysis is very informative and useful but hides the actual mechanism in that those who receive the thin money are the rich and the financiers who do not spend the money they earn. They continue hoarding the money and investing this fund overseas.

This is also reflected in the indicator that all these thin moneys have not created inflation. People who can spend the money are not obtaining this money. That is, the people who own just their labor power are recovering no thin money and can not even find high paying jobs.

This point can be restated by arguing that inequality in income distribution and wealth has increased significantly for the wealthy people. Inequality creates cheap returns for the wealthy. Cheap and easy returns do not come out of the production process for taking risk by investing in real means of production but by speculation and higher prices of financial assets due to more creation of thin money. In short, the increased money supply does dislocate economic activity and does create inequality and recessions. The wealthy people have not increased their wealth due to innovation, real investment, and risk taking but by the monopoly power of the central banks.

I should state that Marx in capital did explain how capitalists move to speculation in fictitious assets when a crisis is expected and the rate of profit starts declining.

Hayek suggested that a society should provide basic income to people for the system to continue functioning properly. The USA is need such a policy for helping people. But some presidents are cutting this help, as Trump has been doing as additional financial repression to the cutting interest rate that has been hurting those who save money.